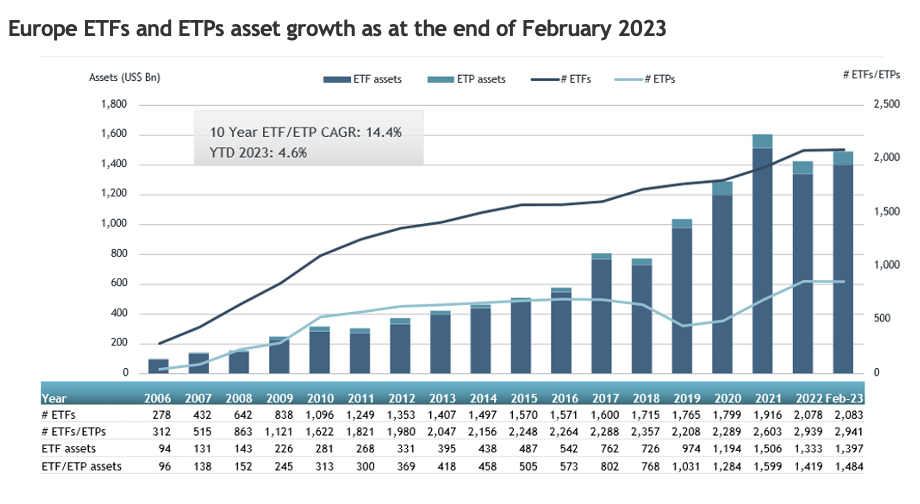

LONDON — March 17, 2023 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that ETFs industry in Europe gathered net inflows of US$8.61 billion during February, bringing year-to-date net inflows to US$27.94 billion. During the month, assets invested in the ETFs industry in Europe decreased by 5.4% from US$1.57 trillion at the end of January to US$1.48 trillion, according to ETFGI's February 2023 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in Europe gathered $8.61 Bn in net inflows in February.

- YTD net inflows in 2023 of $27.94 Bn are third highest on record, after YTD net inflows of $41.91 Bn in 2021 and YTD net inflows of $40.98 in 2022.

- 5th month of net inflows.

- Assets of $1.48 Tn invested in ETFs industry in Europe at the end of February.

“The S&P 500 decreased by 2.44 % in February but is up by 3.69% YTD in 2023. Developed markets excluding the US decreased by 2.59% in February but are up 5.47% YTD in 2023. Israel (down 6.97%) and Hong Kong (down 6.94%) saw the largest decreases amongst the developed markets in February. Emerging markets decreased by 5.57% during February but are up 0.72% YTD in 2023. Colombia (down 11.62%) and Thailand (down 9.38%) saw the largest decreases amongst emerging markets in February.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

The ETFs industry in Europe had 2,941 products, with 11,912 listings, assets of $1.48 Tn, from 98 providers listed on 29 exchanges in 24 countries at the end of February.

During February, ETFs gathered net inflows to US$8.61 billion. Equity ETFs gathered net inflows of $7.03 Bn during February, bringing YTD net inflows to $16.77 Bn, lower than the $32.07 Bn in net inflows YTD in 2022. Fixed income ETFs reported net inflows of $602 Mn during February, bringing net inflows YTD in 2023 to $9.54 Bn, higher than the $3.65 Bn in net inflows YTD in 2022. Commodities ETFs/ETPs reported net inflows of $761 Mn during February, bringing YTD net inflows to $399 Mn, much lower than the $3.89 Bn in net inflows YTD in 2022. Active ETFs attracted net inflows of $110 Mn during the month, gathering YTD net inflows of $840 Mn, slightly lower than the $874 Mn in net inflows YTD in 2022.

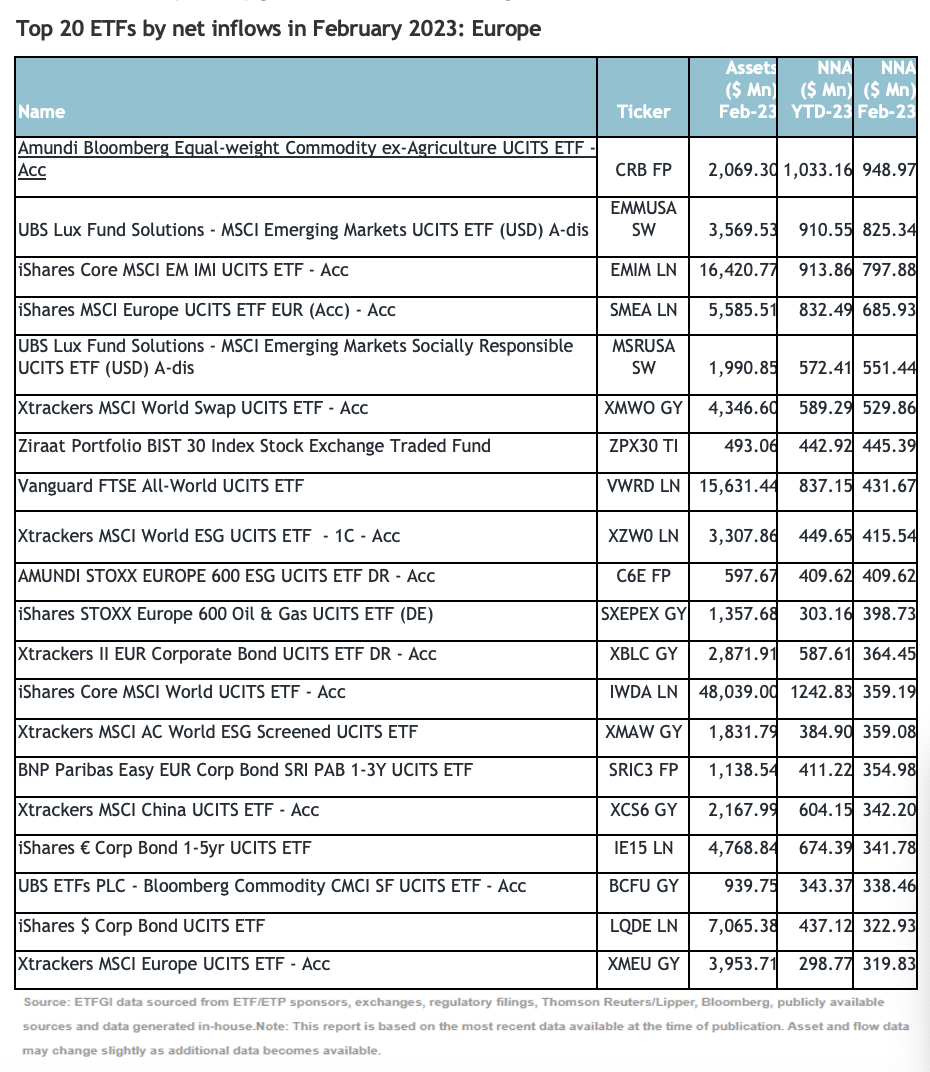

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $9.54 Bn during February. Amundi Bloomberg Equal-weight Commodity ex-Agriculture UCITS ETF - Acc (CRB FP) gathered $949 Mn, the largest individual net inflow.

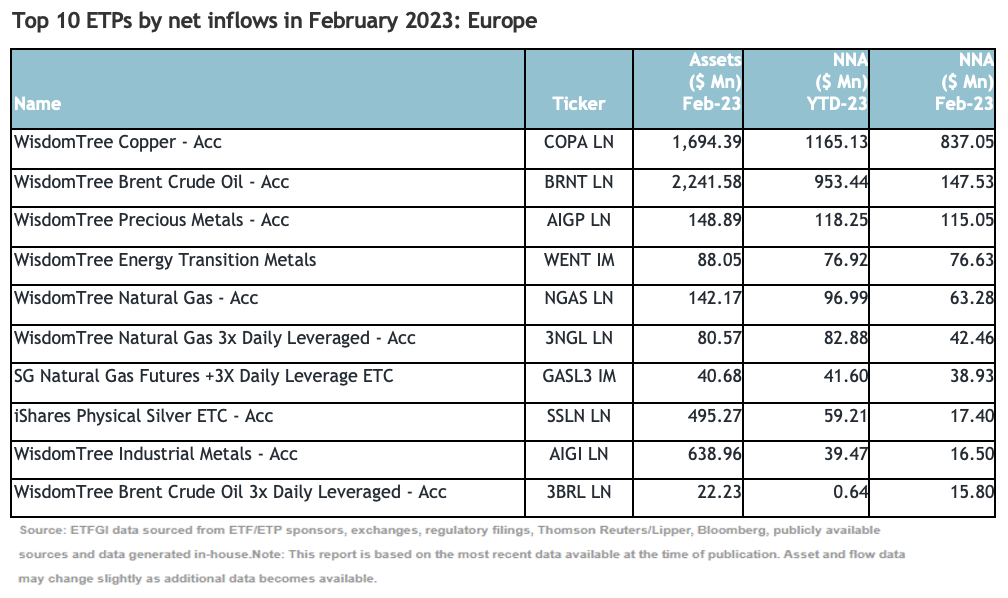

The top 10 ETPs by net new assets collectively gathered $1.37 Bn during February.

WisdomTree Copper - Acc (COPA LN) gathered $837 Mn the largest individual net inflow.

Investors have tended to invest in Active ETFs/ETPs during February.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.