ETFGI Reports the ETFs Industry in Asia Pacific Ex Japan Gathered $559 Million in Net Inflows During February 2023

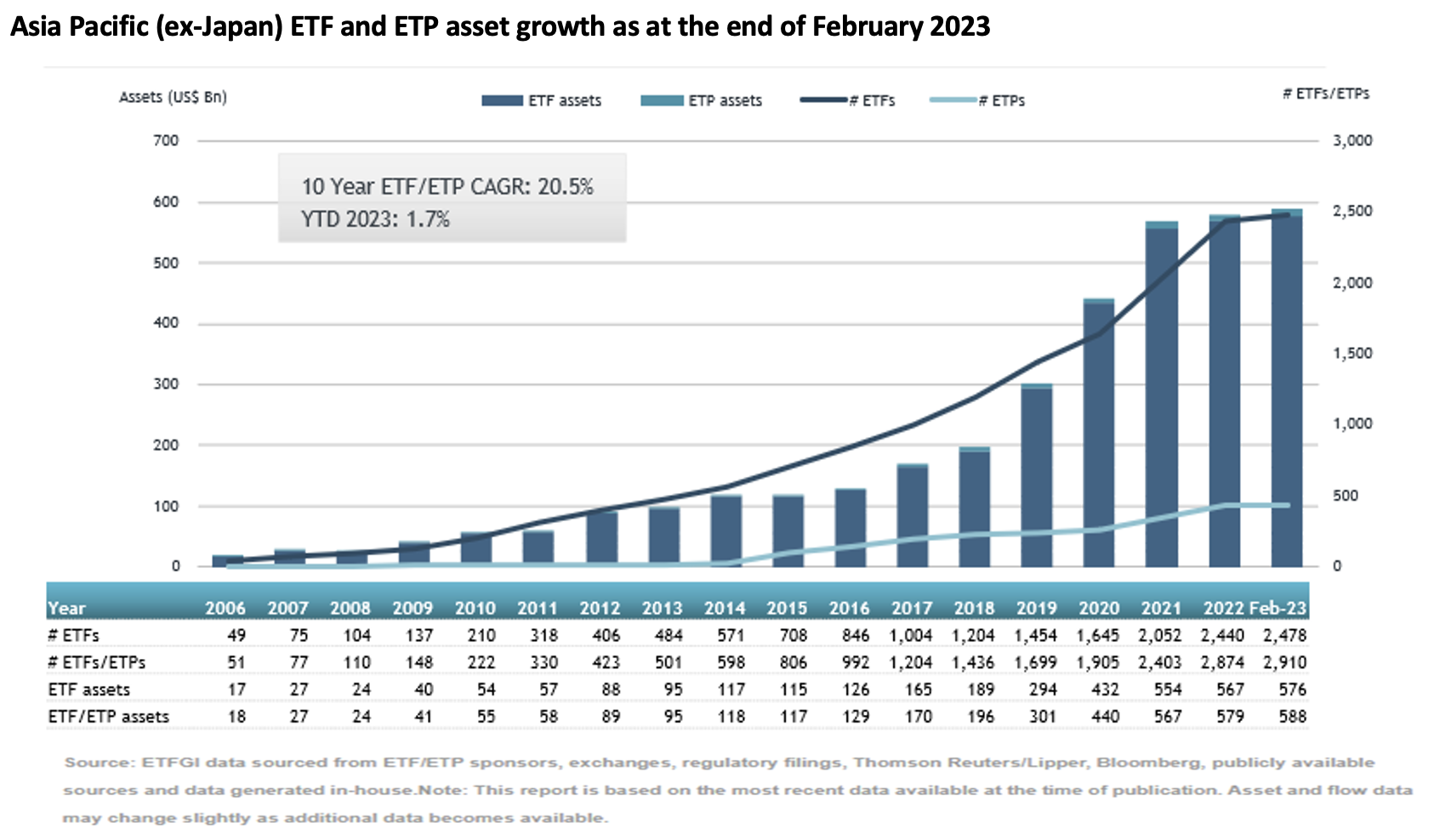

LONDON —March 28, 2023 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that ETFs industry in Asia Pacific ex Japan gathered net inflows of US$559 million during February, bringing year-to-date net inflows to US$1.99 billion. During the month, assets invested in the Asia Pacific ex-Japan ETFs industry increased by 6.1%, from US$555 billion at the end of January to US$588 billion, according to ETFGI's February 2023 Asia Pacific (ex-Japan) ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in Asia Pacific ex Japan gathered $559 million in net inflows during February

- YTD net inflows of $1.99 Bn are the eighth highest on record, while the highest recorded YTD net inflows are $31.38 Bn for 2022 followed by YTD net inflows of $12.34 Bn in 2021.

- 20th month of consecutive net inflows.

- Assets of $588 Bn invested in ETFs industry in Asia Pacific ex Japan at end of February.

“The S&P 500 decreased by 2.44 % in February but is up by 3.69% YTD in 2023. Developed markets excluding the US decreased by 2.59% in February but are up 5.47% YTD in 2023. Israel (down 6.97%) and Hong Kong (down 6.94%) saw the largest decreases amongst the developed markets in February. Emerging markets decreased by 5.57% during February but are up 0.72% YTD in 2023. Colombia (down 11.62%) and Thailand (down 9.38%) saw the largest decreases amongst emerging markets in February.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

ETFs industry in Asia Pacific ex Japan had 2,910 products, with 3,075 listings, assets of $588 Bn, from 236 providers listed on 20 exchanges in 15 countries at the end of February.

During February, ETFs gathered net inflows of $559 Mn. Equity ETFs suffered net outflows of $4.50 Bn over February, bringing YTD net outflows to $2.66 Bn, much lower than the $26.35 Bn in net inflows YTD in 2022. Fixed income ETFs reported net inflows of $3.10 Mn during February, bringing YTD net inflows to $2.94 Bn, lower than the $3.87 Bn in net inflows YTD in 2022. Commodities ETFs/ETPs reported net inflows of $99 Mn during February, bringing YTD net outflows to $137 Mn, less than the $1.05 Bn in net outflows YTD in 2022. Active ETFs attracted net inflows of $1.45 Bn over the month, gathering YTD net inflows of $1.89 Bn, slightly higher than the $1.78 Bn in net inflows YTD in 2022.

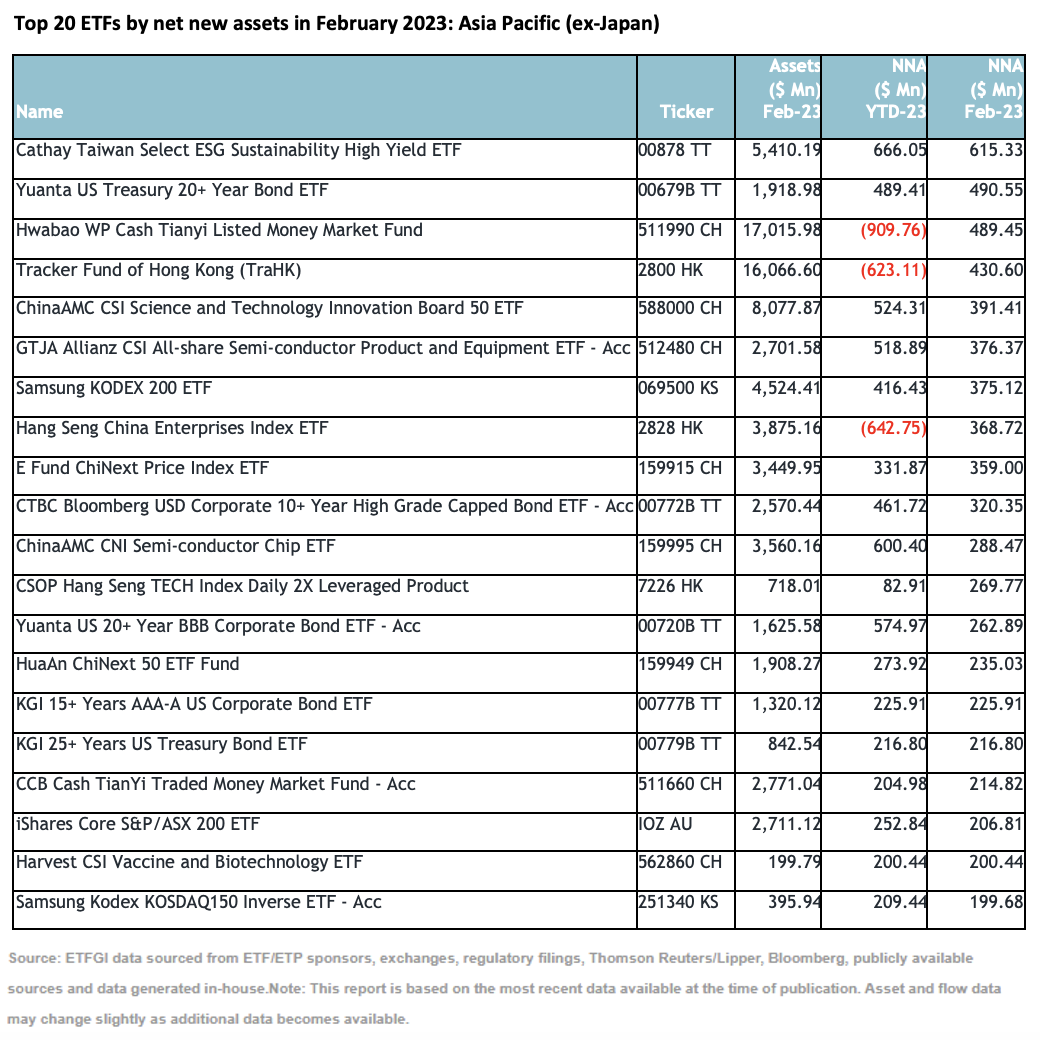

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $6.54 Bn during February. Cathay Taiwan Select ESG Sustainability High Yield ETF (00878 TT) gathered $615 Mn, the largest individual net inflow.

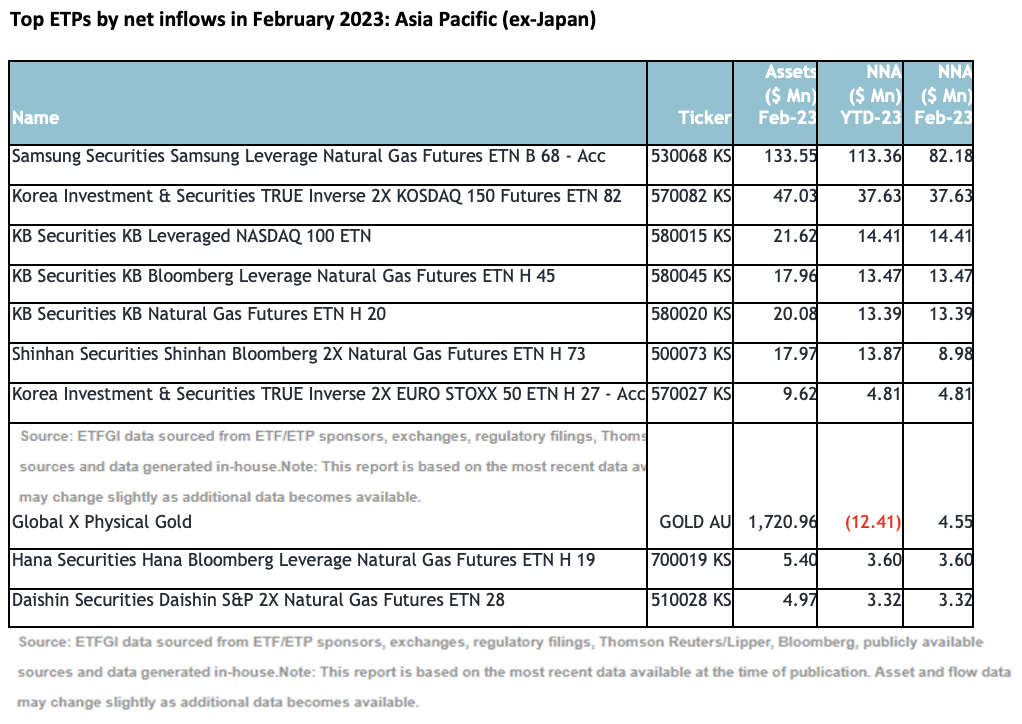

The top ETPs by net new assets collectively gathered $186.33 Mn during February. Samsung Securities Samsung Leverage Natural Gas Futures ETN B 68 - Acc (530068 KS) gathered $82.18 Mn, the largest individual net inflow.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.