Eni SPA E began local discussions to develop Coral Norte, a second floating LNG (“FLNG”) platform on the Coral gas field offshore northern Mozambique.

Eni hired Consultec to conduct the environmental impact assessment process.

The Coral Norte FLNG project will build on its existing Coral Sul facility offshore Mozambique. Notably, Eni operates the Coral Sul floating LNG project.

In 2015, Eni acquired its environmental license for Coral Sul. The facility shipped its first cargo in November last year. Shortly, Eni started working on plans for a second unit.

The latest facility will be developed 25 kilometers north of Coral Sul. The Coral Norte project is estimated to cost $7 billion. The facility is expected to begin liquefaction and export in 2027 if it progresses as planned.

The Coral reservoir holds 17.7 trillion cubic feet of gas and needs a multi-phase development strategy to tap the abundant gas reserves. Coral Norte is the next phase of the development plan.

Coral Norte, which will be a replica of Coral Sul, will be able to produce 3.5 million tons per year of LNG. The facility will comprise six production wells and a subsea production system, with umbilical, risers and flowlines to transport gas to the FLNG vessel.

As the world is moving toward a more sustainable and low-carbon future, Mozambique represents an excellent platform and will play a strategic role in satisfying the world’s energy requirements. The gas reserves in Mozambique will contribute to energy security in Europe.

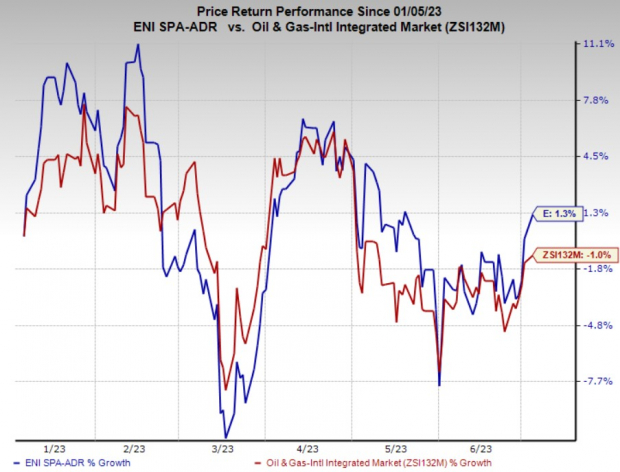

Price Performance

Shares of Eni have outperformed the industry in the past six months. The stock has gained 1.3% against the industry’s 1% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Eni currently carries a Zack Rank #3 (Hold).

Some better-ranked players in the energy space are Seadrill Limited SDRL, Evolution Petroleum Corporation EPM and PHX Minerals Inc. PHX. SDRL and EPM currently sport a Zacks Rank of 1 (Strong Buy), and PHX carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Seadrill is a market-leading international driller with strong exposure in key strategic basins like the U.S. Gulf of Mexico, Brazil and Angola. SDRL reported first-quarter 2023 earnings of 83 cents per share, beating the Zacks Consensus Estimate of earnings of 55 cents per share.

Seadrill has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days. The consensus estimate for SDRL’s 2023 and 2024 earnings per share is pegged at $2.93 and $4.01, respectively.

Evolution Petroleum is an independent energy company. EPM reported first-quarter 2023 earnings of 42 cents per share, beating the Zacks Consensus Estimate of earnings of 17 cents.

Evolution Petroleum has a Zacks Style Score of A for Growth, and B for Value and Momentum. The consensus estimate for EPM’s 2024 earnings is pegged at $1.11 per share.

PHX Minerals is an oil and natural gas mineral company. The company posted first-quarter 2023 earnings of 11 cents per share, beating the Zacks Consensus Estimate of earnings of 7 cents per share.

PHX has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days. The consensus estimate for the company’s 2023 and 2024 earnings per share is pegged at 28 cents and 45 cents, respectively.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.Eni SpA (E) : Free Stock Analysis Report

Seadrill Limited (SDRL) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report

PHX Minerals Inc. (PHX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.