Eni SPA E entered an exploration and production agreement with Sonatrach in the onshore Berkine Basin in Algeria, where the companies have been operating since 2013.

The $1.4-billion agreement, which covers 7,880 square kilometers, involves the exploration and production of oil and gas in the southern part of the Berkine Basin. Eni is already a leading player in the basin.

In the initial stage, the project expects the rapid development of reserves estimated at 135 million barrels of oil equivalent. Production from the Berkine Basin is anticipated to start by the end of 2022. The project, the first-ever signed under the new Algeria oil law, will boost synergies with the companies’ existing plants.

In December 2020, Eni and Sonatrach signed an agreement to bolster their exploration and production partnership in the Berkine Basin. The deal enabled the companies to form a road map for new hydrocarbon contracts there as part of Algeria’s new hydrocarbon law, which provides much improved financial terms for investors.

Eni and Sonatrach also signed a memorandum of understanding (MoU) to work on clean energy goals. The MoU aims to enhance the existing technological collaboration and reduce emissions. The agreement allows the assessment of joint opportunities focused on renewables, hydrogen, carbon dioxide capture, use and storage, bio-refining, and other activities. The agreement is well-aligned with Eni’s pledge to reach net-zero emissions by 2050.

Eni has had a presence in Algeria since 1981. The Italy-based oil major is a leading energy company operating in the country, with various mining permits. The company has an equity production of 95,000 barrels of oil equivalent per day in Algeria.

Company Profile & Price Performance

Headquartered in Rome, Italy, Eni is one of the leading integrated energy players in the world.

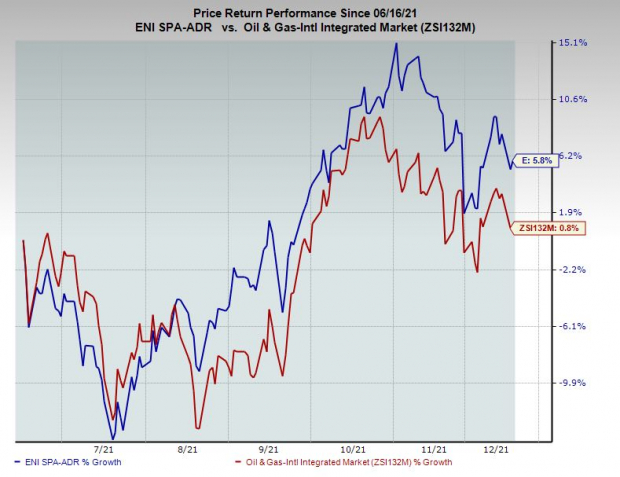

Shares of Eni have outperformed the industry in the past six months. The stock has gained 5.8% compared with the industry’s 0.8% growth.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Eni currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Continental Resources, Inc. CLR is an explorer and producer of oil and natural gas. CLR operates resources across the East, South and North areas in the United States. Continental Resources’ strategic water assets add huge value to its operations in Bakken and Oklahoma. As of Dec 31, 2020, CLR’s estimated proved reserves were 1,103.8 MMBoe.

Continental Resources’ earnings for 2021 are expected to surge 485.5% year over year. CLR currently has a Zacks Style Score of A for Growth and B for Value. Notably, Continental Resources’ board of directors increased its quarterly dividend payment to 20 cents per share from 15 cents in the previous quarter. CLR also resumed its existing stock repurchase program. Continental Resources already executed $65 million of share repurchases in the September-end quarter, while $618 million of the share-repurchase capacity remain available.

SM Energy Company SM is one of the most attractive players in the exploration and production space. It engages in the exploration, exploitation, development, acquisition, and production of natural gas and crude oil in North America. SM’s operations focus on the Permian basin and the South Texas & Gulf Coast region. It has 443,188 net acres under its possession, of which 33.5% is developed.

SM Energy’s earnings for 2021 are expected to surge 708.7% year over year. SM currently has a Zacks Style Score of A for both Growth and Momentum. The upstream energy player beat the Zacks Consensus Estimate thrice in the last four quarters and missed once, with an earnings surprise of 126.3%, on average.

Sunoco LP SUN is a master limited partnership that engages in the distribution of motor fuel to roughly 10,000 customers, including independent dealers, commercial customers, convenience stores, and distributors. In the United States, Sunoco is among the largest motor fuel distributors in the wholesale market by volume. In 2020, the partnership sold 7.1 billion gallons of motor fuel.

SUN’s earnings for 2021 are expected to surge 743.4% year over year. Sunoco currently has a Zacks Style Score of A for both Value and Growth. For 2021, SUN expects fuel volumes of 7.25-7.75 billion gallons, indicating a rise from the 2020 reported level of 7.09 billion gallons.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eni SpA (E): Free Stock Analysis Report

Sunoco LP (SUN): Free Stock Analysis Report

SM Energy Company (SM): Free Stock Analysis Report

Continental Resources, Inc. (CLR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.