Eni SPA E, through its wholly-owned subsidiary, Eni gas e luce, entered an agreement with Azora Capital to acquire nine renewable energy projects in Spain, with a combined capacity of 1.2 gigawatts (“GW”).

The acquisition involves three operational wind farms and a wind farm under construction in the central/northern area of the country, with a total capacity of 230 megawatts (“MW”). Additionally, it involves 1 GW of five large solar projects, which are in advanced stages of development.

Eni and private equity manager Azora will collaborate to ensure that the facilities, which are currently under construction, commence production by 2024. The companies are aiming for a broader agreement to expand Eni’s renewable energy business in Spain. The agreement is part of Eni’s strategy to increase its presence in the Spain market.

In a separate transaction, Eni gas e luce acquired the Dhamma Energy Group from the relevant founding partners. Dhamma’s asset portfolio includes solar projects for almost 3 GW in France and Spain, which are at various stages of development. It also includes 120 MW plants in France, which are already in operation or advanced development stages.

Investors have been expressing their concerns about sustainability for several decades. But not until recently have they transformed their words into action by suing companies for not doing enough to reduce emissions and prevent climate change. The pressure to reduce emissions is forcing major oil companies to transform their businesses. Hence, Eni, like its European peers, is directing its investments into renewable energy.

Eni gas e luce already has a strong presence and a significant customer base in France. The transaction will help enhance its renewable power generation capacity and its integration in the retail activities at the markets in France and Spain.

Company Profile & Price Performance

Headquartered in Rome, Italy, Eni is one of the leading integrated energy players in the world.

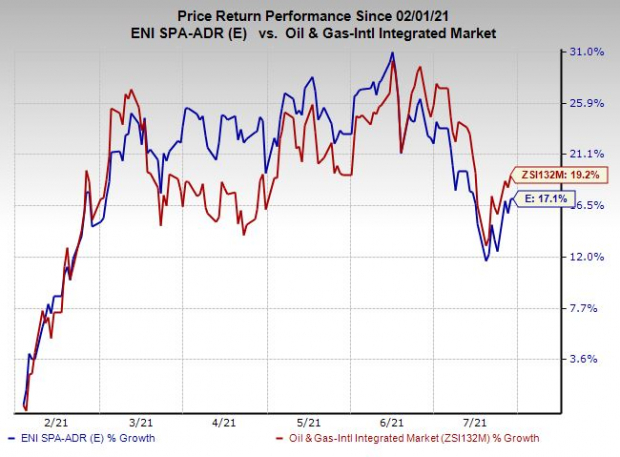

Shares of the company have underperformed the industry in the past six months. Its shares have gained 17.1% compared with the industry’s 19.2% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Eni currently carries a Zack Rank #3 (Hold).

Some better-ranked players in the energy space are ConocoPhillips COP, Cabot Oil & Gas Corporation COG and Enerplus Corporation ERF, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Over the past 60 days, the Zacks Consensus Estimate for ConocoPhillips’ 2021 earnings has been raised by 38.6%.

Cabot Oil’s earnings for 2021 are expected to increase 10.3% year over year.

Enerplus’ earnings for 2021 are expected to rise 41.7% year over year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth. Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP): Free Stock Analysis Report

Cabot Oil & Gas Corporation (COG): Free Stock Analysis Report

Eni SpA (E): Free Stock Analysis Report

Enerplus Corporation (ERF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.