Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

- Total Q4 earnings for the 402 S&P 500 members that have reported results are up +4.9% from the same period last year on +3.4% higher revenues, with 78.6% beating EPS estimates and 64.4% beating revenue estimates.

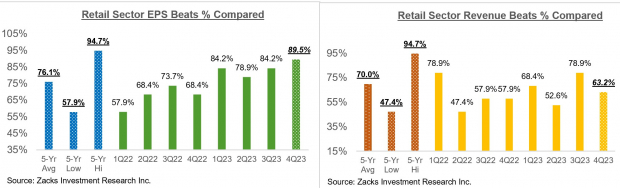

- For the Retail sector, we now have Q4 results for 84.1% of the sector’s market capitalization in the index. Total earnings for these Retail companies are up +43.1% from the same period last year on +8.4% higher revenues, with 89.5% beating EPS estimates and 63.2% beating revenue estimates.

- The Q4 EPS beats percentage for these Retail sector companies is notably above what we had seen from the group in other recent periods, but the revenue beats percentage is tracking below other recent quarters.

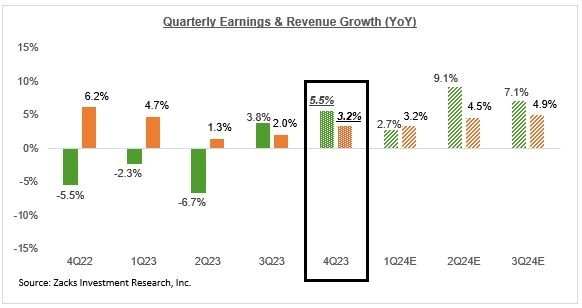

- Looking at Q4 as a whole, combining the actual results that have come out with estimates for the still-to-come companies, total S&P 500 index earnings are currently expected to be up +5.5% from the year-earlier level on +3.2% higher revenues, which would follow the +3.8% earnings growth in 2023 Q3 on +2.0% higher revenues.

Walmart WMT kicked off the Q4 reporting cycle for the conventional retailers in style by handily beating estimates and providing reassuring guidance that many in the market see as conservative.

The market’s positive reaction to the Walmart release, despite the stock’s impressive recent momentum, shows that the retail giant is able to sustain investors’ enthusiasm. Target TGT, which reports on March 5th, continues to struggle to gain investors’ confidence.

Walmart’s Q4 earnings increased +5.4% from the year-earlier period on +5.7% higher revenues on better-than-expected same-store sales and improving gross margins. Management noted continued market share gains, particularly on the grocery side, as higher-income households find the combination of Walmart’s value proposition and digital offerings hard to resist. Walmart’s digital unit crossed the $100 billion revenue level in the trailing 12-months through 2023 Q4.

The chart below shows the one-year performance of Walmart shares that are currently trading at their 52-week high relative to Target and the S&P 500 index.

Image Source: Zacks Investment Research

For the Zacks Retail sector, which includes online vendors like Amazon AMZN and restaurant operators in addition to conventional retailers like Walmart and Target, we now have Q4 results from 84.1% of the sector’s market capitalization in the S&P 500 index. Total earnings for these companies are up +43.1% from the same period last year on +8.4% higher revenues, with 89.5% beating EPS estimates and 63.2% beating revenue estimates.

As you can see in the comparison charts below, the Q4 EPS beats percentage is tracking above what we have seen from this group of retailers in the past, but the revenue beats percentage is on the weak side.

Image Source: Zacks Investment Research

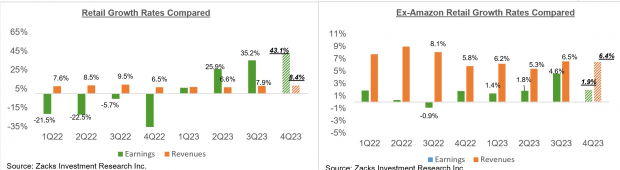

The Q4 earnings growth pace of +43.1% is mostly thanks to Amazon’s blockbuster results, whose earnings increased +410.9% from the year-earlier level on +13.9% higher revenues. Excluding Amazon’s substantial earnings contribution, Q4 earnings for the rest of the Retail sector companies that have reported would be up +1.9% on +6.4% higher revenues. The comparison charts below show the Q4 earnings and revenue growth for these retailers with and without Amazon.

Image Source: Zacks Investment Research

Beyond the Retail sector, Q4 earnings for the S&P 500 index are currently expected to be up +5.5% above the year-earlier period on +3.2% higher revenues. This would follow the +3.8% increase in index earnings in 2023 Q3 on +2.3% higher revenues. The chart below shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

Below, we show the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

Given the expected moderation in the U.S. economy’s growth trajectory due to the cumulative effects of Fed tightening, these estimates likely need to come down. But the +4.7% revenue growth expectation is hardly aggressive, considering that the U.S. economy produced a nominal GDP growth rate in excess of +6% last year.

The rest of the 2024 earnings growth is coming from margin expansion, with 2024 net margins for the index going up to +12.4% from last year’s 11.7%. Embedded in this margin expectation is the view that the inflation cycle has run its course, with easing cost pressures letting net margins return to the 2022 level.

We don’t see this margin (or revenue) outlook as unreasonable or out-of-sync with the economic ground reality.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.