A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

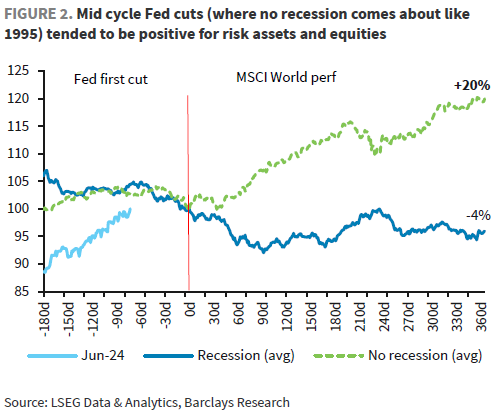

"Party like it's 1995: Dovish central banks are further improving the growth/policy trade-off. Mid-cycle rate cuts amid a resilient economic activity is a positive environment for risk assets."

-Barclays' Emmanuel Cau

|"Markets also trimmed the amount of Fed rate cuts they are expecting this year by -4.7bps to 80bps. We also saw the expected probability of a June cut fall to 79%, down from nearly 86% at the peak last week.

...the amount of ECB cuts priced by December coming down -6.1bps to 88bps."

-Deutsche Bank, Jim Reid

* source: Barclays' Emmanuel Cau

* source: Goldman Sachs Global Investment Research

* source: BofA's Michael Hartnett, The Flow Show

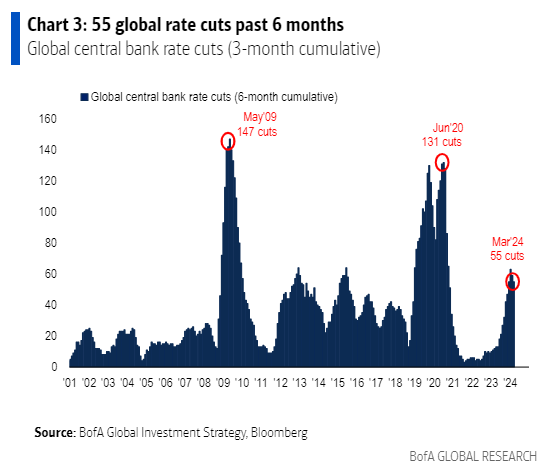

| "Fed desperate to cut rates, ECB/BoE need to cut rates, SNB cutting rates, PBoC also cutting rates, only BoJ raising rates (by a minimal 10bps); 55 global central bank rate cuts over the past 6 months ; the DNA of today's "everything bull.""

-BofA's Michael Hartnett

* source: BofA's Michael Hartnett, The Flow Show

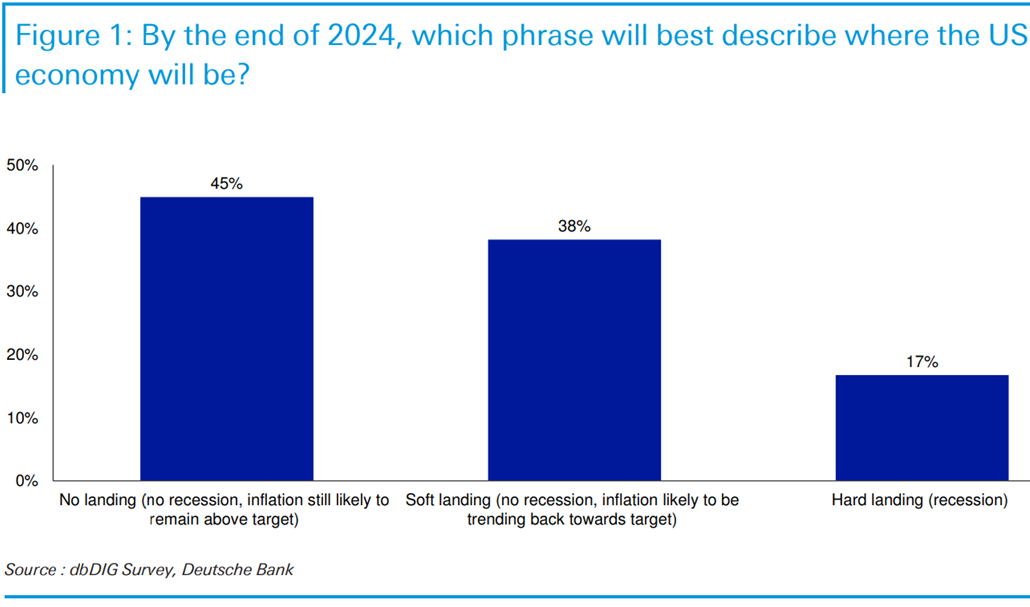

| DB investor survey: inflation risk remains while investors are more optimistic on the economy...

* source: Deutsche Bank

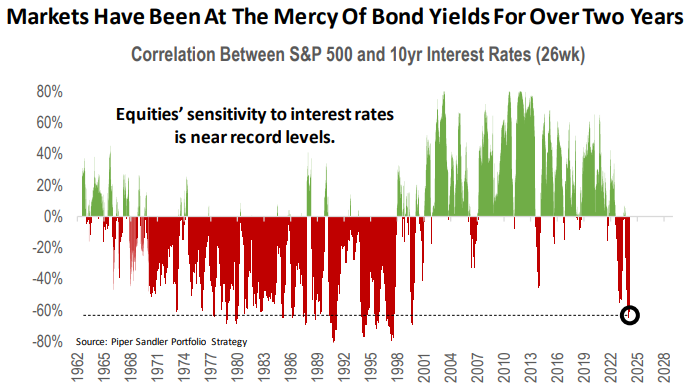

| 10YR yield remains firmly above 4% | equities' sensitivity to interest rates is near record levels

* source: CNBC

* source: Michael Kantrowitz, Piper Sandler

| "There have been 27 market corrections of 10% or greater since 1964; every single one of them had at least one of three main catalysts: 1) higher rates; 2) rising unemployment; or 3) a global (exogenous) issue.

Today, we see higher rates as the likeliest threat to a continued uptrend in stocks."

-Michael Kantrowitz, Piper Sandler

* source: Michael Kantrowitz, Piper Sandler

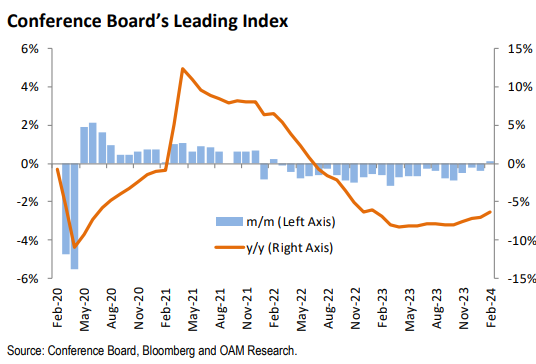

| The Hot & Cold Economy: (Economic) leading index posts first monthly gain in two years

* source: John Stoltzfus, Oppenheimer Asset Management

| rich valuations + bifurcated market

* source: Goldman Sachs Global Investment Research

1) KEY TAKEAWAYS

1) Equities + Gold HIGHER | Dollar + Oil LOWER | TYields MIXED

-Headline + core durable goods beat consensus, breaking two months of consecutive drops

DJ +0.1% S&P500 +0.2% Nasdaq +0.4% R2K +0.5%

Stoxx Europe 600 +0.1% APAC stocks MIXED, 10YR TYield = 4.261%

Dollar LOWER, Gold $2,181, WTI -0%, $82; Brent -0%, $86, Bitcoin $70,756

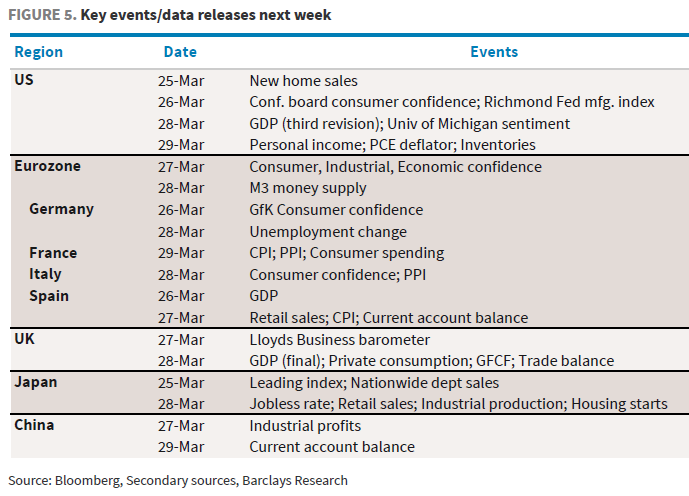

2) THIS WEEK:

light macro calendar

* source: Barclays' Emmanuel Cau

2) MARKETS, MACRO, CORPORATE NEWS

- China manufacturing drive risks higher US Inflation, NY Fed says-BBG

- Analysis-Bank of Japan may be less dovish than markets think-RTRS

- Traders bet BOE more likely to start rate cuts than Fed or ECB-BBG

- US faces Liz Truss-style market shock as debt soars, warns watchdog-FT

- Hedge funds flock to Europe, ditch US stocks-RTRS

- Employment in 16 US states remains below pre-pandemic levels-BBG

- German consumer sentiment stays on slow recovery path, finds GfK-RTRS

- Australia consumer mood darkens anew in March – survey-RTRS

- S.Korea consumer sentiment dips as food inflation top election issue-RTRS

- US CEOs extend China stay on last-minute invite to meet Xi-BBG

- China seen delivering more RRR cuts this year to boost economy-BBG

- PBOC extends yuan support as it boosts fix by most since January-BBG

- China pushes banks speed approvals of new loans to private developers-RTRS

- Bloomberg/Morning Consult swing state poll hints at Biden comeback-AXIOS

- Meng Foon won't quit as a PGG Wrightson director-DESK

- Major bridge in Baltimore collapses after being struck by cargo ship-NYT

- Carlyle said to weigh $1 billion IPO for India IT firm Hexaware-BBG

- Beige likely sell up to 2.90% stake in Mankind Pharma via block deals-CNBC

- Boeing may turn to outsider CEO to tackle spiraling crisis-RTRS

- Hershey, Mondelez bet big on Easter as cocoa price crisis looms-RTRS

- Tesla offers U.S. customers a month's trial of its driver-assist technology-RTRS

- Trump's Truth Social to start trading as DJT-AXIOS

Oil/Energy Headlines: 1) Summer pump prices set to hit $4 a gallon just as Americans hit the road-BBG 2) US oil production set to rise to record as costs decline, Macquarie says-BBG 3) Russia’s crude shipments rebound even as sanctions snare tankers-BBG 4) Indian buyers of Venezuelan oil halt imports on sanction fears-BBG 5) Indian refiners buy more US crude as Russia sanctions tighten-RTRS 6) Russian, Chinese ships face risks despite Houthi pact-BBG

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.

Text

Byline

Submit Application In the United States left solid buttonbody

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.