E-commerce accounted for around 16.2% of total U.S. retail sales. The fourth quarter, being the holiday quarter, is always the strongest for the industry. Therefore, this is a good time to jump into some ecommerce stocks, as the Q4 earnings season gathers momentum. Our stock picks for this season are ACV Auctions ACVA, Amazon AMZN and JD.com JD.

The convenience of online shopping remains the top reason for ecommerce volumes and this is particularly true of Gen-Z, which is, increasingly, the more relevant component of sales. Many of these buyers have grown up on the Internet and are accustomed to a high level of digitization.

They are also likely to hang out on popular social media platforms, allowing themselves to be influenced by the latest trends there. This is driving an entirely new perspective on the ecommerce space, one that revolves around digital influencers and appears to be expanding with more advanced technology such as AR/VR, social commerce and the Metaverse.

The 2024 holiday sales have come in extremely strong. Adobe Analytics, which marks the season from Nov. 1 to Dec. 31 has said that steep discounting (30.1% off the list price in electronics and 28% on toys), mobile shopping (54.5% of shopping was on smartphones) and artificial intelligence (as chatbots and shopping assistants powered by generative AI) played a big role this season. The research firm said that in 2024, consumers spent 8.4% more than the last year.

Salesforce agrees that it was a record-breaking season, with discounts averaging 26% during cyber week and the jump in online sales somewhat spread out over a longer period (up 15% in the preceding week and 10% in the following week). Mobile accounted for 67-69% of orders and wallet usage grew 10%. The research firm said that escalating supply chain costs limited deep discounts. Also, 19% of orders was influenced by AI and generative AI usage grew 25%.

While growth trends are exciting to say the least, valuation tends to be rich because of the positive sentiments at both sell side analysts and the general public. So, it’s important to choose wisely.

About the Industry

Internet - Commerce continues to evolve as the technologies driving it advance.

On one side are increasingly powerful and capable user devices. On the other are increasingly sophisticated platforms often combining chatbots and/or social media. While AI continues to deliver increased user satisfaction, the metaverse promises another paradigm shift.

Differentiation comes from better technology for improved showcasing, easier navigation and payment, speedier delivery and returns, brand building, comparison shopping, loyalty, etc. as well as good customer service and more shipping options, which generally tip the scales in favor of larger players. Particularly so because there is fierce price competition, necessitating deep discounting in many cases.

Current Trends Driving the Internet-Commerce Industry

- The total retail experience between physical and digital continues to blur, as most consumers blend their online and offline activities. This usually takes the forms of research online and buy in-store or buy online and pick up in-store. Since convenience is the main requirement, any experience that increases the speed of delivery/pickup is preferred. This may entail increased reliance on robots, self-driven delivery vehicles and drones that could ease bottlenecks and make deliveries smoother and cheaper. Therefore, it isn’t just the online-first retailers that are building a physical presence, but also those that have traditionally been physical retailers that are digitizing to various degrees, or growing themselves a substantial digital store-front.

- Another notable trend is a subscription format for repeat-use items. This makes it easier for the consumer to order and for the retailer to plan. Retailers usually offer some kind of discount to consumers choosing this option, which makes it more attractive. The trend is expected to expand going forward as both tangible and intangible commodities and low-value and high-value items are increasingly sold ‘as-a-service.’

- Direct access to the consumer is something that no retailer can afford to pass up because this is the only way to acquire customer data. Since some of the larger companies are already providing services based on customer data (such as Amazon’s AI-powered assistants), buyers are getting used to these services. Because of the many details involved in satisfying a customer, data mining has grown in importance over the years, with the party controlling the customer’s data being best positioned to identify and service demand while also delivering the desired experience. Most of the big ecommerce players are also into payments processing, which gives them further insight into a customer’s tastes, preferences and buying habits. As machines read and process customer data, they can create programs and processes to maximize customer satisfaction, drive sales and minimize returns. Artificial intelligence, as used by companies like Amazon, already decides how competitive a player is. So harnessing big data has become imperative for survival.

- The macroeconomic situation continues to evolve, although we can probably say with confidence that a deep recession doesn’t appear to be in the offing. On the other hand, rate cuts have started, boosting consumer sentiments. Therefore, although today’s consumer is thrifty, the easing of pressure on their disposable incomes can only be a good thing. For producers, both supply chain issues and labor tightness has eased. Global uncertainties continue to weigh on foreign exchange effects for companies with international operations. Overall, industry players will continue to see the benefits of operating leverage they have built up in the last few years. The importance of having a digital presence has never been greater, particularly considering the fact that the retail ecommerce market continues to expand into new product segments and geographies, and consumers continue to prefer the convenience of online shopping.

- A trend that Gen-Z is popularizing is social commerce. Social commerce means the ability to discover, research, buy and checkout on a social media platform, often and increasingly more so, through influencers. Brands usually have store fronts on these platforms where influencers also discuss their products, thus driving traffic to them. The social element of shopping that ecommerce had taken out is thus returning through this route. Since social commerce first became popular in China, it isn’t surprising that the Chinese social media platform TikTok that’s also very popular with Gen Z is the number one place for social commerce. But Facebook, Instagram and a host of others are also very popular.

Zacks Industry Rank Indicates Strength

The Zacks Internet - Commerce industry is a rather large group within the broader Zacks Retail And Wholesale sector. It carries a Zacks Industry Rank of #70, which places it in the top 28% of 250 Zacks industries.

Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. So the group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates positive near-term prospects.

Ecommerce being in the top 50% of Zacks-ranked industries is the result of its relative performance versus others. What we’re seeing in the aggregate estimate revisions is more or less steady improvement in estimates over the past year. The aggregate earnings estimate for 2024 is up 17.9%. The 2025 number dipped sharply in March last year but has gained 12.6% since. The rate cuts this year should have a positive impact on spending, likely providing buoyancy to estimates.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Generates Strong Shareholder Returns

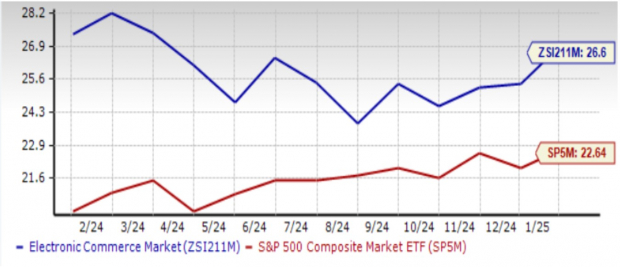

Over the past year, the Zacks Electronic - Commerce Industry has traded relatively close to the broader Retail and Wholesale sector as well as the S&P 500, although usually at a premium to both.

The stocks in this industry have collectively gained 43.5% over the past year, compared to the 31.8% gain for the broader Zacks Retail and Wholesale Sector and the 24.8% gain for the S&P 500.

One-Year Price Performance

Image Source: Zacks Investment Research

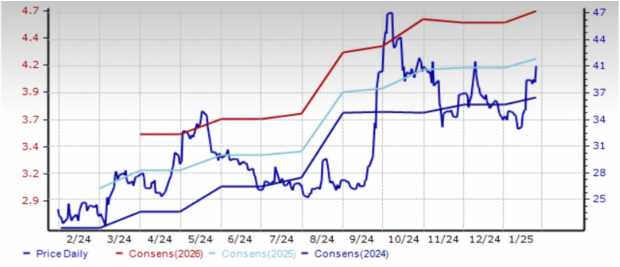

The Industry is Overvalued

Historically, the industry has traded at a premium to the sector as well as the S&P 500. Its current price-to-forward 12 months’ earnings (P/E) of 26.6X represents a premium of 17.5% to the S&P 500 and 4.5% to the broader retail sector, which are currently trading at 22.64X and 25.45X, respectively. It’s worth noting, however, that the industry is currently trading at a slight premium to its own median level of 25.42X, which seems to point to overvaluation.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

3 Stocks Worth Considering

The improving prospects mean that there are a large number of stocks currently worth picking, especially because of the significant variety that exists in this industry in terms of lines of business, business model, location and so forth. This is also the reason that choosing can be tricky. We have used our proprietary ranking system to pick 3 stocks that appear attractive today.

ACV Auctions Inc. (ACVA): Buffalo, New York-based ACV operates a digital marketplace connecting buyers and sellers of wholesale vehicles on auction. It offers a comprehensive list of services related to vehicle sales so buyers can take informed decisions and correctly estimate prices. It also offers inventory management and financing, vehicle reconditioning and storage, support services like data-based insights into the condition and value of used vehicles, as well as a host of other related services for dealers and commercial partners.

ACV’s business is limited by ongoing shortage of used vehicle inventory and a softer retail market. The company continues to scale operations and grow its suite of dealer solutions to take additional share at commercial buyers.

Analyst estimates for 2024 and 2025 have not changed in the last 60 days and at current levels, represent 160% growth in 2024 followed by 517% growth in 2025. This is expected to come off some stellar revenue growth of 32% in 2024 and 24% the following year.

Investors are certainly piling into this Zacks #1 (Strong Buy) ranked stock, with the shares up 54% in the past year.

Price & Consensus: ACVA

Image Source: Zacks Investment Research

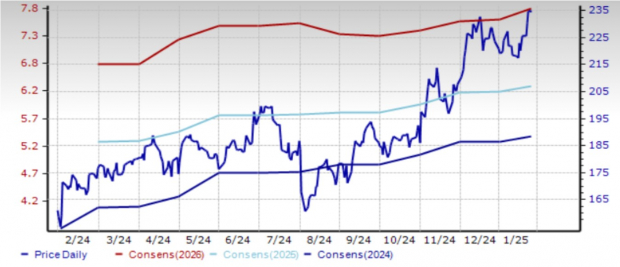

Amazon, Inc. (AMZN): Seattle, Washington-based Amazon is one of the leading online marketplaces in the world. It has developed its business around the Prime loyalty program that drives sales across merchandise and media categories. The online business is supplemented with broad physical presence, augmented by the acquisition of the premium grocery company Whole Foods Market back in 2017. Amazon also enjoys a dominant position in the in the Infrastructure as a Service (IaaS) space, thanks to Amazon Web Services (AWS).

The company’s sheer size and scale allow it to offer products at some of the cheapest prices. Amazon is known for its huge discounts and deals, and the number of services it piles into Prime has ensured a subscription revenue channel. Amazon has steadily increased prices over the years, but the user base remains sticky. Its profitability depends on the AWS business, where it still enjoys first-mover advantage. With access to humongous amounts of data, Amazon has developed some AI-powered products to make the most of generative AI and other developments in the space.

Despite its huge business volumes, analysts are optimistic about double-digit revenue and earnings growth in 2024 and 2025. For 2024, they expect 10.9% revenue growth and 82.4% earnings growth. For 2025, revenue and earnings growth are expected to be a respective 10.8% and 20.1%. In the last 30 days, analyst estimates for 2024 and 2025 have increased 10 cents (1.9%) and 12 cents (1.9%).

The shares of this Zacks Rank #2 (Buy) company up 45.6% over the past year.

Price & Consensus: AMZN

Image Source: Zacks Investment Research

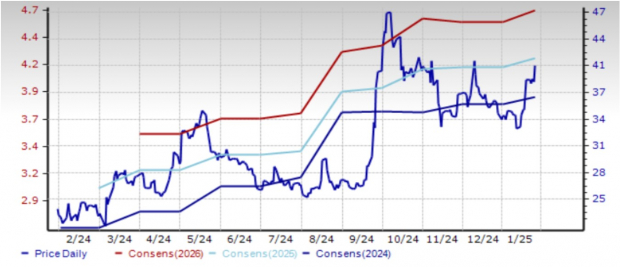

The company is continuing to see improved consumer sentiments, which along with efforts to boost user experience and increase user mindshare is driving top line growth. At the same time, supply chain buildup for stronger scale and efficiency are helping profitability. In the last quarter, its revenue and earnings growth came on the back of the general merchandise category, as the company was able to leverage the Chinese government’s trade-in program designed to boost domestic consumption and economic growth, as well as Singles Day shopping. Its broad selection, competitive pricing and good customer service no doubt helped. The strong momentum in the business is likely to ensure payouts to investors in the form of both dividends and share repurchases.

In the last seven days, the Zacks Consensus Estimate for 2024 has increased 7 cents (1.7%). For 2025, it is up 9 cents (2.1%). Analysts expect earnings growth of 31.7% in 2024 and 8.8% in 2025.

The Zacks Rank #2 stock is up 73.6% over the past year.

Price & Consensus: JD

Image Source: Zacks Investment Research

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpAmazon.com, Inc. (AMZN) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

ACV Auctions Inc. (ACVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.