Three takeaways from Nasdaq’s new report on Private Markets DEI Data

Newly published report on private markets DEI data

In late 2021, Nasdaq announced the creation of a private fund manager diversity, equity, and inclusion (DEI) data set that would dig deeper into firm diversity primarily at the key professional and portfolio management level.

Since then, more than 170 fund managers have submitted their DEI data for inclusion in the data set and over 100 institutional investors have requested access to the data through the eVestment platform.

Nasdaq’s new report, Driving Diversity: A View of DEI Across the Private Markets, presents some of the initial findings of the data set and features insights on DEI from leaders at FCLTGlobal, Mercer, and StepStone Group

Here are three key takeaways from the report:

1) Asians are most represented ethnic minority at respondent firms

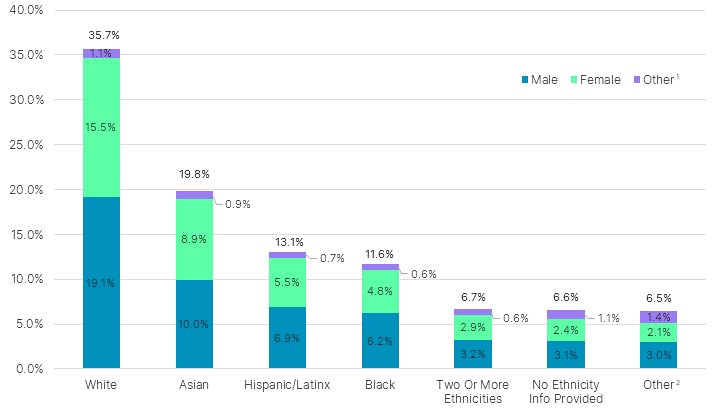

Asians of any gender are the most represented minority group accounting for 19.8% of the professional teams at private markets firms who submitted their DEI data to Nasdaq eVestment. Hispanic/Latinx and Black professionals represent 13.1% and 11.6% of the workforces of respondent firms respectively. Additionally, employees of two or more ethnicities represent 6.7%.

Ethnicity & Gender Breakdown of Private Markets Professionals

2) Black and Hispanic/Latinx firm owners less likely to serve on investment team

Black and Hispanic/Latinx individuals accounted for 13.0% and 11.1% respectively of owners at respondent private equity firms. At the investment team level, Black and Hispanic/Latinx representation stood at 11.4% and 9.4% respectively. This suggests that Black and Hispanic/Latinx owners are more likely to serve in non-investment team C-suite roles like CFO, COO or CCO.

3) Private fund manager DEI data matters to investors

Institutional investors are now seeking to incorporate DEI themes or metrics into their decision-making processes and more broadly into how they operate their organizations. Private markets DEI data is a growing component of these investors’ manager selection efforts within both their emerging manager programs and their core portfolios as many view diversity as a form of risk management. Diverse teams bring contrasting viewpoints, complementary thought processes, and a more complete approach to investing.

Contact us to learn more about Private Markets.

![]()

Subscribe to the Top Quartile, our bi-weekly newsletter with insights into the private markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.