Dycom Industries, Inc. DY has been witnessing mixed market reaction after it reported tepid results for third-quarter fiscal 2025. This Florida-based specialty contracting service provider’s stock grew 1.3% in the past three months compared with the Zacks Building Products - Heavy Construction industry’s 25.5% growth.

Image Source: Zacks Investment Research

During the fiscal third quarter, the company’s adjusted EBITDA margin expanded just 52 basis points from the year-ago level due to integration costs related to the acquisition of Black & Veatch’s wireless telecommunications infrastructure business. The trend is also likely to be witnessed in the fiscal fourth quarter.

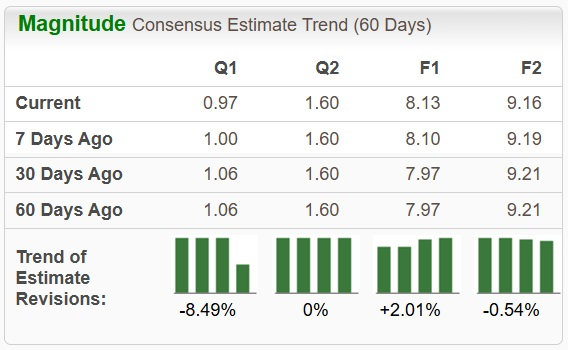

A Quick Glance at Estimates & Historical Performance

Estimates for the company’s fourth-quarter fiscal 2025 earnings per share (EPS) have decreased to 97 cents from $1.00 in the past seven days. Although fiscal 2025 EPS expectation moved upward, the same for fiscal 2026 has reduced by 3 cents in the past seven days.

Image Source: Zacks Investment Research

Let's discuss the factors that are influencing Dycom’s performance.

Telecom Momentum & Acquisitions: A Bright Spot for DY

The telecommunications industry is undergoing rapid transformation, fueled by increased demand for broadband expansion and 5G network buildouts. Dycom has positioned itself well within this ecosystem, partnering with industry giants to deliver critical infrastructure projects. The company’s strong order backlog and consistent contract wins reflect the ongoing demand for its services.

In August, Dycom announced the acquisition of Black & Veatch’s public carrier wireless telecommunications infrastructure business for $150.7 million. This marks Dycom’s largest-ever buyout in the wireless services space, strengthening its capabilities in wireless construction services. The expansion allows Dycom to broadly address growth opportunities in wireless network modernization, including Open RAN transformation initiatives and deployment services. With the ongoing transformation of wireless networks, Dycom is now better equipped to meet the evolving needs of its customers. Black & Veatch is expected to contribute $250-$275 million in revenues by fiscal 2026.

In its most recent earnings report, Dycom showcased solid revenue growth supported by increased project activity. Its strategic focus on higher-margin work and long-term customer relationships has enabled stable cash flows amid economic uncertainty.

Dycom’s backlog at the fiscal third-quarter end totaled $7.856 billion compared with $6.917 billion at the fiscal 2024-end. Of the backlog, $4.467 billion is projected to be completed in the next 12 months. The company remains positive about substantial opportunities across a broad array despite prevailing market uncertainties.

Why is DY Stock Struggling?

Despite these operational strengths, Dycom’s stock has underperformed recently as broader market conditions and sector-specific challenges weigh on investors’ sentiment. With the acquisition of Black & Veatch's public carrier wireless telecommunications infrastructure business, Dycom is expected to incur $4.2 million in pre-tax integration costs in the fiscal fourth quarter, which will affect its EBITDA margins in the short term. Also, Dycom’s fiscal fourth-quarter performance is expected to be impacted by fewer workdays, reduced daylight hours, and winter weather conditions.

Meanwhile, the company projected a potential deceleration in organic revenue growth for the fiscal fourth quarter. Organic revenues in the fiscal fourth quarter are expected to increase in the low to mid-single digits. The slowdown may partly be due to seasonal factors and some customers’ stronger performance in the first half of the year.

Rising labor costs and supply chain constraints continue to pressure margins. Dycom’s first and fourth quarters of every fiscal year are prone to seasonality. Each year, the company’s fiscal first and fourth quarters’ results are impacted by inclement weather, fewer available workdays, reduced daylight work hours and the restart of calendar payroll taxes.

Final Verdict

Dycom remains a solid name in the telecom services space, driven by robust demand for its offerings. Its long-term growth prospects are undeniable, especially as governments and corporations invest heavily in digital infrastructure. The recently passed Infrastructure Investment and Jobs Act is expected to provide a significant boost to telecom and broadband funding, indirectly benefiting Dycom's business.

However, with persistent cost pressures and macro-economic woes, the near-term outlook remains uncertain. While the company's operational strengths warrant keeping it on the radar, the stock doesn’t yet present a strong buying opportunity for growth-oriented investors.

DY’s Zacks Rank and Key Picks

Presently, Dycom carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader sector have been discussed below:

EMCOR Group, Inc. EME presently flaunts a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 32.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for EME’s 2024 EPS indicates an improvement of 55.5% from the prior-year levels. The estimated figure moved up to $20.74 from $19.50 over the past 30 days.

MasTec, Inc. MTZ, a Zacks Rank #1 company, has a trailing four-quarter earnings surprise of 40.2%, on average.

The consensus estimate for MTZ’s 2024 EPS is expected to climb 84.3% year over year. The estimated figure moved up to $3.63 from $3.01 over the past 30 days.

Sterling Infrastructure, Inc. STRL presently sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 21.5%, on average.

The consensus estimate for STRL’s 2024 EPS is expected to surge 33.3% year over year. The estimated figure moved up to $5.96 from $5.66 over the past 30 days.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpEMCOR Group, Inc. (EME) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

MasTec, Inc. (MTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.