In the wake of the election and the release of its third-quarter results, Energy Transfer (NYSE: ET) saw its stock hit a 52-week high and is now up more than 25% on the year as of this writing, without even taking into consideration its handsome distribution. Speaking of distributions, the master limited partnership (MLP) just raised that as well.

Against the backdrop of what is expected to be a more favorable regulatory environment and growing energy needs stemming from power demand for artificial intelligence (AI), let's take a closer look at this pipeline company's most recent results and whether now is a good time to buy the stock.

Growth opportunities ahead

Energy Transfer turned in solid Q3 results, with its adjusted EBITDA in the quarter rising to $3.96 billion. Distributable cash flow (DCF) to partners, which is how much cash the company generates before growth project capital expenditures (capex), edged up by $4 million to $1.99 billion. Volumes were solidly up across its systems, with a number of volume records set in the quarter. This included a 25% year-over-year jump in crude volumes, a 6% jump in midstream volumes gathered, and a 12% climb in NGL fractionation volumes.

In October, the company increased its per-share distribution by 3.2% year over year to $0.3225. That's good for a forward yield of about 7.4%.

Enterprise paid out $1.1 billion in distributions to unitholders in the quarter, which would put its distribution coverage ratio at 1.8 times. After paying out distributions, Energy Transfer had $890 million in excess cash flow, of which it spent $724 million on growth projects during the quarter. This continues to demonstrate that Energy Transfer's distribution is well covered.

Looking ahead, Energy Transfer kept its full-year EBITDA guidance of $15.3 billion to $15.5 billion. Its original guidance at the start of the year was for EBITDA to between $14.5 billion and $14.8 billion. However, the company said there was potential upside in the fourth quarter from optimization efforts and natural gas spreads, but it was being conservative on spreads at this time.

Energy Transfer actually lowered its growth capital expenditures (capex) estimate for the year, now expecting to spend between $2.8 billion and $3 billion. That's down from prior guidance of $3 billion to $3.2 billion. However, it has talked more about a $2.5 billion to $3.5 billion run rate going forward, up from a prior outlook of $2 billion to $3 billion.

The company said it was seeing increasing power needs across several of its pipelines driven by power demands from AI and data centers, and that it is one of the best-positioned companies to meet this demand given its natural gas pipeline network. It says it has received requests to connect to approximately 45 power plants that it does not currently serve in 11 states and more than 40 prospective data centers in 10 states.

Meanwhile, Co-CEO Marshall McCrea said that the Trump administration would bring "a breathe of fresh air" to the oil & gas industry by easing up on regulations and enforcement measures. He especially thinks this will help the company getting LNG (liquified natural gas) export projects built.

Image source: Getty Images.

Is it time to buy Energy Transfer?

With a growing number of growth project opportunities in front of it and what is likely to be a more friendly regulatory environment, Energy Transfer finds itself in one of the strongest positions in quite some time. The AI infrastructure buildout is happening, and while some companies are looking to help their power needs with nuclear energy, natural gas will play a big role as well. Natural gas projects can be completed more quickly than nuclear, while Enterprise's systems around cheap associated gas from the Permian Basin put it in a good position to capture AI power opportunities.

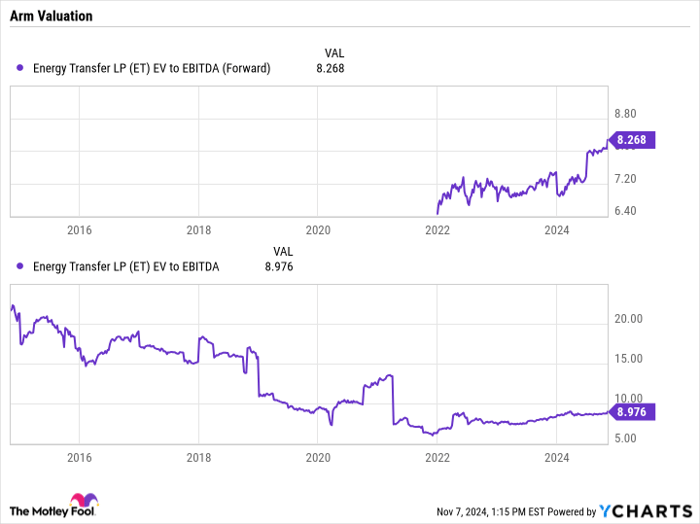

Meanwhile, the stock trades at an attractive enterprise value (EV)-to-EBITDA multiple of just 8.3 times. While that has risen recently, the multiple is well below where Energy Transfer traded at before the COVID-19 pandemic, and well below the average 13.7 multiple that midstream MLPs traded at between 2011 and 2016.

ET EV to EBITDA (Forward) data by YCharts

Between its valuation, attractive yield, the growth opportunities in front of it, and the likely improved regulatory environment, Energy Transfer continues to look like a buy.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $23,446!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,982!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $428,758!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 11, 2024

Geoffrey Seiler has positions in Energy Transfer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.