The market was up through mid-day trading on Tuesday as Wall Street attempts to end November on an upbeat note and shake out of its sideways movement over the last few weeks. The recent chop is, however, a sign that Wall Street is acting somewhat rationally following the huge rebound since markets never go straight up.

The recent wave of horizontal activity showcases that there isn’t much desire to take profits because the bulls and some of the former bears do not want to miss out on a potential rally to new highs in the coming months.

Wall Street is becoming far more comfortable calling for the start of rate cuts in the back half of 2024. This means that inflows into stocks should continue in December and beyond.

This backdrop likely means many investors are looking to add more exposure to stocks. Today, let's explore a segment of the stock market that appeals to numerous investors seeking diversification: cheap stocks priced at $10 per share or below.

Along with the low price tags, the stocks we explore today boast strong Zacks Ranks on the back of their improving earnings outlooks.

Penny Stocks

One dollar or less used to be the common threshold for what we call “penny stocks.” Today, the SEC has expanded penny stocks to securities that trade for less than $5 a share. Many investors avoid these stocks because they are speculative in nature.

Meanwhile, penny stocks often trade infrequently and hold wide bid/ask spreads. These stocks also carry many other traits that, in many cases, cause excessive volatility. With that said, some penny stocks perform incredibly well, which helps them remain attractive.

Stocks Under $10

Moving on, let’s briefly discuss the next class of cheap stocks. Stocks that trade in the $5 to $10 range are generally less risky than their penny stock counterparts. Investors might be more likely to have heard of these companies or seen the tickers. They are, however, still inherently more speculative than many other higher-priced stocks.

Investors can obviously find winning stocks for under $10 if they are extremely selective. So today, we narrowed the list of thousands of these more speculative stocks down to a more manageable group of $10 and under stocks that might help boost your portfolio.

Screen Parameters

• Price less than or equal to $10

• Volume greater than or equal to 1,000,000

• Zacks Rank less than or equal to 2

(No Holds, Sells or Strong Sells.)

• Average Broker Rating less than or equal to 3.5

(Average Broker Rating of a Hold or Better.)

• # of Analysts in Rating greater than or equal to 2

(Minimum of at least two analysts covering the stock.)

• % Change F1 Earnings Estimate Revisions -- 12 Weeks greater than or equal to 0

(Preferably upward earnings estimate revisions, but definitely no downward revisions.)

Here are two stocks out of the nearly 80 highly-ranked names trading under $10 a share that made it through the screen today…

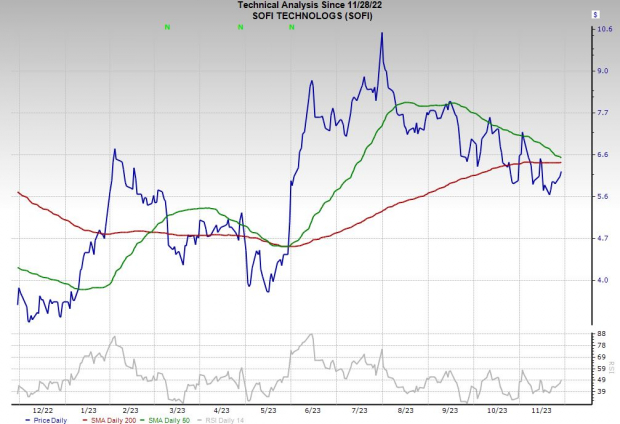

SoFi Technologies (SOFI)

SoFi Technologies, founded in 2011, was part of the fintech vanguard. SoFi attempts to be a one-stop shop for consumer finance. SoFi’s offerings include banking, personal loans, credit cards, investing, insurance, and beyond. In fact, the firm’s most recent ad campaign's tagline is “All Your Ambitions, All in One App.”

SoFi remains firmly in its growth phase, having boosted its members by 47% YoY during the third quarter to close the period with 6.9 million total members. SoFi posted a much smaller than projected quarterly loss for the fourth quarter in a row in Q3. The company’s revenue is projected to climb by 30% this year to hit $2.05 billion and then jump 23% higher to $2.53 billion in FY24.

Image Source: Zacks Investment Research

Sofi’s upward earnings revisions help it land a Zacks Rank #2 (Buy) right now. The company is projected to swing from an adjusted loss in 2023 to +$0.06 a share in FY24. And the fintech firm’s earnings estimate for FY24 has doubled since its Q3 release.

Sofi shares have soared 57% over the last year, including some big up and down moves. Still, Sofi trades about 70% below its own highs and 32% under its average Zacks price target at roughly $7.25 a share. SoFi is attempting to retake both its 200-day and its 50-day moving averages. And it trades at a 33% discount to the Zacks Tech sector at 2.7X forward 12-month sales.

Nu Holdings Ltd. (NU)

Nu Holdings Ltd. is a digital financial services powerhouse with a platform that currently reaches nearly 90 million customers across Brazil, Mexico, and Colombia. The fintech company is in the midst of shaking up the banking and financial services sector in large economies with huge populations.

Nu burst into the fintech space in these countries by attempting to cut out some of the burdensome red tape at more traditional banks. Nu now boasts that it is the fifth-largest financial institution in Latin America by the number of total customers.

Nu added 18.4 million or 28% more customers in 2022. More recently, Nu added 5.4 million customers in Q3 and 18.7 million year-over-year to finish the period with 89.1 million customers. Nu also crucially boosted its monthly average revenue per active customer by 18% to $10.0 per month.

Image Source: Zacks Investment Research

Nu crushed our Q3 EPS estimate on November 14 and boosted its bottom line outlook in a big way to help it land a Zacks Rank #2 (Buy) right now. Nu is projected to grow its revenue by 67% in FY23 to soar from $4.79 billion all the way to $8.01 billion and then boost its sales by another 40% next year to $11.21 billion. NU’s adjusted earnings are projected to skyrocket 450% this year from $0.04 to $0.22 and then soar another 85% in FY24.

NU stock still trades 30% below its highs at around $8.11 per share even though it has jumped 100% YTD. NU shares are also trading above their 50-day moving average. Plus, Nu trades at a 15% discount to the Zacks sector at 21.0X forward 12-month earnings.

Get the rest of the stocks on this list and start screening for the best stocks under $10 for yourself. And don't forget to backtest your strategy so you'll know how successful it's been before you put any of your money at risk.

Click here to sign up for a free trial to the Research Wizard today.

Want more articles from this author? Scroll up to the top of this article and click the FOLLOW AUTHOR button to get an email each time a new article is published.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: https://www.zacks.com/performance/.

Zacks' Super Screen

It's hard to believe, even for us at Zacks. But since 2000, while the market gained +6.2% per year, one of our top stock-picking screens averaged +55.2% per year.

In fact, our top 10 screens substantially outperformed the market with an average gain of +36.1%.

Free – See the Stocks They're Turning Up for Today >>Nu Holdings Ltd. (NU) : Free Stock Analysis Report

SoFi Technologies, Inc. (SOFI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.