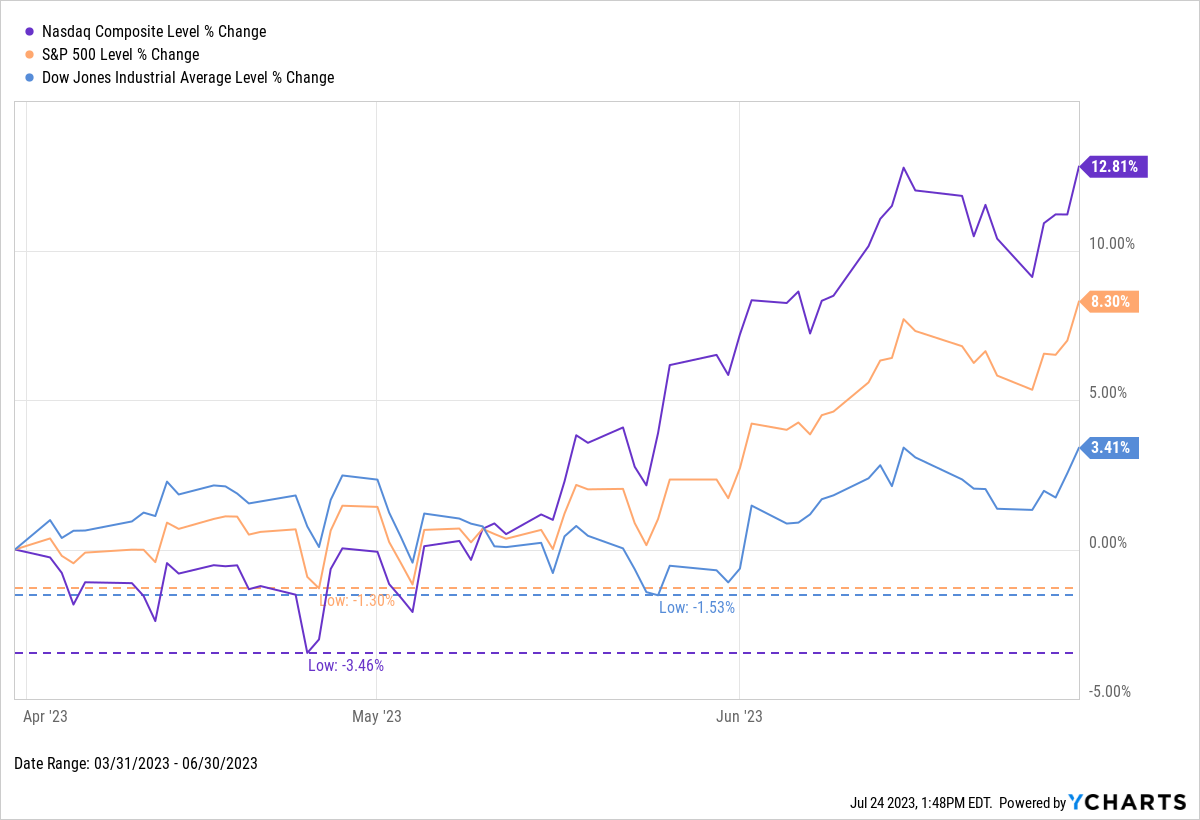

The first half of the year is officially in the rearview mirror, and so far, stocks have posted an impressive performance. The NASDAQ led the way with a 12.81% surge in the quarter, the S&P 500 rose 8.3%, and the Dow Jones saw a 3.41% gain.

The continued rise in stocks in the quarter marked the start of a new bull market, with the S&P 500 now up 24.42% from its October 12, 2022 low.

Download Visual | Modify in YCharts

Below is a sneak peek of insights from the YCharts Q2 2023 Economic Summary Deck. The deck, published quarterly, arms advisors and investors with key insights from the previous quarter to help you make smarter investment decisions going forward. Visuals can also be copied from the deck for your preferred use.

You can join YCharts on Tuesday, August 1st, for a live review of the full Q2 Economic Summary Deck: When Will the Recession Happen? Click Here to save your seat!

The Effect of Skyrocketing Mortgage Rates on the Market

The ongoing cycle of interest rate hikes by the Federal Reserve has triggered significant ripple effects throughout the real estate market. This impact has been felt not only in commercial office spaces but also in the residential mortgage sector. 2021 was marked by 30-year mortgage rates falling to their lowest in decades. However, that situation quickly reversed.

Mortgage rates have skyrocketed, with the 30-year rate peaking at 7% at the conclusion of 2022 before descending slightly to 6.71% by the end of Q2 2023. This abrupt increase has led to a significant downturn in mortgage originations and refinances.

Download Visual | Modify in YCharts

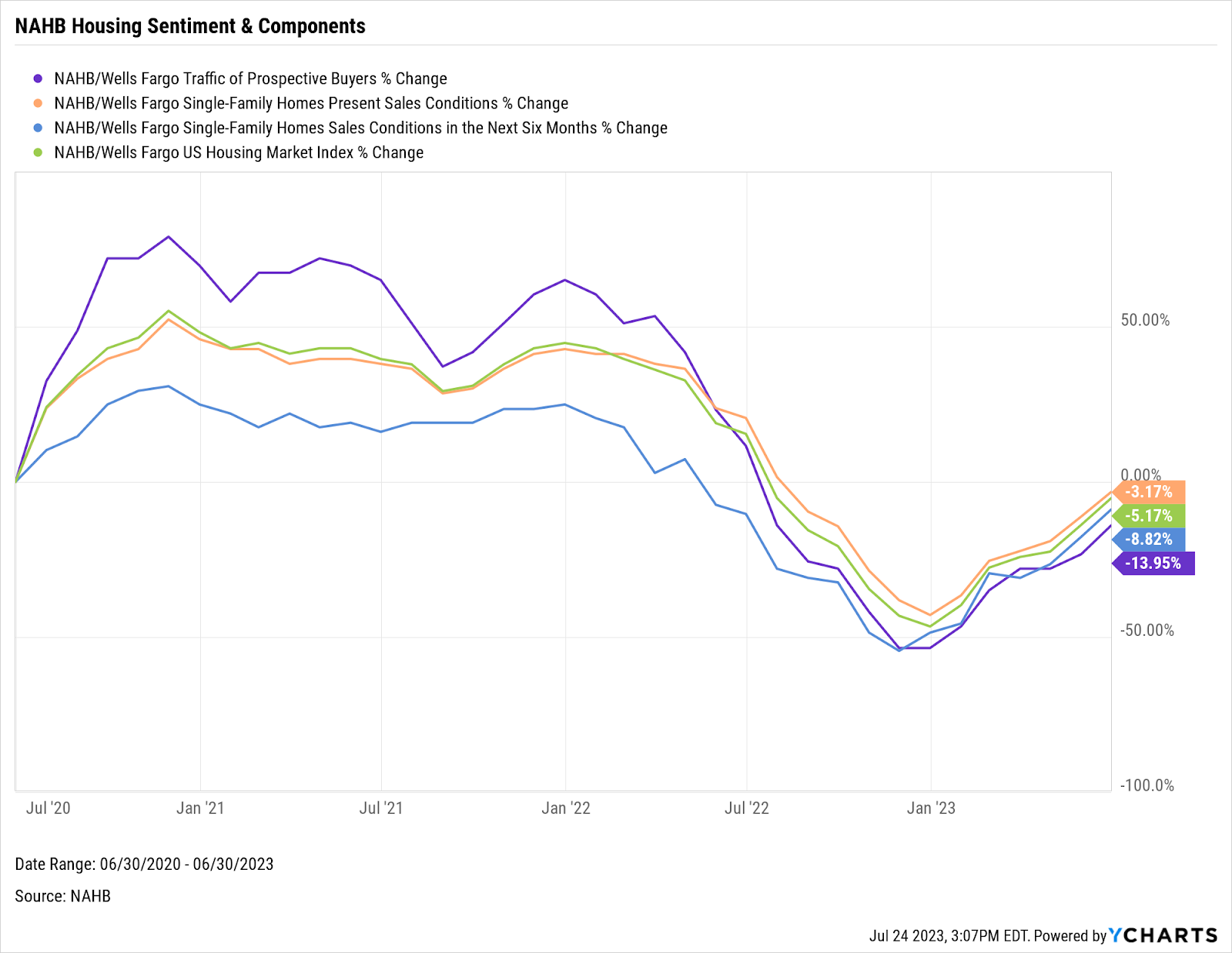

Nevertheless, there’s a silver lining in the housing market. According to data from the National Association of Home Builders (NAHB) and Wells Fargo, current and near-future predictions suggest a rebound in home sales, which are recovering from a dip seen in the final quarter of 2022. This resurgence carries significant weight, as the real estate sector represents a vital component of the economy that the Federal Reserve closely monitors when making rate decisions.

Download Visual | Modify in YCharts

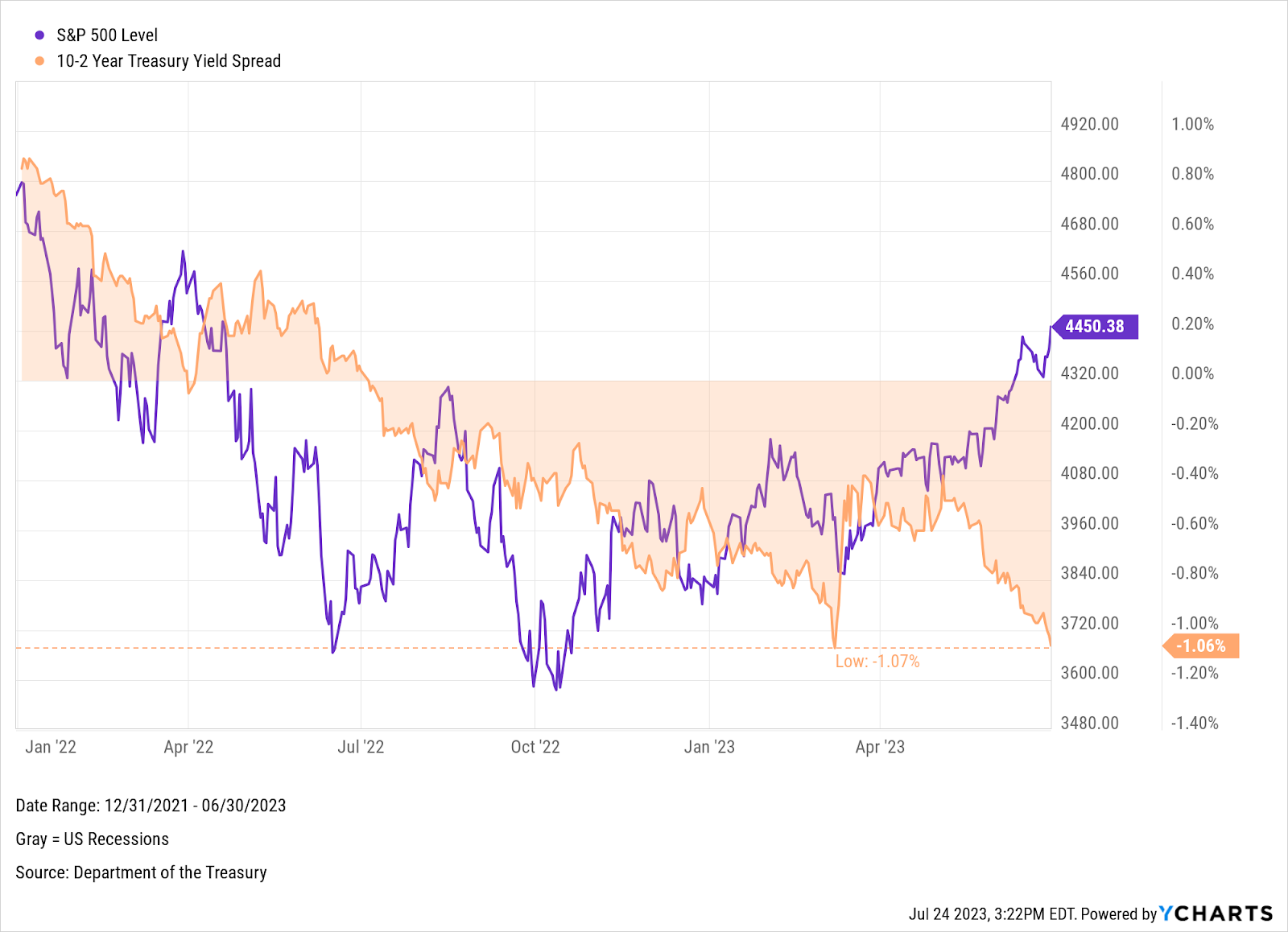

The 10-2 Treasury Yield Spread Inversion and Escalating Recession Concerns

Since July 2022, the 10-2 Treasury Yield Spread has been inverted. Historically, a negative 10-2 Spread has been a leading indicator of a recession. In Q1, that 10-2 Spread sank to -1.07%, its deepest level in over forty years. And on the final day of Q2, the 10-2 revisited that same low.

Download Visual | Modify in YCharts

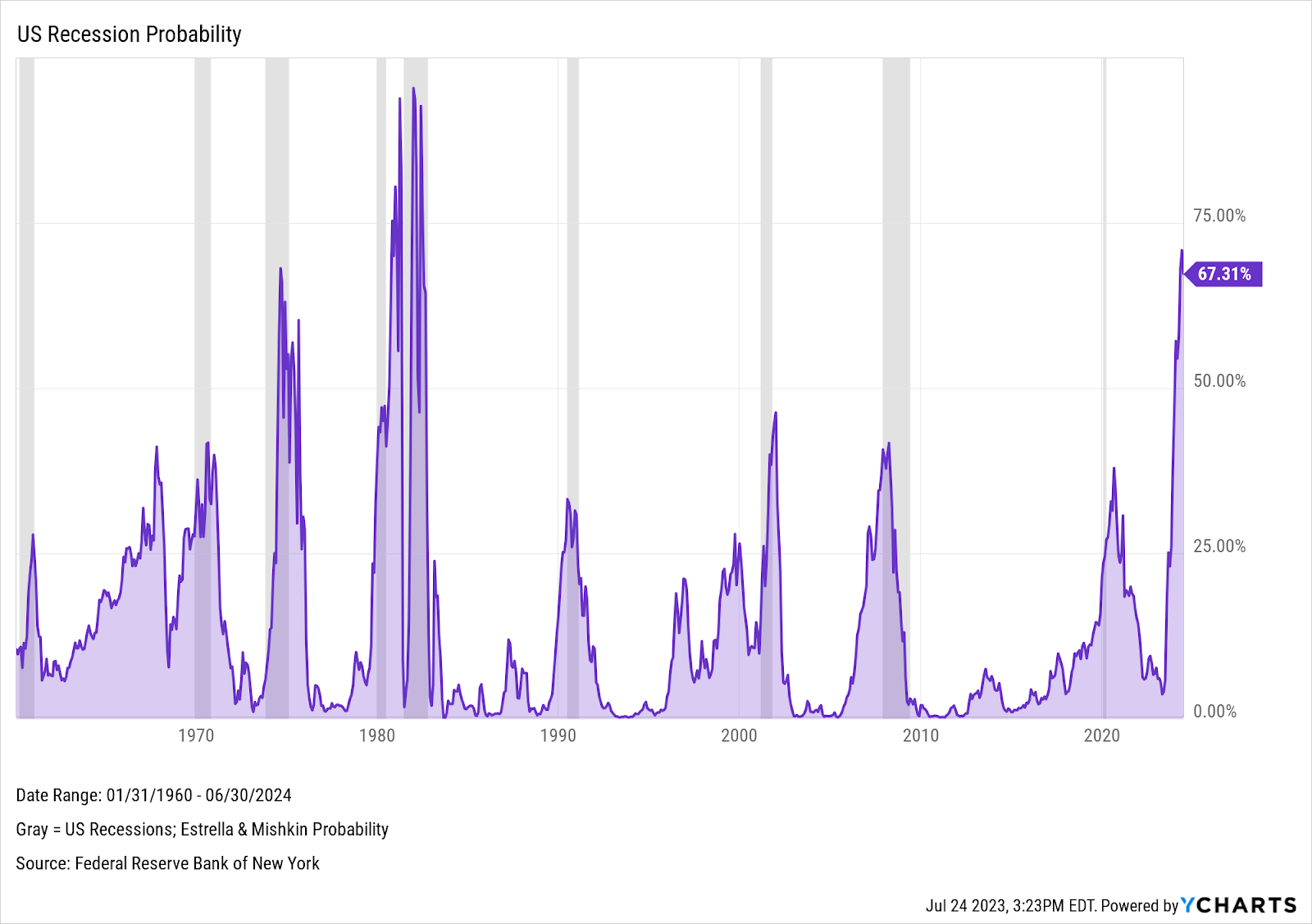

This persistent inversion of the Yield Curve has triggered a dramatic spike in US Recession Probability indicators. The one-year US Recession Probability (based on the Estrella & Mishkin model) stands at 67.3%, a level not seen since the early 1980s. Despite the prevailing positivity in the equity markets, a recurring question hangs over the economy as we close out the second quarter: Is a recession on the horizon, or will the economy prove resilient?

Download Visual | Modify in YCharts

This article was originally published on YCharts.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.