Fastenal Company FAST crafted a new 52-week high of $64.18 on Dec 10, 2021. The stock pulled back to end the trading session at $64.10. The surge was probably after Fastenal was named as one of America's Safest Companies by EHS Today.

Inside the Headlines

Fastenal has been considered for an America's Safest Companies award. Just more than 250 companies have been under the radar of EHS Today for this recognition since 2002. Fastenal recently joined the group, being among the 10 new joiners.

For this recognition, organizations must demonstrate excellence in many aspects like support from leadership and management for EHS efforts, employee involvement in the EHS process, innovative solutions to safety challenges, comprehensive training programs, evidence that prevention of incidents is the cornerstone of the safety process, good communication about the value of safety, a way to substantiate the benefits of the safety process, and injury and illness rates lower than the average for their industries.

In this regard, Dave Olson, Fastenal's EHS & Sustainability Director, said, “As a people-centered organization and a partner in our customers' daily operations, we believe safety is a core value.” He further added, "We're striving to be a beacon for workplace health and safety throughout the world."

Share Price Performance

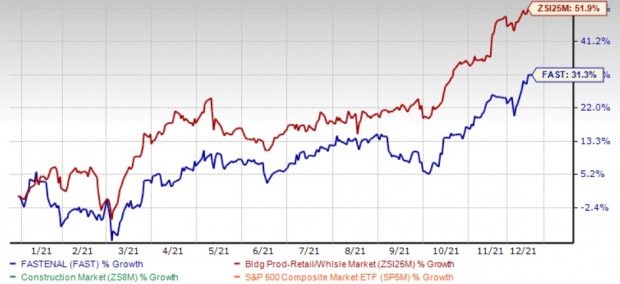

In fact, Fastenal has gained 31.3% year to date compared with the Zacks Building Products - Retail industry’s 51.9% rally. Although shares have underperformed the industry, earnings estimates for 2021 and 2022 have trended 0.6% and 1.2% upward over the past 30 days. This depicts analysts’ optimism over the company’s prospects.

Fastenal has been witnessing strong demand for manufacturing and construction equipment as well as supplies and an uptick in sales of certain COVID-related products. The company's greater focus on virtual platforms to boost customers’ engagement also bodes well. Yet, slower growth or contraction in sales of certain COVID-related products in a few end markets limits growth. Also, product pricing affected net sales by 230-260 basis points (bps) for the third quarter. It continues to experience pressure related to product and transportation cost inflation.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Rank

Fastenal currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Top-Ranked Stocks From Broader Retail-Wholesale Sector:

Builders FirstSource, Inc. BLDR presently has a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 71.5%, on average. Shares of BLDR have gained 95% year to date (YTD).

The Zacks Consensus Estimate for Builders FirstSource’s sales and earnings per share for the current financial year suggests an improvement of 129.1% and 207.6%, respectively, from the year-ago period.

GMS Inc. GMS presently has a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 24.9%, on average. Shares of BECN have gained 96.4% YTD.

The Zacks Consensus Estimate for GMS’ sales and earnings per share for the current financial year suggests an improvement of 36.6% and 87.9%, respectively, from the year-ago period.

Beacon Roofing Supply, Inc. BECN presently has a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 566.8%, on average. Shares of BECN have gained 36.9% YTD.

The Zacks Consensus Estimate for Beacon Roofing’s sales and earnings per share for the current financial year suggests an improvement of 6.7% and 7.8%, respectively, from the year-ago period.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fastenal Company (FAST): Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN): Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR): Free Stock Analysis Report

GMS Inc. (GMS): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.