Eni SPA E plans to launch an initial public offering (IPO) for its Plenitude retail and renewable business, which combines renewable power generation, sale of electricity, gas and energy services and a European network of electric vehicle charging points.

The move is being planned as the company attempts to capitalize on renewed investor interest in energy stocks in a depressed IPO market amid the Russia-Ukraine conflict. The spin-off would be the most significant structural move by an energy major in response to the rising pressure to curb climate change.

Eni will conduct the IPO on the Euronext Milan stock exchange, involving a public offering and a private placement. The company plans to retain a majority stake in the business following the IPO this year. The IPO will help Plenitude diversify its ownership structure, consolidate its position and develop rapidly.

Oil and gas companies face increasing challenges in raising finances amid rising sustainability concerns, leading to costlier debt financing. Higher debt financing, associated with depressed equity valuations, leaves most oil companies with a higher cost of capital.

Hence, energy companies are under pressure to invest more in renewables while generating profits from legacy assets to pay shareholders and fund transition. However, Plenitude will have access to cheaper funding under the new structure and gain from the continued integration of the renewable division and gas and power business.

Plenitude has a portfolio of 1.4 gigawatts (GW) of installed renewable energy capacity in operation. It plans to increase the capacity to more than 6 GW by 2025 and 15 GW by 2030. Plenitude provides natural gas and energy to around 10 million customers.

The move reflects Eni’s strong focus on capitalizing on mounting demand for renewables and green energy products. The creation of the industrial and financial entity will help it lower its Scope 3 emissions.

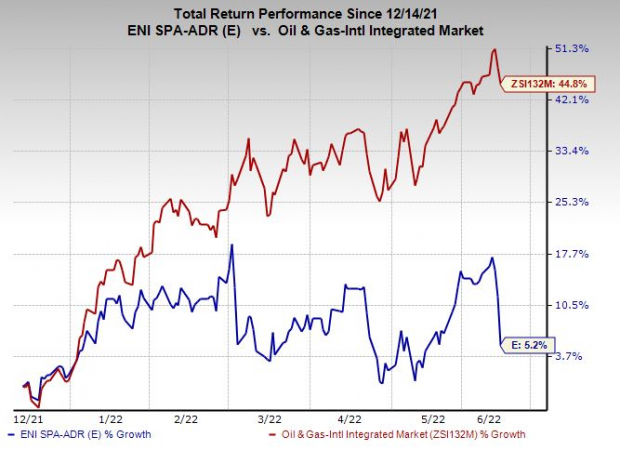

Price Performance

Shares of Eni have underperformed the industry in the past six months. The stock has gained 5.2% compared with the industry’s 44.8% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stock to Consider

Eni currently has a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Oasis Petroleum OAS is an independent explorer that engages in the acquisition and development of oil and gas resources. OAS exited Chapter 11 Bankruptcy sometime back with a clean balance sheet. The company has managed to wipe out $1.8 billion in debt and now the figure stands at less than $400 million.

The company’s quality asset base and balance sheet strength will support free cash flow generation and consequent shareholder returns. Oasis Petroleum currently pays a quarterly dividend of 58.5 cents ($2.34 annualized) while it recently completed a $100 million share repurchase program.

PDC Energy, Inc. PDCE is an independent upstream operator that explores, develops and produces crude oil, natural gas and natural gas liquids. As of Mar 31, 2022, PDCE had $1.65 billion in total liquidity, while its credit facility currently has a total borrowing base of $3 billion. Thus, PDC Energy’s debt maturity profile is a favorable one.

PDC Energy’s cash flows will also receive some downside protection from oil and gas hedges. The company has hedged a portion of its 2022 oil production at attractive prices. At that price, PDCE’s hedges are expected to add robust positive value in revenues and considerably soften the blow if there is another meltdown in oil prices.

Cenovus Energy Inc. CVE is a leading integrated energy firm based in Calgary, Canada. With multiple divestments announced last year, the company reached its asset sale commitment for 2021, making it well-positioned to focus on high-return opportunities in the portfolio.

Cenovus has a strong focus on returning capital to shareholders. CVE increased the quarterly base dividend to 10.5 Canadian cents per share, suggesting a 200% increase from 3.5 Canadian cents per share. The dividend will be paid on Jun 30, 2022, to common shareholders of record as of Jun 15, 2022. This year’s commitment to growing shareholders returns comprises the plan to buy back up to 146.5 million common shares.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eni SpA (E): Free Stock Analysis Report

Cenovus Energy Inc (CVE): Free Stock Analysis Report

PDC Energy, Inc. (PDCE): Free Stock Analysis Report

Oasis Petroleum Inc. (OAS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.