A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

* source: Goldman Sachs Global Investment Research

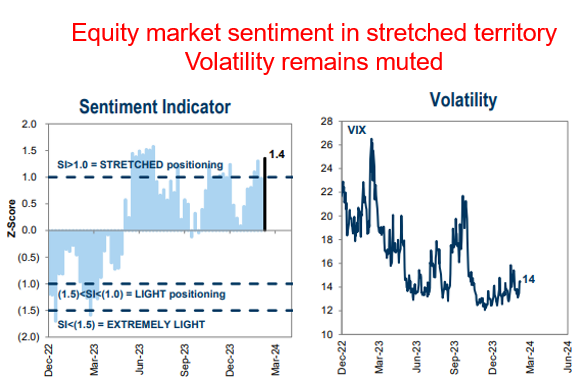

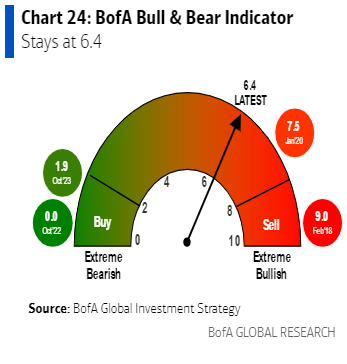

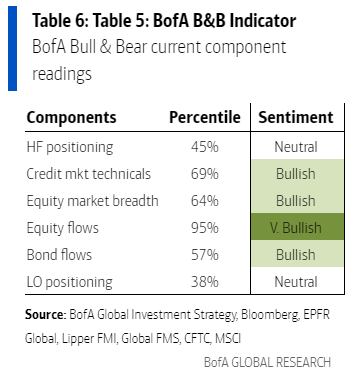

* source: Michael Hartnett, The Flow Show, BofA

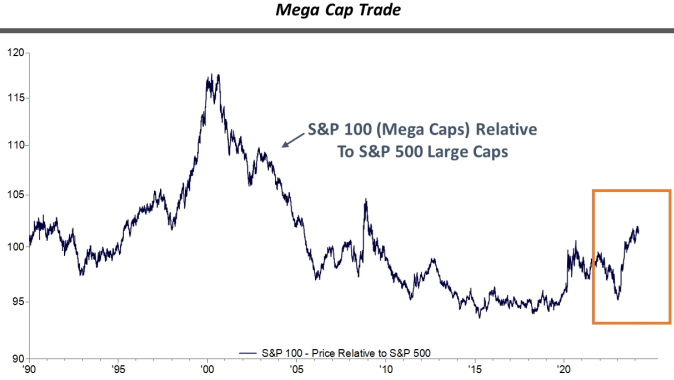

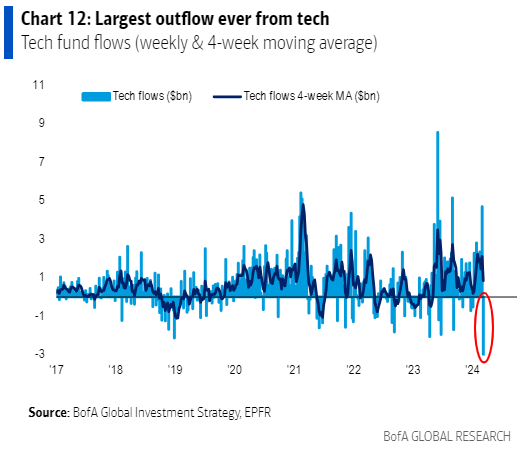

concentration risk!

* source: Goldman Sachs Global Investment Research

| "It seems like the topic of mega caps and bubbles comes up in nearly every conversation with investors these days"

-Piper Sandler

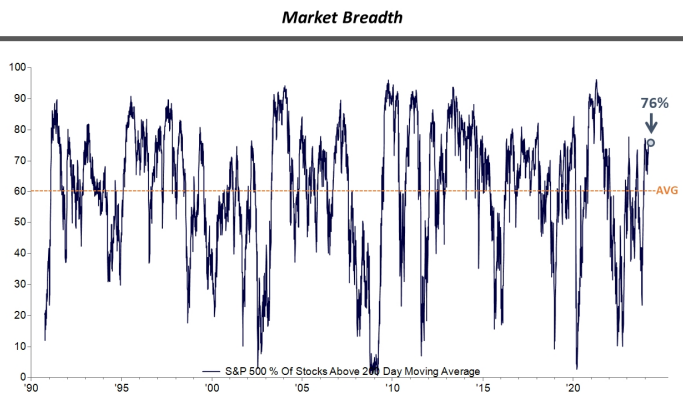

| "While performance has been impressive in the mega cap space, we have seen breadth continue to expand." [better economic growth prospects]

-Piper Sandler

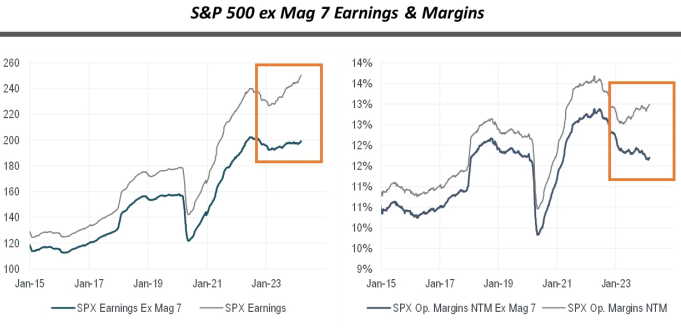

| "What we need to see next is broadening in the earnings story. Nearly all of the earnings and margin strength continues to come from the biggest of the big (i.e. Mag 7)."

-Piper Sandler

* source: Piper Sandler

| hmmm, getting bubbly...food for thought?

* source: Michael Hartnett, The Flow Show, BofA

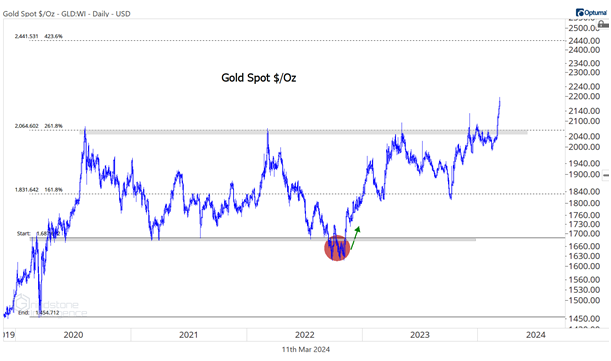

| Gold hitting new highs | geopolitical risk, equity market concentration risk, near term inflation risk, commercial real estate a source of risk?

* source: Grindstone Intelligence

| Flows in equities continue to favor ETFs (passive > active)

* source: Goldman Sachs Global Investment Research

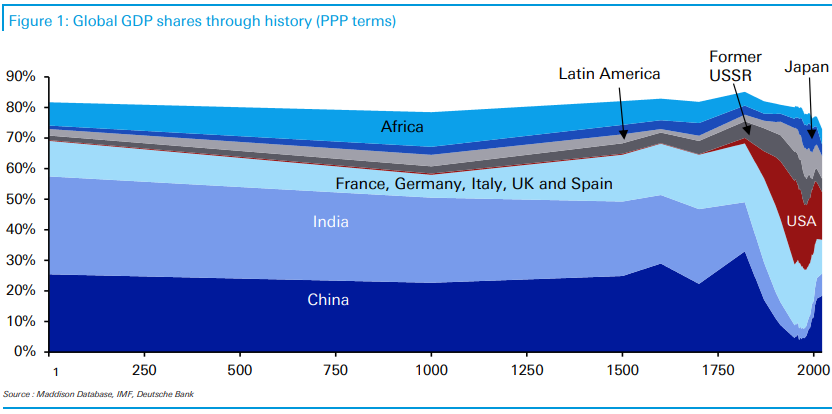

| Food for thought:

"For much of observable economic history, China and India had the largest share of global GDP. However this changed in the nineteenth century as Europe and then the US became the most geopolitically powerful."

* source: Deutsche Bank

1) KEY TAKEAWAYS

1) Equities + Oil + Gold LOWER | Dollar HIGHER | TYields MIXED

-CPI data tomorrow!

"Private equity groups globally are sitting on a record 28,000 unsold companies worth more than $3tn, as a sharp slowdown in dealmaking creates a crunch for investors looking to sell assets." -FT

DJ -0.4% S&P500 -0.5% Nasdaq -0.6% R2K -0.8% Cdn TSX -0.4%

Stoxx Europe 600 -0.4% APAC stocks LOWER, 10YR TYield = 4.087%

Dollar LOWER, Gold $2,177, WTI -1%, $77; Brent -1%, $81, Bitcoin $71,704

2) Yields falling and flirting with the psychological 4% level

* source: John Stoltzfus, Oppenheimer Asset Management

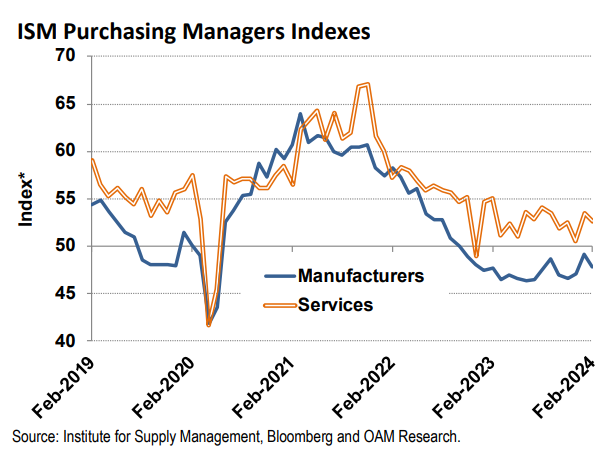

3) Overall the ISM report suggests the economic conditions are likely to remain resilient but not robust.

* source: John Stoltzfus, Oppenheimer Asset Management

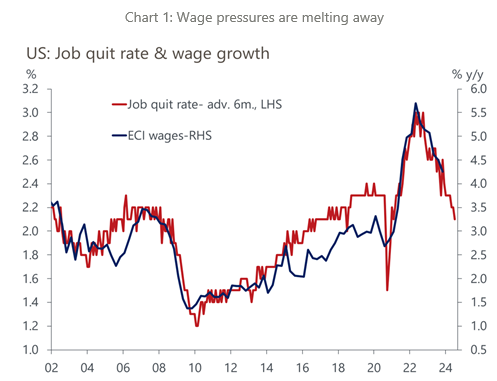

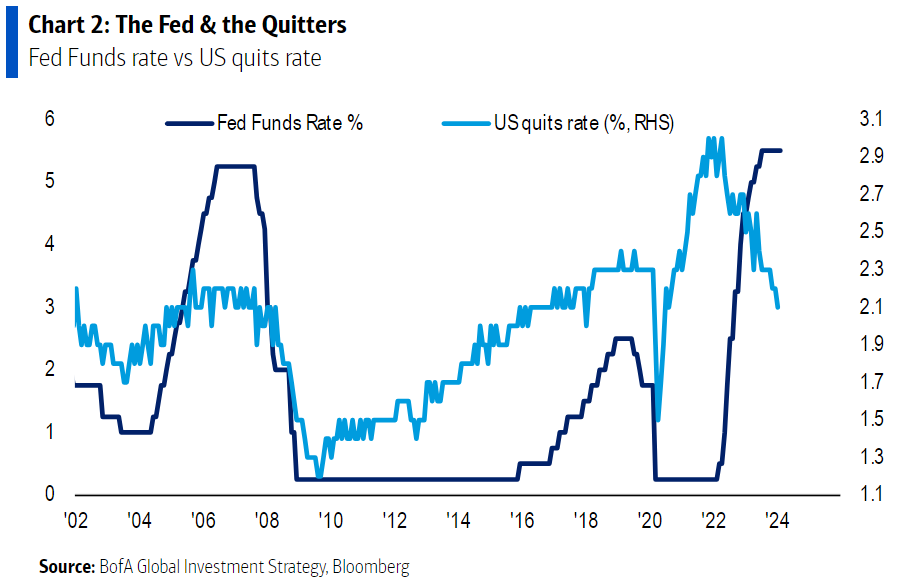

4) Job market still strong but cooling as quit rate falling...

* source: Oxford Economics

labor market risks growing?

* source: Michael Hartnett, The Flow Show, BofA

5) THIS WEEK:

"The US CPI and retail sales reports will be the key data releases next week.

In Europe, the focus will be on the monthly GDP and labour market indicators in the UK.

Over in Asia, investors will also pay attention to the 1-yr MLF rate announcement

in China as well as signals from wage talks in Japan."

-Deutsche Bank

2) MARKETS, MACRO, CORPORATE NEWS

- It isn’t just big tech propelling gains in the stock market anymore-MSN

- One of the most infamous trades on Wall Street is roaring back-BBG

- Magnificent 7 stocks aren’t too pricey, JPMorgan strategist says-BBG

- Bank of Japan leaning toward exiting negative rates in March-RTRS

- Japan Q4 GDP revised up to slight expansion, economy avoids recession-RTRS

- China's consumer prices swing up on seasonal Lunar New Year gains-RTRS

- China housing chief pledges 'reasonable' aid for distressed developers-NIKKEI

- Chinese regulators ask large banks to step up support for Vanke-RTRS

- China warns overall pressure on employment yet to ease-RTRS

- Bitcoin hits record above $71,000 as demand frenzy intensifies-RTRS

- Biden's 2024 US government budget is also a campaign pitch-RTRS

- China’s big policy meet offers little to excite commodity bulls-BBG

- US mulls blacklisting CXMT to curb China’s chip advance-BBG

- Apple to open new Shanghai store as China iPhone sales slump-BBG

- Direct Line boss Adam Winslow bets on tech to repel predators-MONEY

- TP ICAP separates data unit following investor pressure-FT

- Kering and EssilorLuxottica among suitors for eyewear makerMarcolin-FT

- TSMC to win more than $5 billion in grants for US chip plant-BBG

- Delta CEO expects Boeing 737 Max 10 may be delayed until 2027-BBG

- Vale CEO to keep job through 2024 as miner seeks successor-BBG

- UK-focused retail broker eToro considers New York for IPO-FT

- Foreign heavyweights lob NBIOs for GPG Australia; auction delayed-AFR

- Citigroup CEO Jane Fraser will have to pull off the restructuring of the century to bring banking empire back to its former glory-NYP

Oil/Energy Headlines: 1) Hedge funds cut bearish US oil bets to October lows on OPEC move-BBG 2) Aramco sees 'healthy' oil demand growth of 1.5 million b/d this year-PLATTS 3) Aramco sees China demand growing, eyes more investments-RTRS 4) Asian oil demand growth in focus as OPEC+ move carves out supply roadmap-PLATTS 5) Most Aramco buyers get full April volumes but heavy crude supply trimmed, sources say-RTRS 6) The Houthis are schooling us in asymmetric warfare-BBG

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.