Eversource Energy ES announced that it has begun drilling approximately 90 bore holes as part of its ongoing commitment to advance a comprehensive strategy to aid decarbonize its natural gas system. This initiative is a crucial part of its networked geothermal pilot program in Framingham, MA.

To minimize community and environmental impacts while construction, Eversource Energy has closely collaborated with municipal partners at the City of Framingham.

During the coming months, drilling activities will take place within two parking lots held by the city and one owned by the Framing Housing Authority. Each of these wells will be as deep as 600-700 feet, owing to a partnership between the energy company and a drilling contractor who specializes in this kind of work.

Benefits of the Move

Once completed, ES’ geothermal loop will link 140 customers across nearly 40 buildings, including residential homes, a cabinet store, fire station, Framingham Housing Authority buildings and the community college. The idea is to provide an environmentally friendly heating and cooling system, regulated by the earth's natural temperature.

Over the following two years, Eversource Energy will research if this technology is cost effective for its customers and whether it can make this sort of networked geothermal system available to customers and communities outside of the Framingham neighborhood.

The company expects to finish and put a networked geothermal system into operation by the 2023 heating season. ES will run its geothermal system for two full heating and cooling seasons, sending frequent updates to the Massachusetts Department of Public Utilities, as part of the pilot program's 2020 approval.

Growth Prospects

Geothermal technology works by transferring heat to and from the earth using water, wells, piping and pumps. It pulls the earth’s heat out of the ground to warm buildings in winter and pumps heat from buildings back into the ground in summer to cool them.

According to Markets and Markets analysis report, the global geothermal energy market size was valued at $6.6 billion in 2021, and is projected to reach $9.4 billion by 2027. It is expected to witness a CAGR of 5.9% during 2022-2027. Increasing demand for constant power supply among residential, commercial and industrial sectors, and growing demand for electricity generation through sustainable means in industries are the major driving factors for the geothermal energy market.

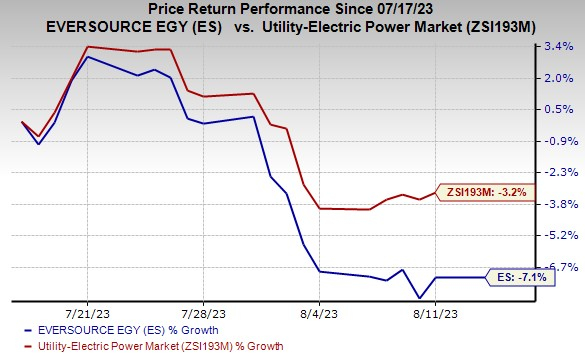

Price Performance

In the past month, shares of ES have lost 7.1% compared with the industry’s 3.2% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Eversource Energy currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the same industry are Consolidated Edison ED, NextEra Energy, Inc. NEE and Entergy Corp. ETR, each carrying Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ED’s long-term (three- to five-year) earnings growth rate is 2%. The Zacks Consensus Estimate for 2023 earnings per share (EPS) indicates a year-over-year increase of 6.8%.

NEE’s long-term earnings growth rate is 8.38%. The Zacks Consensus Estimate for 2023 EPS indicates a year-over-year improvement of 7.2%.

ETR’s long-term earnings growth rate is 5.65%. The Zacks Consensus Estimate for 2023 EPS implies year-over-year growth of 4.2%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.