Eaton Corporation ETN announced that it has completed the acquisition of Cobham Mission Systems, a manufacturer of air-to-air refueling systems, which will allow Eaton to further expand the Aerospace business. Cobham Mission — which primarily operates in the defense space — has operations in the United States and United Kingdom.

The acquisition of Cobham Mission Systems comes after the buyout of Souriau-Sunbank. Eaton’s aerospace business contributed 12.5% of total revenues in 2020 and these acquisitions will surely increase the contribution from this segment going forward. It expects 2021 operating margin growth from the Aerospace segment in the range of 19.8-20.2%.

How Will This Acquisition Aid Eaton?

Per a report from MarketandMarkets, North America is expected to lead the global air-to-air refueling market during the 2020-2025 time period. The report also indicates that the air-to-air refueling market will increase from $501 million in 2020 to $851 million in 2025, primarily due to increasing demand for combat aircraft and military spending by various countries.

Given the expected increase in global demand for air-to-air refueling, the above acquisition will expand Eaton’s offerings in a market that has the potential to further improve from the present level. In addition, this acquisition will further strengthen the company’s position, and allow it to compete with defense majors like Lockheed Martin LMT as well as The Boeing Company BA for air refueling contracts.

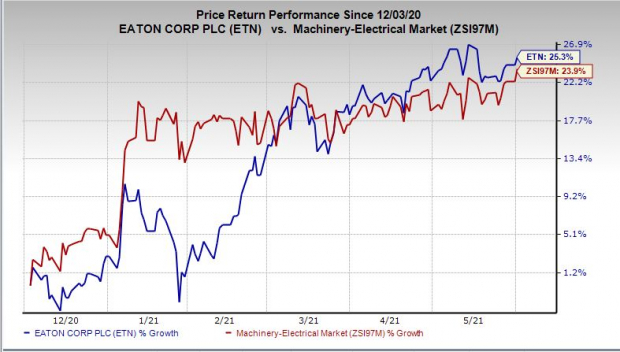

Price Performance

In the past six months, shares of Eaton have gained 25.3% compared with the industry’s 23.9% rally.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Rank & Key Pick

Eaton currently has a Zacks Rank #3 (Hold). A better-ranked stock in the same industry is AZZ Inc. AZZ, currently having a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AZZ ’s current dividend yield is 1.3%. The Zacks Consensus Estimate for fiscal 2022 earnings per share of the company has moved up 1.5% in the past 60 days.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA): Free Stock Analysis Report

AZZ Inc. (AZZ): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Eaton Corporation, PLC (ETN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.