By Kathryn Maraist & Andy Poreda

Aerospace & Defense is a critical component of the economy and global safety, yet many ESG investing strategies eliminate the industry because of its ties to controversial weapons. At Sage, we take a pragmatic approach to ESG analysis, and while we do exclude some industries, we prefer to look for companies that are intentionally building sustainable business models. In this case study, we analyze the ESG policies of Northrop Grumman, an ESG leader within the Aerospace & Defense industry.

About Northrop Grumman

Northrop Grumman (NG) is an aerospace and defense (A&D) company that employs 90,000 people across all 50 states and around the globe. NG’s product base comprises a wide range of capabilities: autonomous systems; cyber; command, control, communications and computers, intelligence, surveillance and reconnaissance (C4ISR); space; strike; and logistics and modernization. The U.S. government (specifically, the Department of Defense and intelligence community) accounted for 83% of NG’s $34 billion in sales in 2019, making it the fourth-largest defense contractor in the country. The company also increasingly conducts business with foreign countries through the U.S. government’s Foreign Military Sales (FMS) Program, and a small share of its profits is derived from local and state governments as well as commercial sales. Due to the sometimes-controversial nature of military operations and their various negative externalities, ESG risk is prevalent in almost every aspect of this industry; therefore, it is vital that companies perform due diligence and effective risk management across all activities.

Environmental

U.S. military operations are responsible for a disproportionately large share of the world’s greenhouse gas (GHG) emissions, with estimated annual emissions as high as those of small countries, such as Switzerland or the Netherlands. Aviation accounts for the largest share of these emissions due to the extreme energy-intensive nature of military aircraft. Because 41% of NG’s revenue comes from aerospace systems, this is an area of material concern. For example, Northrop Grumman’s B-2 Spirit or Stealth Bomber averages only 0.24 nautical miles per gallon of fuel, and its successor, the B-21, which is also being built by NG, will likely have an equal or worse fuel economy.

While important for ESG investors, considerations for environmental impacts do not appear to be a focal point in military aviation contracts and new systems design. It is important to note that the U.S. government and international collaborations such as the Paris Agreement do not mandate strict environmental standards on military products; however, even incremental improvements in fuel economy, with or without customer request, would help mitigate the military’s carbon footprint. Not only is climate change important to obvious stakeholders like the U.S. taxpayer, but it is a critical risk to military readiness. Climate change directly impacts military operations; examples include flooding naval bases due to rising sea levels or Category 5 hurricanes wiping out entire Air Force fleets, such as Hurricane Michael did in 2018, causing $5 billion in damage. The slower-burning effects of climate change will require already-strained military resources and manpower to increasingly focus on disaster relief and humanitarian aid.

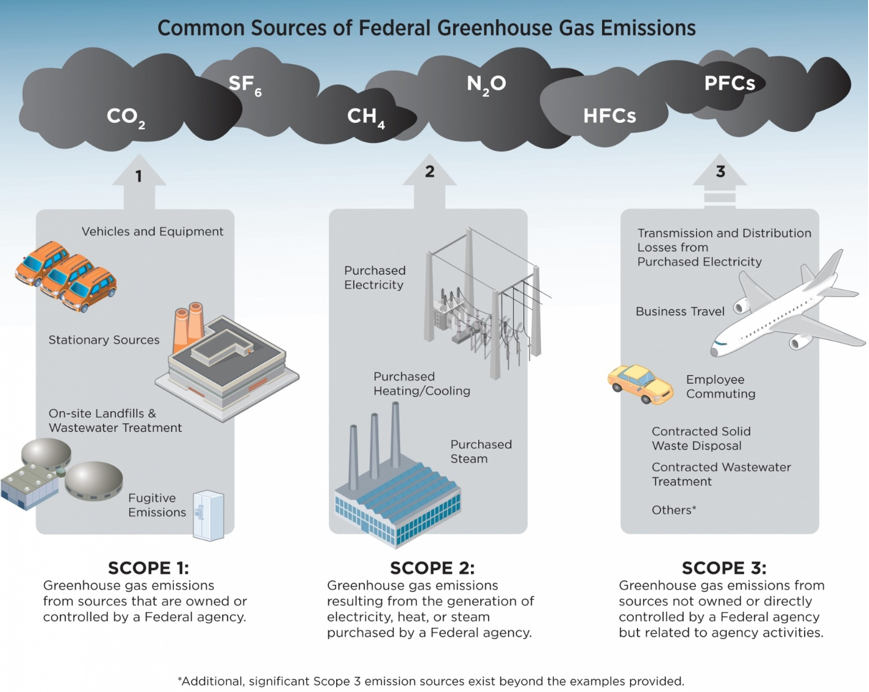

Source: U.S. Department of Energy

To take a preventative stance, defense companies must first find ways to accurately measure emissions from product end-use (a major component of Scope 3 emissions), as it will be critical in discussions on future military operations. Because there is no universal standard for making those calculations, many companies (including NG) exclude them from GHG reduction initiatives. Despite this information gap, NG has made progress in reducing Scopes 1 and 2 emissions by 35.5% since 2010, exceeding its goal of 30% reduction. The company could build upon this success by continuing to employ or purchase renewable energy at suitable facilities, as it has done with its collaboration with Dominion Energy in Virginia to purchase solar power. Since renewables account for only 2% of its electricity generation, NG has a long way to go. An additional hurdle will be its exposure to increasing regulatory risks as it operates in places with emissions trading schemes, such as California. Future executive action from the incoming Biden Administration will only make this a more important issue for companies to focus on.

Social

Diversity and inclusion are an important hallmark of social sustainability, and it is an area where Northrop Grumman does particularly well. Since 2010 women and people of color have gained representation at the vice president level and above. This follows the industry trend of above-average female representation, which is somewhat surprising given the link to the U.S. military. Half the members on NG’s board of directors are women and/or people of color. NG’s low rate (5.6%) of coverage by collective bargaining agreements likely reflects high employee satisfaction, as many rate the company as an innovative and fulfilling place to work. NG has many accolades to support these claims, including DiversityInc’s Top 50 Companies for Diversity award, for which NG was rated as a top employer for veterans, people with disabilities, and the LGBTQ community. NG was also a Top-Rated Workplace by Millennials and Top Rated for Work-Life Balance on Indeed.com, indicating its position as a forward-looking, employee-oriented company.

Maintaining good stakeholder relations is especially important since NG has operations in all 50 states and can be a major player in local economies. NG encourages employees to give back to their local communities, and as a result, employees log over 60,000 hours of volunteer service annually, including numerous service projects focused on the veteran community. With rising competition from Silicon Valley tech companies for talent, NG has increased its career development efforts by hosting numerous programs, including education assistance and mentorships for employees to develop job-specific skills. These efforts also extend beyond existing employees, with an array of partnerships supporting advanced STEM education for K-12 and university students.

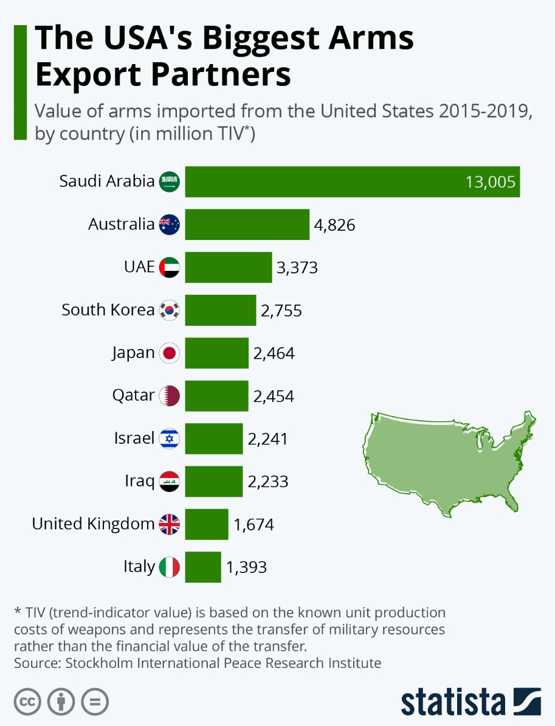

Some social issues associated with the A&D industry and U.S. military (often referred to as the military-industrial complex) are complicated and potentially problematic, especially where geopolitics are involved. It is important to note that although all foreign military sales are authorized by the U.S. government, restrictions imposed by Congress are not always impactful, so some of the burden for social responsibility should fall on companies. NG’s subsidiary Vinnell Corporation has been involved in a joint venture to train portions of the Saudi Arabian National Guard since the 1970s. Saudi-led coalitions have been known to violate international humanitarian law and commit human rights abuses on their own people as well as their neighbors in Yemen – and yet, many of the largest A&D companies are responsible for militarizing them.

The United Nations has declared the conflict in Yemen the world’s most severe humanitarian crisis, with 24 million people dependent on aid and protection – a situation that has only worsened since the Covid-19 outbreak. Because Vinnell accounts for a tiny fraction of NG’s overall revenue (an estimated $212.85 million out of $33 billion in total sales annually), we assert NG should better weigh these humanitarian risks, especially as investors and stakeholders continue to call attention to and exert pressure on companies over human rights concerns.

Source: Statista

Another area that is highly material in this industry is data security, both with regard to confidential national security-related business, and to the public, whose personal data is a highly sought-after commodity. NG has solid measures in place to manage this risk, including frequent self-audits, supplier risk assessments, and annual privacy training. However, the ethics surrounding data usage are ambiguous and largely unregulated since the field is rapidly evolving. The NG-developed Homeland Advanced Recognition Technology (HART), a biometric recognition system that collects and stores an array of data on people entering/leaving the U.S. at the southern border, is a potentially risky venture. Many human rights groups have called out HART’s role in facilitating wrongful arrests and deportations of undocumented people since Immigration and Customs Enforcement (ICE) began using it in 2019. After one-third of shareholders voted for enhanced due diligence procedures, NG established a Human Rights Working Group to ensure proper implementation of its Human Rights Policy. This is a step in the right direction in protecting this sensitive data from future misuse; however, we see risk in HART’s future operations and recommend the company weigh potential controversies and reputational risk, especially given that the $94 million contract represents only a small fraction of NG’s annual revenue.

Governance

Northrop Grumman’s board of directors is a source of strength for the company; 11 of 12 directors are independent, and fully independent board committees oversee audit, nomination, and remuneration. A thorough executive remuneration policy is geared towards both immediate and long-term sustainable value creation, which includes analyzing progress on seven key non-financial ESG metrics.

The company’s comprehensive code of ethics clearly defines all aspects of appropriate business conduct and is enforced via regular compliance training and audits. Employees and suppliers also undergo training in relevant areas, such as counterfeit materials prevention, anti-human trafficking and forced labor policy, and cybersecurity. The company’s OpenLine whistleblower hotline is another compliance assurance system, and users have the option of anonymity.

Corporate transparency is of heightened importance in this industry since taxpayers are essentially the primary source of funding for defense projects. NG has room for improvement in this area. For example, in the company’s recent annual reports, sales to Middle Eastern and European countries are arbitrarily grouped together. This can be misleading because the relationships to Middle Eastern and European customers are entirely different from a risk perspective. NG should disclose all sales broken down by country to reduce ambiguity. Because A&D companies have millions (and sometimes billions) of dollars in government contracts at stake, thorough disclosure of political activities is paramount. Although NG participates in trade associations that lobby for the industry’s political interests, it discloses its major political donations in detail. Another area for improvement is in NG’s Climate Change Report, which details its positions on some environmental policy areas but should improve disclosure in other areas, such as corporate tax policy and data privacy legislation.

Strong product governance that covers every step of the supply chain is highly material in this industry, especially where conflict materials are involved; however, supply chain management is a monstrous task as defense contractors are usually dealing with thousands of suppliers. NG participates in various trade organizations that help alleviate this burden, as member companies largely draw from the same supplier pool and therefore divide the administrative responsibilities among themselves. One area of concern is the use of 3TG minerals (gold, tantalum, tin, and tungsten) in dozens of NG’s products. This is potentially problematic because profits from mining 3TG minerals often benefit groups that commit human rights violations. Tracing the origins of these minerals is difficult, as suppliers associated with these groups may deliberately obscure this information. As reported in its filing with the Securities and Exchange Commission (SEC), NG considers itself a “downstream consumer,” several levels removed from the smelters and refiners who obtain these minerals. Therefore, these initial suppliers were excluded from the company’s due diligence audits and NG was only able to verify origins for some, but not all suppliers.

A company’s product portfolio can usually be a good indicator in helping judge its intentionality, but we see NG’s products merely mirroring what is being requested by the U.S. government (which is in line with NG’s peers). This means that Northrop Grumman has numerous ties to nuclear weaponry, but also has had past ties to controversial weapons systems, such as anti-personnel landmines, cluster munitions, and depleted uranium rounds through the company’s wholly owned subsidiary Orbital ATK Inc. U.S. policy on landmines and cluster munitions is currently not in line with most of the international community, which deems the potential collateral damage on civilians and soldiers as outweighing any benefits. Therefore, we will monitor any NG bids on new contracts, which may be a moot point if the Biden Administration updates military policy on usage.

Risk & Outlook

The military-industrial complex can be controversial in many respects, but divestment is not feasible because global ideological differences are ever present. There are numerous stakeholders in the equation, and having well-run, ESG-minded companies are in everyone’s best interests: better product safety protects our troops; companies free of corruption ensure that taxpayers are paying for the best products; and technological innovation is one of our greatest adaptation tools. We believe A&D companies that place an emphasis on mitigating ESG risks while also demonstrating positive intentionality will perform well over the long-term.

Sage sees NG, along with Lockheed Martin, as ESG leaders among large U.S.-based A&D companies. NG has created a framework for future success, as it has made strong governance and human capital management focal points for the company’s future. We believe, however, that NG should place a stronger emphasis on management and reporting of environmental risks, as well as properly address its involvement in both current and future controversial government contracts (e.g., HART and Saudi Arabian arms deals).

We believe A&D companies need to be held more accountable for their actions, which will be a part of the referendum moving forward. Many of the A&D companies’ largest shareholders (State Street, Blackrock, and Vanguard) are starting to emphasize ESG issues while also expanding their sustainable fund offerings. While many ESG funds are excluding companies like NG for their controversial weapon ties, we believe engagement from shareholders will start to tackle some of these issues. NG has already demonstrated its responsiveness to investors with the establishment of its Human Rights Working Group, which is why we are confident that NG will continue to be an ESG leader in the industry, even if it requires investor engagement to remain so. Until we see an increase in more proactive and preventative policies, we hold NG as a three-leaf company, with a neutral outlook.

Sage ESG Leaf Score Methodology

No two companies are alike. This is exceptionally apparent from an ESG perspective, where the challenge lies not only in assessing the differences between companies, but also in the differences across industries. Although a company may be a leader among its peer group, the industry in which it operates may expose it to risks that cannot be mitigated through company management. By combining an ESG macro industry risk analysis with a company-level sustainability evaluation, the Sage Leaf Score bridges this gap, enabling investors to quickly assess companies across industries. Our Sage Leaf Score, which is based on a 1 to 5 scale (with 5 leaves representing ESG leaders), makes it easy for investors to compare a company in, for example, the energy industry to a company in the technology industry, and to understand that all 5-leaf companies are leaders based on their individual company management and the level of industry risk that they face.

For more information on Sage’s Leaf Score, click here.

Originally published by Sage Advisory

Sources

- “AIA Key Workforce Statistics.” Aerospace Industries Association.

- “AIA Facts and Figures.” Aerospace Industries Association.

- McCarthy, Niall. “World’s Largest Arms-Producing Companies.” Statista and SIPRI. December 7, 2019.

- Willings, Adrian. “28 ways military tech changed our lives.” Pocket-Lint. May 31, 2019.

- S&P 500 and Corporate Bond Market Statistics calculated via FACTSET.

- “Northrop Grumman 2019 Sustainability Report.” Northrop Grumman.

- “Northrop Grumman 2019 Annual Report and 2020 Proxy Statement.” Northrop Grumman.

- Crawford, Neta. “Pentagon Fuel Use, Climate Change, and the Costs of War.” Watson Institute: Brown University. November 13, 2019.

- “Northrop Grumman Sustainability Reports and ESG Information.” Northrop Grumman.

- McCarthy, Niall. “Report: The US Military Emits More CO2 Than Many Industrialized Nations.” Brown University, Forbes and Statista. June 13, 2019.

- Mckenna, Phil. “Hurricane Michael Cost This Military Base About $5 Billion, Just One of 2018’s Weather Disasters.” Inside Climate News. February 6, 2019.

- “Common Sources of Federal Greenhouse Gas Emissions.” US Department of Energy.

- “US: Trump Administration Abandons Landmine Ban.” Human Rights Watch. January 31, 2020.

- “Dominion Energy Acquires Central Virginia Solar Project.” Dominion Energy. August 17, 2020.

- Root, Al. “The Captains of Industry Are Still Mostly Men- but Not in Defense.” Barron’s. June 20, 2019.

- Gallagher, Mary Beth. “Northrop Grumman’s Human Rights Record in the Spotlight.” Investor Advocates for Social Justice.

- “Yemen: Wartime Abuses Face Global Spotlight.” Human Rights Watch. January 14, 2020.

- Armstrong, Martin. “The USA’s Biggest Arms Export Partners.” Stockholm International Peace Research Institute and Statista. March 9, 2020.

Disclosures

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. The information included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. This report is for informational purposes only and is not intended asinvestment adviceor an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results. Sustainable investing limits the types and number of investment opportunities available, this may result in the Fund investing in securities or industry sectors that underperform the market as a whole or underperform other strategies screened for sustainable investing standards. No part of this Material may be produced in any form, or referred to in any other publication, without our express written permission. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Read more on ETFtrends.com.The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.