Eni SPA E is collaborating with JPMorgan Chase & Company JPM to divest a minority interest in its power generation unit, Enipower, per a report by Reuters.

The divestiture is part of Eni’s efforts to fund its low-carbon transition. The company is undergoing a major restructuring, which aims at separating its traditional oil and gas business from assets related to energy transition.

Per Reuters, the company is planning to divest 40% of Enipower’s stake. Notably, a stake of up to 49% could be worth as much as $704 million. The company expects non-binding bids for the transaction to start in two to three weeks. Although infrastructure and investment funds showed interest in the deal, no industrial players have come forward so far.

Energy companies are aiming to diversify and invest in clean energy due to mounting pressure from investors. Investors have been expressing concerns about sustainability for several decades. But not until recently have they transformed their words into action by suing companies for not doing enough to reduce emissions and prevent climate change.

A group of leading global investors engaged with major energy companies, including Eni, BP plc BP, Royal Dutch Shell plc (RDS.A), Repsol and TotalEnergies, is going to present a set of expectations for the oil and gas sector in aligning to net-zero emissions. The initiative outlines the actions that energy companies must include in their plans to achieve net-zero emissions and how they should report on those actions so that investors have fair conditions to evaluate their progress efficiently.

In accordance with the Paris Climate accord, almost all oil and gas companies throughout the world are entering the renewable energy sector to support the clean energy transition. Hydrocarbon firms transitioning toward renewable energy will bring in more capital even when renewable energy forms a small portion of their portfolios.

Company Profile & Price Performance

Headquartered in Rome, Italy, Eni is one of the leading integrated energy players in the world.

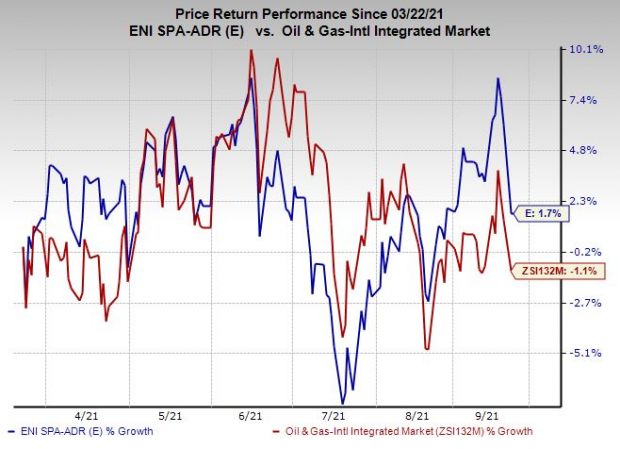

Shares of the company have outperformed the industry in the past six months. The stock has gained 1.7% against the industry’s 1.1% decline.

Image Source: Zacks Investment Research

Zacks Rank

Eni currently carries a Zack Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

BP p.l.c. (BP): Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A): Free Stock Analysis Report

Eni SpA (E): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.