Weight loss goals may be at the forefront of many New Year's resolutions, which could push the exuberance for Eli Lilly LLY and Novo Nordisk NVO stock.

As the major players in the hyper-scale shift of injectable drugs that treat obesity, investors may be pondering which pharmaceutical giant is the better investment at the moment.

Zepbound & Wegovy

Eli Lilly’s Zepbound and Novo Nordisk’s Wegovy are both once-weekly injectable medications designed for chronic weight management. Both have added billions of dollars in additional revenue for these pharmaceutical leaders although Zepbound was more recently approved in November of 2023 while Wegovy has been cleared for usage since June of 2021.

That said, Zepbound has shown greater weight loss, helping patients lose an average of 20.2% of their body weight in a Phase IIIb trial which was 47% more effective than Wegovy.

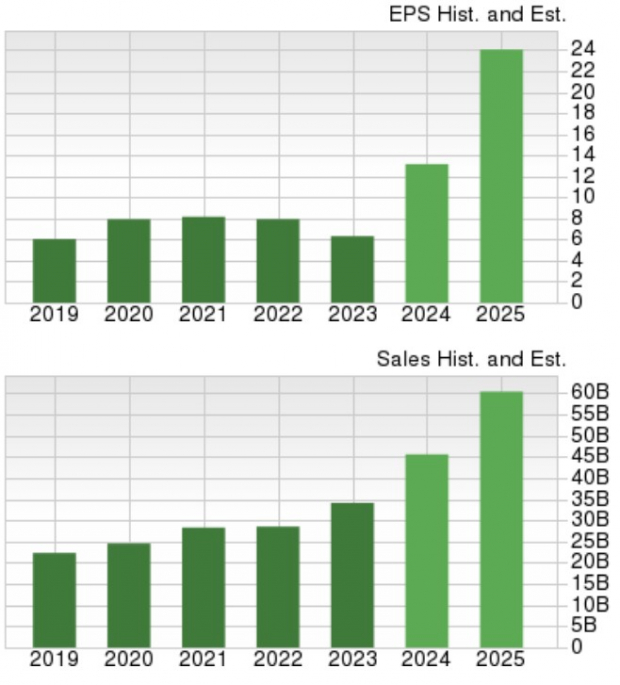

Growth & Outlook Comparison

Based on Zacks estimates, Eli Lilly’s total sales are now expected to expand 33% in fiscal 2024 to $45.44 billion versus $34.12 billion in 2023. Furthermore, FY25 sales are projected to climb another 33% to $60.36 billion.

More intriguing, Eli Lilly’s annual earnings are slated to soar 108% in FY24 to $13.14 per share compared to EPS of $6.32 in 2023. Plus, FY25 EPS is forecasted to climb another 83% to a whopping $24.04.

Image Source: Zacks Investment Research

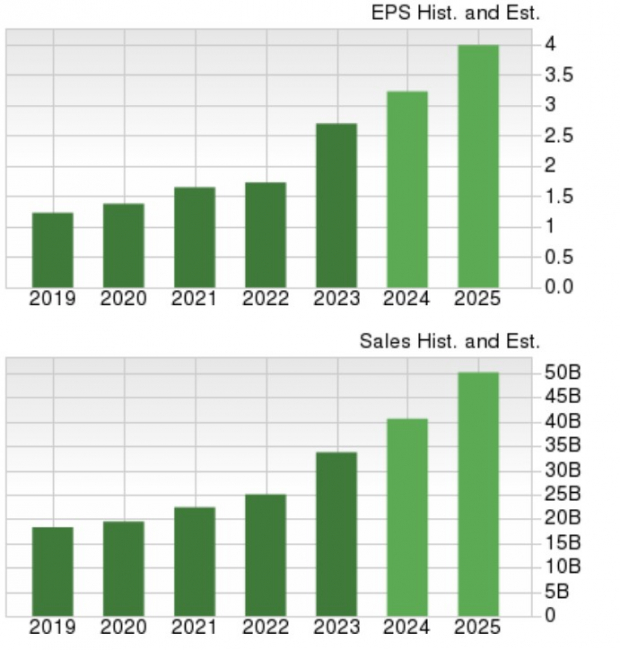

Pivoting to Novo Nordisk, its top line is projected to expand 18% in FY24 and is forecasted to increase another 23% in FY25 to $49.03 billion. Novo Nordisk is now expected to post 18% EPS growth in FY24 with annual earnings projected to rise another 22% in FY25 to $3.89 per share.

However, it is noteworthy that FY24 and FY25 EPS estimates are noticeably lower for Novo Nordisk over the last 60 days.

Image Source: Zacks Investment Research

Price Performance Comparison

Over the last year, Eli Lilly’s stock is up a very respectable +25% which has roughly matched the S&P 500 while Novo Nordisk shares are down a lackluster -21%. Notably, the dip in Novo Nordisk’s stock has been attributed to subpar clinical trial results for its new weight-loss drug CagriSema along with patent concerns.

That said, over the last three years, Novo Nordisk stock is up more than +60% to impressively top the broader market although this has noticeably trailed Eli Lilly’s gains of +200%.

Image Source: Zacks Investment Research

Takeaway

Eli Lilly does appear to have the advantage as it relates to expansion in the weight loss drug market with its stock landing a Zacks Rank #3 (Hold). Although there could be better buying opportunities ahead based on Eli Lilly’s valuation, the company's robust top and bottom lines are hard to overlook especially for long-term investors.

In contrast, Novo Nordisk shares land a Zacks Rank #4 (Sell) based on a trend of declining earnings estimate revisions which has started to sour the company’s attractive outlook.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.