The Denominator Effect – How volatility and market turmoil in the public markets have impacted fundraising in the private markets

The Denominator Effect occurs when the value of one portion of portfolio decreases drastically and pulls down the overall value of the portfolio. As a result, any segments of portfolio, which did not decrease in value, now represent a large percent of the overall pie.

In and of itself, the Denominator Effect does not negatively impact those other segments of the portfolio, but in the context of the institutional investing, when the Denominator Effect hits, it is the private markets holdings of LP investors that generally increase in terms of portfolio sizing. This is of course because valuations for private markets funds are calculated on a lag compared to the LP’s public markets holdings, which are essentially valued in real-time.

As the public markets slip into a bear market pension plan investors have seen significant impacts to the valuations of their public markets holdings and as a result, their private markets holdings have ticked up as an overall percentage of their respective portfolios.

While the public markets holdings of pension plans will likely recover in value over time, in the short-term, the Denominator Effect has the potential to impact fundraising and new commitment activity to private markets fund managers. Stringent governance and target allocation policies mean that LPs who are now over-allocated to the private markets cannot make new commitments that would push them farther beyond those limits.

Who’s feeling the pressure from the Denominator Effect?

These documents, sourced from Nasdaq eVestment’s Market Lens platform, highlights how three LPs are currently monitoring the impact of the Denominator Effect on their portfolios and how they are reacting.

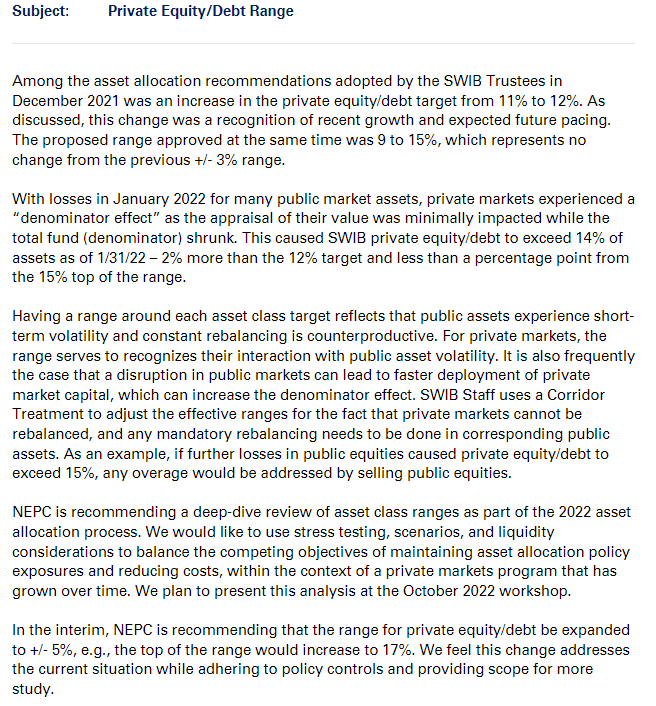

State of Wisconsin Investment Board (SWIB)

In an update from February 22 2022, SWIB indicated that in December 2021 their private equity and private debt target exposure was updated to 12% with an acceptable range of 9 – 15%. Just one month later in January 2022 as a result of public market losses and the Denominator Effect, their private equity and private debt allocation was less than 1% from the upper end of their newly set acceptable range. As a result their consultant NEPC has recommended a short-term increase of the acceptable range to 17% as well as a “deep-dive review of asset class ranges as part of the 2022 asset allocation process.”

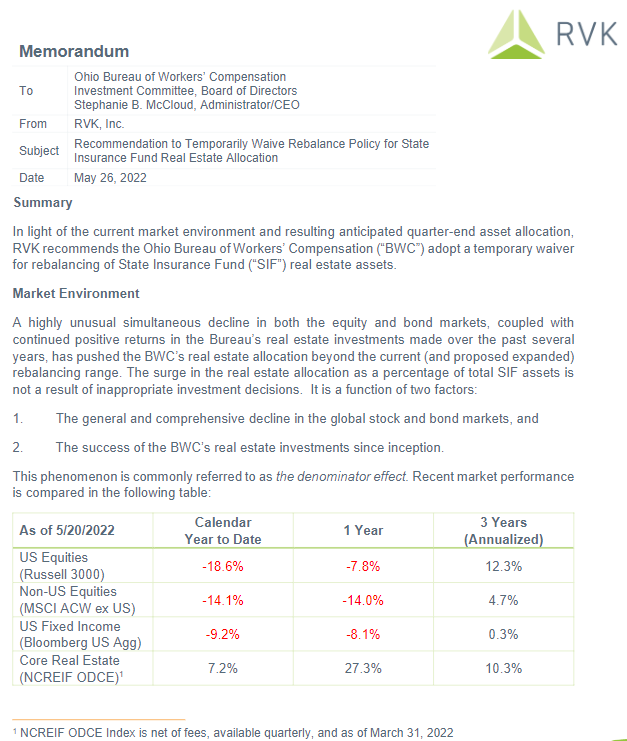

Ohio Bureau of Workers’ Compensation

RVK, the consultant for Ohio Bureau of Workers’ Compensation has recommended that the pension plan adopt a temporary waiver for rebalancing their real estate assets. “The surge in the real estate allocation as a percentage of total SIF assets is not a result of inappropriate investment decisions. It is a function of two factors: 1) The general and comprehensive decline in the global stock and bond markets, and 2) The success of the BWC’s real estate investments since inception.”

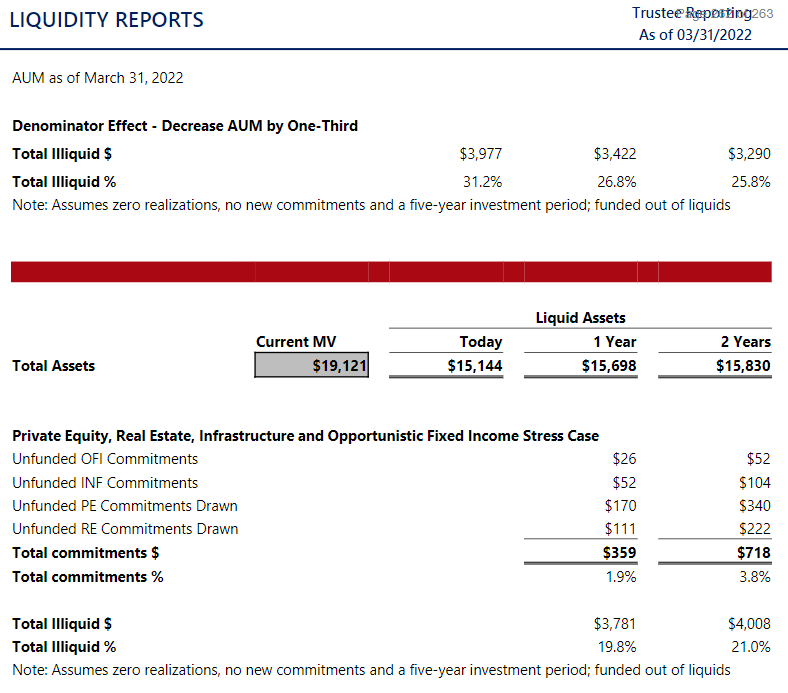

New York City Fire

Liquidity reports for New York City Fire feature Denominator Effect analysis that measures the illiquidity ratio of their portfolio as of the current quarter end and 1 and 2 year time horizons to model the effect of a 33% decline in portfolio value.

A challenge for some managers and an opportunity for others

All that said many LPs were sufficiently under-allocated to Private Equity and other private asset classes and therefore still have capacity to make commitments. According to data highlighted in the most recent edition of the Private Market Monthly Monitor, as of April 30, 84 LPs were underweight to private equity with $12.7 billion in open commitment opportunities.

For fundraising managers, the Denominator Effect is without question an impediment to closing commitments, but at the same time it has also narrowed the list of potential investors they need to focus on. Tools like Market Lens help fund managers identify those LPs who are still in the market to make new commitments and can help them tailor their message to the needs of those investors.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.