ESG: An Issuer’s Perspective

ESG, which is short for environmental, social and governance, represents one of the strongest growing investment segments in Europe and the U.S., as socially conscious investors, keen to “do the right thing,” direct their investments to companies seen to be doing more to make the world better.

With Earth Day tomorrow, we wanted to look at data from an August 2021 U.S. Chamber survey to get insights from issuers on ESG. Importantly, this represents our analysis of the data, and is not Nasdaq’s opinion on ESG and the recently proposed climate disclosures rules from the U.S. Securities and Exchange Commission (SEC).

Solving the ESG problem is new

ESG, being a relatively new form of investment style, creates some new questions. First and foremost, there is no standardization of what data is required and little history to back-test against to see if it matters (for investors or the world).

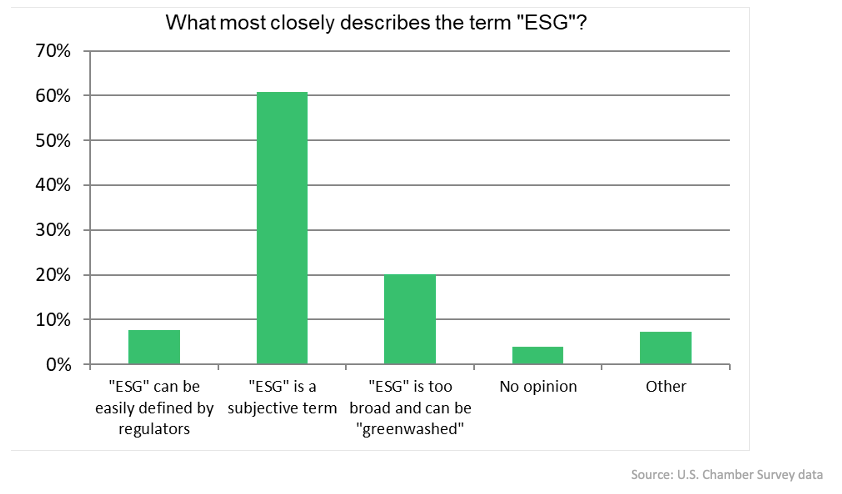

Chart 1: Most companies see ESG as a subjective term

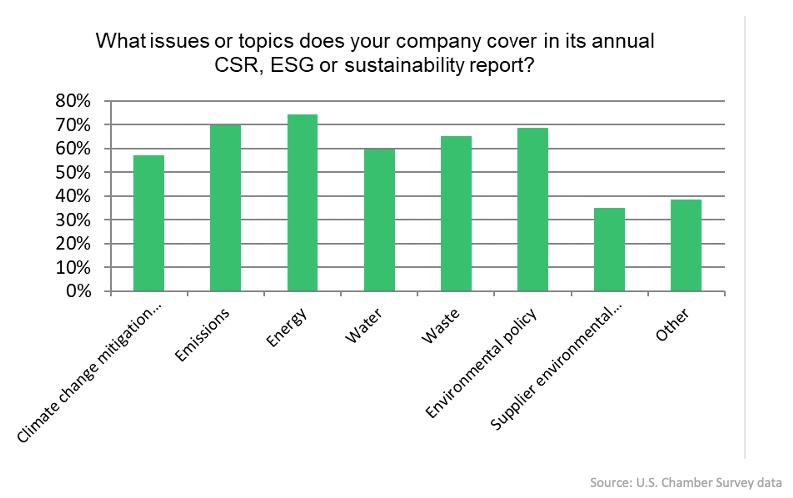

That makes it hard to agree on what is “good ESG” and what isn’t. And sometimes (like now, with the war in Ukraine), that can change. There is disagreement about what should be included, as well as whether E and S and G should have equal importance. The survey data, however, shows companies’ “E” disclosures, ranging from energy to environment or emissions disclosures.

Chart 2: What topics do corporates include in ESG reporting

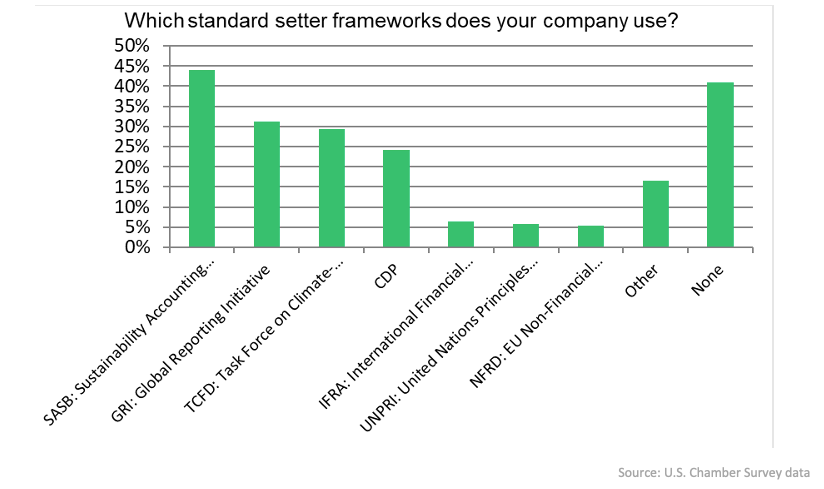

In order to bring some consistency to the process, a number of groups have created ESG standards. Notably, the Chamber survey found that many companies are reporting against more than one of these, as the sum of the bars in Chart 3 adds up to more than 100%.

Chart 3: There are a number of ESG data standards, each with different questions and scoring systems

But it's not just standard setters that ask ESG questions of companies. Often shareholders or research analysts also have questions for corporates. In fact, the survey showed most companies have to complete an average of five different questionnaires each year, with some companies reporting they completed many more.

Chart 4: ESG data requests come from a variety of interested parties

An SEC poke back in 2010 helped improve ESG reporting

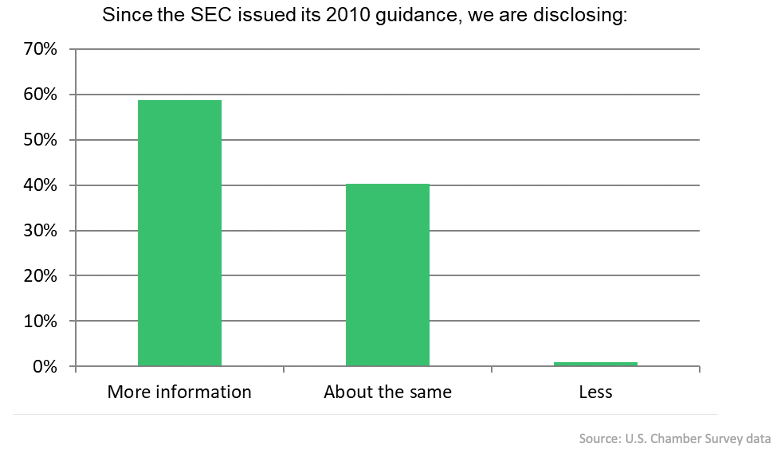

Back in 2010, the SEC provided guidance on reporting material environmental risks.

Since then, the results of the survey seem to show that poke helped. Overwhelmingly, reporting has increased, with almost 60% of companies reporting more information now than in 2010.

Chart 5: Most companies are reporting more ESG now than in 2010

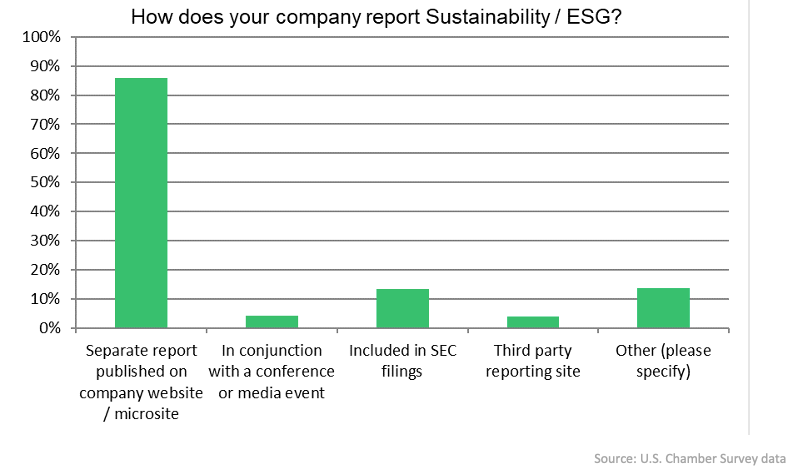

However, the survey also shows that most companies disclose their ESG metrics separately from their SEC filings on financials.

Chart 6: Most companies report ESG separately to regulatory and financial reports

SEC recently proposed new “E” rules

More recently, the SEC has proposed new, more specific rules that require companies to include climate information in annual reports (Form 10-K) and quarterly reports (Form 10-Q). The rules are based on principles from the Task Force on Climate-Related Financial Disclosures (TCFD) and the Greenhouse Gas Protocol (GHG).

For a good summary of the rules, see here. Some of the big changes are:

- Climate-Related Risks and Metrics: Adding the potential impacts of material climate risks to the risks section of the annual report and to the audited financial statements. This includes identifying and evaluating the risks of fires and hurricanes to properties and operations, as well as exposure to sea level rise, and additional financial disclosures if the line-item impact is over 1%. Financial disclosures would also need to comply with internal control over financial reporting (ICFR).

- Emissions Calculations and Attestation: All companies will be required to calculate direct (Scope 1) and indirect (Scope 2) greenhouse gas emissions. Most companies will be required to disclose value chain (Scope 3) emissions too if they are material or part of a target or goal, which include emissions from raw materials purchased, transport and company travel – as well as downstream activities as customers use and dispose of the products. Larger companies will be required to have independent assurance on Scope 1 and 2 emissions.

Implementation will be staggered in phases: First, the largest companies are expected to comply by fiscal year (FY) 2023. The last to join will be smaller reporting companies in FY 2025.

Looking Ahead

The SEC is currently accepting comments on its proposed rules for climate-related disclosures, and we look forward to reviewing the feedback from issuers. We are conducting a new survey with the Chamber about companies' views of the SEC's proposal, and we will compare those results once they are released.

While the ESG space is rapidly evolving, it is good to see companies and regulators making an effort.