Over the coming years, Rivian Automotive (NASDAQ: RIVN) could become the next Tesla. It has several new mass market vehicles set to launch in 2026. If its sales trajectory matches what Tesla achieved when it introduced its first mass market vehicles, huge upside could be ahead.

But for now, there's only one number I'm paying attention to -- and we should get big news regarding this number in a matter of months.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

This could be the most important number in Rivian's history

To become the next Tesla, Rivian has to execute on multiple key objectives. It must be able to ramp up production facilities, get its new mass market vehicles to customers on time, and match the quality that the company has been known for so far. Then, perhaps its sales will take off in a similar way to Tesla's history.

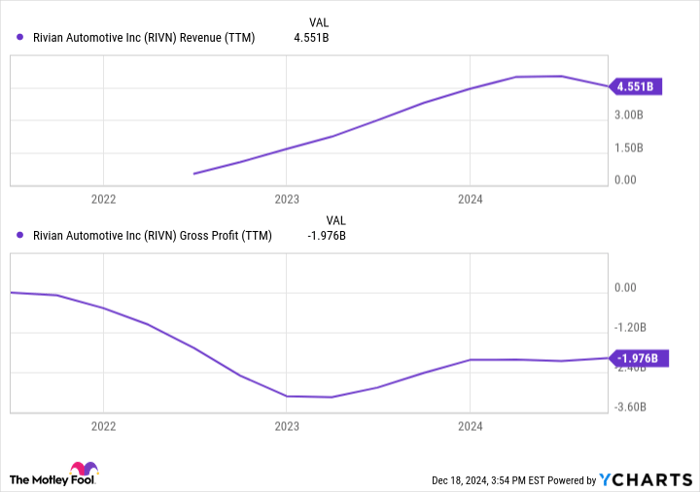

Before all this occurs, the market must remain confident that the company will succeed. That's because, despite reaching $5 billion in sales earlier this year, Rivian is still losing money on every vehicle it sells. Over the past 12 months alone, the company has accumulated a gross loss of nearly $2 billion. Many electric car stocks have failed to survive financially over the decades. If Rivian stumbles, it could see its capital availability dry up at any moment, essentially canceling its ability to pursue its long-term vision.

But as we'll see, there could be great news on this front very soon.

RIVN Revenue (TTM) data by YCharts.

Earlier this year, Rivian's management team announced that they expect to achieve positive gross profits by the end of 2024. To say this would be a feat would be an understatement. Even after incremental improvements, the company still lost nearly $40,000 on every vehicle it sold last quarter. To close the gap to zero over a span of 90 days would be incredible.

If Rivian achieves positive gross profits this quarter, expect sentiment to improve sizably, as the company's future would become much clearer. We'll know more in a matter of months.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $349,279!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,196!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $490,243!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.