ETFGI Reports That Assets of $8.17 Billion Invested in ETFs and ETPs Listed in US at the End of February 2023

LONDON — March 21, 2023 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that the ETFs industry in the United States gathered net inflows of US$8.17 billion during February, bringing year-to-date net inflows to US$47.69 billion. During the month, assets invested in ETFs industry in the United States decreased by 1.9%, from US$6.88 trillion at the end of January to US$6.75 trillion in February 2023, according to ETFGI's February 2023 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in the United States gathered net inflows of $8.17 Bn in February.

- YTD net inflows of $47.69 Bn are the sixth highest on record, while the highest recorded YTD net inflows are of $153.95 Bn for 2021 followed by YTD net inflows of $99.04 Bn in 2022.

- 10th month of consecutive net inflows.

- Assets of $6.76 Tn invested in ETFs industry in the United States at the end of February.

- Assets increased 3.8% YTD in 2023, going from $6.51 Tn at end of 2022 to $6.75 Tn.

“The S&P 500 decreased by 2.44 % in February but is up by 3.69% YTD in 2023. Developed markets excluding the US decreased by 2.59% in February but are up 5.47% YTD in 2023. Israel (down 6.97%) and Hong Kong (down 6.94%) saw the largest decreases amongst the developed markets in February. Emerging markets decreased by 5.57% during February but are up 0.72% YTD in 2023. Colombia (down 11.62%) and Thailand (down 9.38%) saw the largest decreases amongst emerging markets in February.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

The ETFs industry in the United States had 3,119 products, assets of $6.755 Tn, from 276 providers listed on 3 exchanges at the end of February.

During February, the ETFs industry in the United States gathered net inflows of $8.17 Bn. Equity ETFs suffered net outflows of $3.59 Bn during February, bringing YTD net inflows to $7.26 Bn, significantly lower than the $69.15 Bn in net inflows YTD in 2022. Fixed income ETFs reported net inflows of $831 Mn during February, bringing YTD net inflows to $19.33 Bn, higher than the $1.59 Bn in net outflows YTD in 2022. Commodities ETFs/ETPs reported net outflows of $313 Mn during February, bringing YTD net inflows to $486 Mn, significantly lower than the $6.03 Bn in net outflows reported YTD in 2022. Active ETFs attracted net inflows of $10.77 Bn over the month, gathering YTD net inflows of $19.37 Bn, slightly higher than the $17.46 Bn in net inflows active products had reported YTD in 2022.

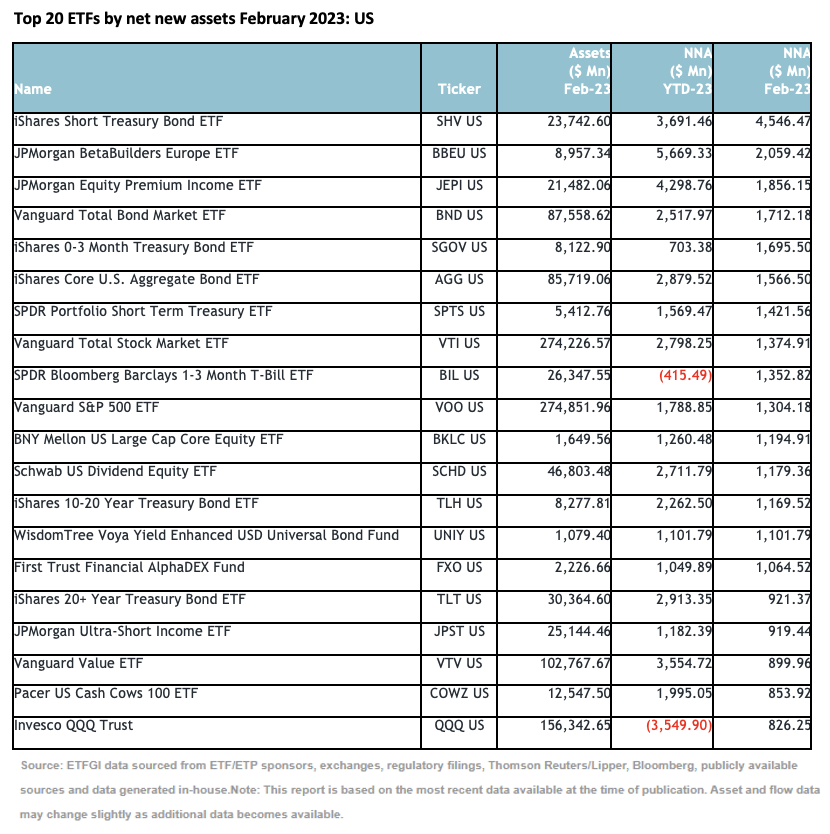

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $29.02 Bn during February. iShares Short Treasury Bond ETF (SHV US) gathered $4.55 Bn, the largest individual net inflow.

The top 10 ETPs by net assets collectively gathered $1.38 Bn during February. ProShares Ultra DJ-UBS Natural Gas (BOIL US) gathered $595.75 Mn, the largest individual net inflow.

Investors have tended to invest in Active ETFs/ETPs during February.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.