Expect Lower Rebates to Lead to a Worse NBBO

The new SEC market structure proposals include dramatically lower access fees.

Today we look at the dual role that access fees play, rewarding lit quotes that lead to trades (liquidity) and encouraging tighter spreads (lower costs).

We compare the costs of liquidity (access fees) and incentives to quote (rebates) now to their potential value in the future based on the SEC’s new proposals.

Access fees help encourage a tight NBBO

While it is true that access fees are a cost to a liquidity taker, that is only part of the economics that they provide for the market as a whole.

First, in the U.S. market, companies cannot pay market makers to keep tight spreads. That makes rebates an essential tool to reward lit quotes that lead to trades (liquidity) and encourage tighter spreads (lower costs).

Rebates help offset adverse selection that is harder to avoid in fair-access markets, leveling the playing field to some degree against other venues that can tier by customer – allowing them to capture more spread, even without earning rebates. Importantly, from the perspective of market fairness:

- Rebates are paid directly to any participants providing a lit quote, not just market makers.

- But only when those quotes actually trade.

- The SIP distributes quotes of the price setter, which can be used market-wide.

In prior research, we have shown that exchanges paying rebates to lit quotes consistently have better market quality, more liquidity, more competitive two-sided quotes, and tighter spreads.

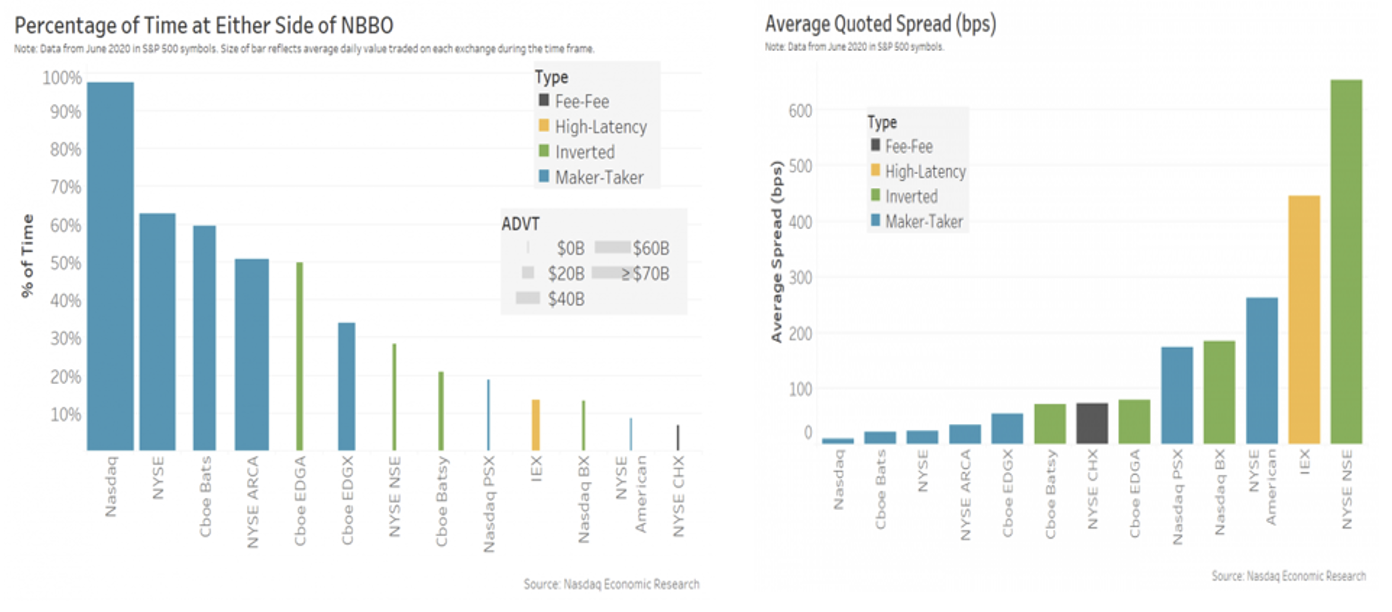

Chart 1: Maker-taker markets add by far the most market quality

Rebates add to depth and tighter spreads, reducing trading costs

We have also shown in the past that the supply and demand of any stock forms in a pretty linear V-shape. Consequently, the subsidy that rebates provide should result in more depth at the NBBO, as they allow a provider to capture more spread.

We show this in the example below, comparing the green NBO (with a rebate) to the blue offers.

In fact, just increasing depth could reduce investors' costs by more than their explicit access fee costs. In the example below, an investor in a market:

- With access fees could fill a 1000 share order at 10.02 + access fees = all-in cost of 10.023 (green bar).

- Without access fees would need to remove the shares at 10.02 and trade a residual at 10.03 for an all-in cost of 10.0235.

In short, although a taker pays access fees, there are offsetting savings from a deeper book that may even offset the access fees.

Chart 2: Rebates should add to depth too

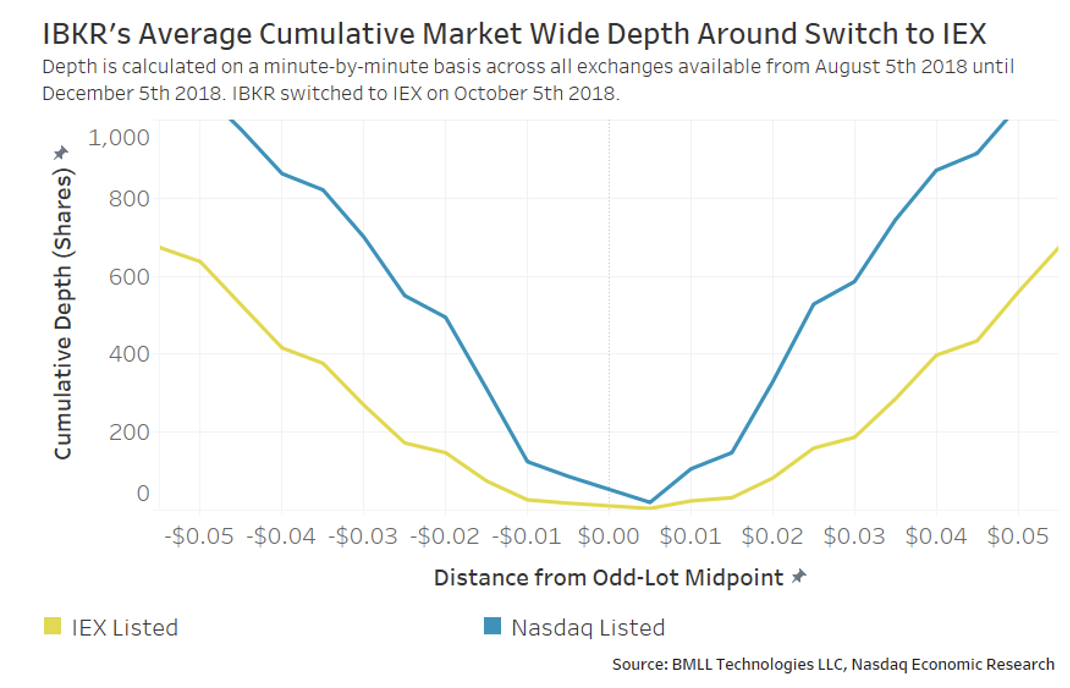

But we’ve also shown in case studies that removing rebates can also lead to spreads getting wider. In fact, when IBKR switched its listing from a maker-taker market to a fee-fee market, the data shows that:

- Spreads widened

- Depth fell (at an equivalent spread)

- Liquidity fell

- Even the close became more volatile

Chart 3: IBKR trading in market-taker (blue) and fee-fee (yellow) markets

Pricing in indirect benefits

Research suggests that tighter spreads don’t just help liquidity takers now but provide what economists call “positive externalities” – that are likely worth billions of dollars to U.S. investors and companies.

1. Tighter spreads reduce mutual fund trading costs

Even though many institutional investors use broker algorithms that work limit orders to capture spreads, research shows they are, as a group, net takers of liquidity. That means crossing artificially wide spreads could add billions to mutual fund trading costs. In fact, that is true even if those mutual funds are trading mostly in dark pools, as those pools often match the NBBO prices on fills.

2. Tighter spreads reduce companies’ costs of capital

A lot of other research suggests that tighter spreads also increase liquidity and lower the costs of capital for companies. Some research suggests that wider spreads could potentially reduce market valuations by billions of dollars, hurting U.S. savers, making the U.S. markets less attractive for IPOs and pushing capital formation and investors overseas.

How expensive are access fees now anyway?

Access fees are currently capped at 30% of the 1-cent tick or 30 mils.

But investment returns are measured in percentage points. So, it makes sense to think about these costs in terms of how much they affect investment returns.

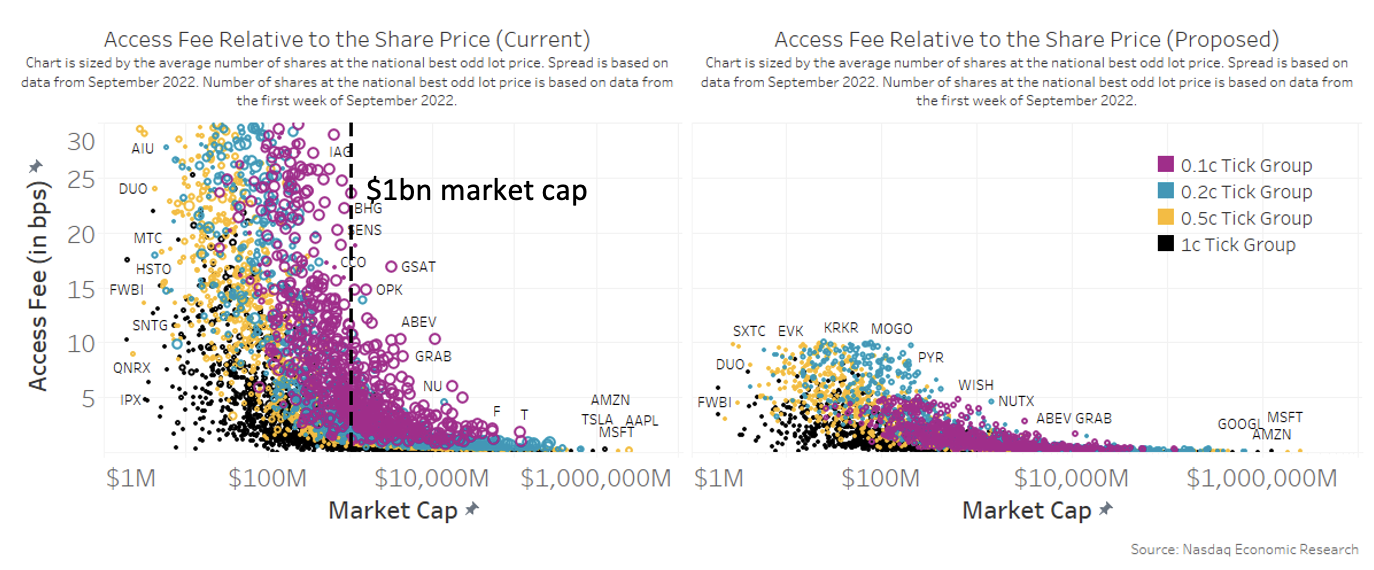

As the data in Chart 4 shows:

- For the most liquid and higher-priced stocks in the U.S. market, spread costs are already very low and access fee costs are even lower.

- As company size falls, so too, typically, does liquidity and stock price. That combines to make spreads and access fees a more significant economic cost. However, we could argue that thinly traded stocks on the left of the chart below, with their wider spreads, actually need more rewards to encourage market participants to tighten spreads and add depth to the NBBO – not less.

Chart 4: Access fees and spreads as a percent of the share price (now)

The other thing we see in Chart 4 is that access fees are well below 30% of the spread already.

That’s because many U.S. stocks already trade with more than 1-cent spreads. For a stock with a 10-cent spread, the 0.3-cent access fees add to just 3% of the spread. This can be seen in Chart 5a below, which is colored the same as Chart 3 from our prior study, where:

- Very tick-constrained stocks are purple.

- Potentially tick-constrained stocks with a spread up to 1.6 cents are blue.

- Perfect tick stocks with a spread from 1.6 cents to 4 cents are yellow.

- Too-many-tick stocks are black.

The results show that access fees represent a much higher proportion of the spread for tick-constrained stocks. However, many of the stocks that trade well (yellow) have access fees representing closer to 5-10% of the spread.

We also use circle size to show depth at the best price, which includes “best odd lots” for all those “too many tick” stocks. What we see is that:

- Tick-constrained stocks (purple and higher blue dots) typically have much larger queues (in shares)

- Too-many-tick stocks (black) often have an odd lot as the true inside – degrading the value of the NBBO. That’s also a sign that maybe rebates are not a sufficient incentive to improve spreads for those stocks.

Chart 5a and 5b: Access fees as a percent of the spread now (left chart) and as proposed (right)

The SEC’s proposal resets ticks but does not change access fees proportionally. Instead, they cut access fees to 10mils for most stocks (and 5mils for stocks in the 1/10th cent group).

However, for the reasons we’ve discussed above, we don’t think spreads will actually fall just because ticks are smaller. For example, many of the yellow and black dots already have multiple 1-cent ticks between their NBBO, and their spreads aren’t falling now.

As a result, the fees (and rebates) as a proportion of spread fall significantly (Chart 5b).

Only stocks that are somewhat tick constrained (blue dots trading closer to a 0.8 cent effective spread) will still have rebates equivalent to 5-10% of the spread. For all other stocks (Purple, yellow and black tick groups) the rewards for lit quotes fall to pretty immaterial levels versus the spread.

The unintended consequences here are clear: the proposal will improve the economics of takers (who pay lower fees to take) and dark pools (who still capture spread) – while acting as a disincentive to display lit quotes and improve the NBBO.

How expensive are access fees in basis points?

Back to the earlier question of how much access fees (and rebates) change the actual economics of trading.

To look at that, we convert the data from Chart 5 into a basis-point cost. As Chart 6 shows:

- This confirms that the economic costs of trading most large-cap stocks – even with a 30mil cap – are minimal (as we saw in Chart 4 too).

- Although for smaller-priced stocks, the costs start to rise. For example, Ford (F) has a total access fee cost of just under 0.02% (or 2 basis points).

- Because lower market cap stocks typically have lower share prices, that factor actually means rebates already benefit small-cap stocks more than large-cap stocks.

- Although if we look vertically up from any market cap level, we see that the tick-constrained stocks (purple) have a higher liquidity cost – while too-many-tick stocks (black) arguably have much lower incentives.

This seems to show that a cents-per-share access fee cap does not provide consistent economic incentives to quote setters for each level of market cap. Arguably, incentives on black tickers should be higher – even if purple stocks queues might benefit from lower incentives.

Chart 6a and 6b: Access fees as a percent of the share price (left chart) and as proposed (right)

Looking at the impact of the SEC’s proposal (right chart), we see that the rewards for setting lit quotes in all stocks are dramatically lower, especially for small-cap and thinly traded stocks.

Data suggests that the NBBO will be shallower and wider for all stocks. But we are particularly concerned about small-cap growth companies, which already struggle to attract market makers that can help tighten spreads, attract institutional investors and lower their costs of capital.

Is there a perfect incentive?

We’ve done a lot of research on the perfect stock price for trading – where spreads are just wide enough to encourage quote setting but not so wide as to create weak market quality and a weak NBBO benchmark.

However, less work has been done on what the right rebate is. Arguably, the right rebate would maximize all those “positive externalities” without adding to queues and takers costs.

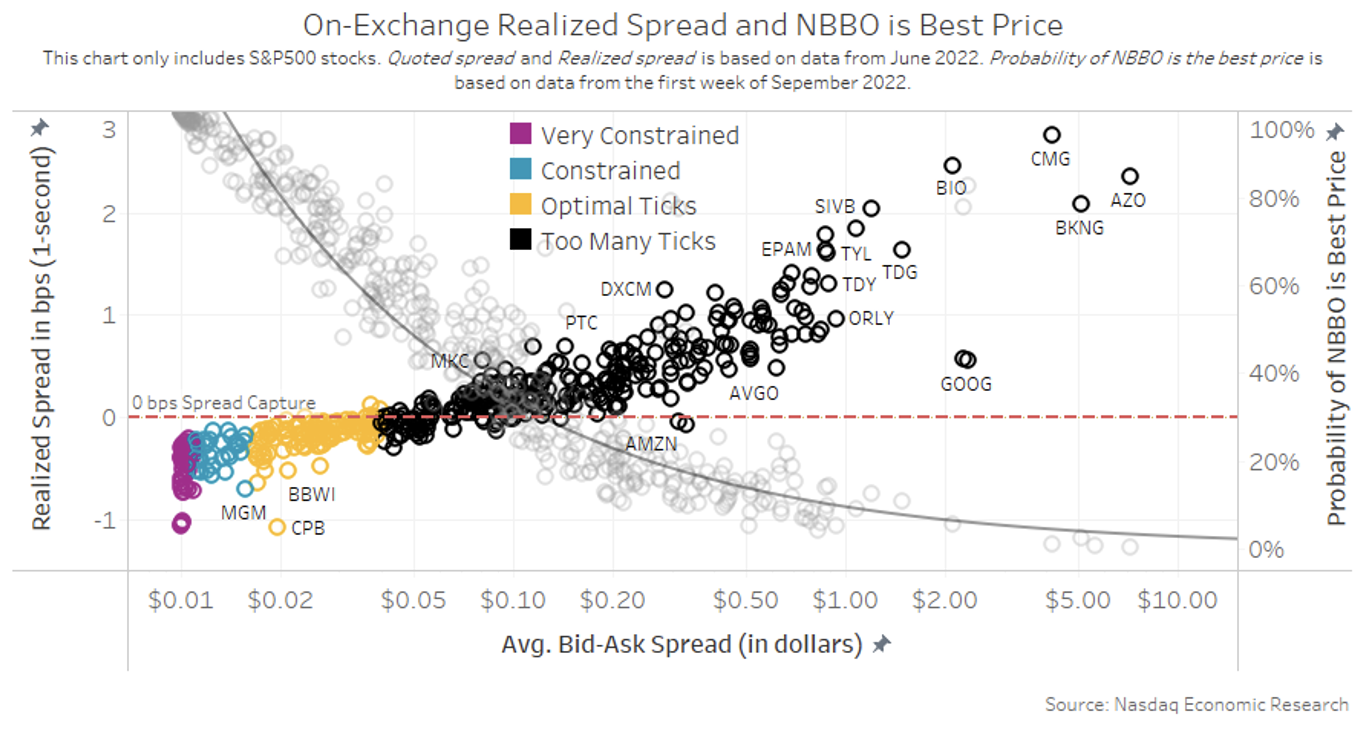

One place to start might be to look at mark-outs and NBBO quality across tick groups (Chart 7). This shows that:

- For tick-constrained stocks (purple and blue dots) an average market maker is willing to make a loss on their quote capture, implying that rebates are a significant economic incentive to queue. However, we also see (grey line and dots) that those stocks also have a very competitive NBBO (where the NBBO is setting the true “best price” more than 80% of the time.

- In contrast, average mark-outs are positive for black stocks, implying rebates are an immaterial incentive to market makers who price the spread to make profits (from the spread alone). However, the market quality of those stocks is poor, with the NBBO representing the “best price” less than 50% of the time, and sometimes almost never.

At first glance, it seems the perfectly priced stocks might also have optimal rebates. Where they provide market makers with some economic benefits but also don’t lead to unusually long queues. That would imply that (30mils x 2-3 cent spread — or around 10-15% of the spread — is optimal).

Chart 7: Market quality changes as access fees change

What does this all mean?

Based on this initial slice of the data, it seems that access fees might be too low for “too many tick” stocks, leading to poor market quality. However, it’s also likely that they are currently too high for tick-constrained stocks, exacerbating the long queues these stocks have.

Access fees around 10-15% of the spread seem to result in a much better NBBO without excessive queuing.

Getting access fees right is important to investors and companies. This initial analysis implies that access fees should be proportional to spreads, not ticks. It also suggests the market might benefit if caps were higher for stocks with wide spreads too.