For the last few months, investors in the artificial intelligence (AI) movement have become enamored with a new opportunity: quantum computing. While quantum computing stocks experienced a fleeting jolt toward the end of 2024, recent price action suggests the momentum may be coming to a halt.

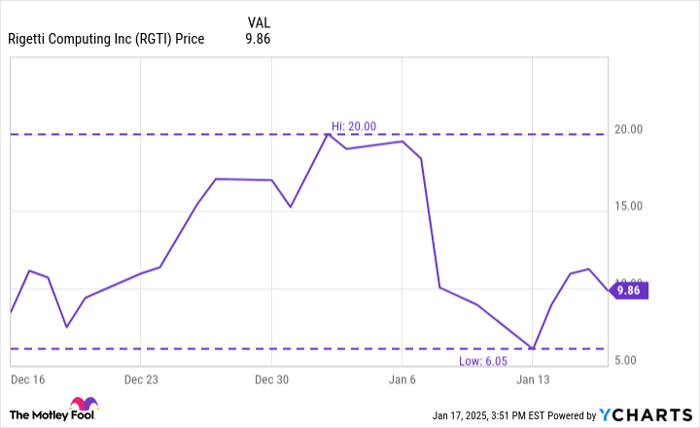

In particular, shares of Rigetti Computing (NASDAQ: RGTI) are down 50% from prior highs (as of Jan. 17). Is now a good time to buy the dip in Rigetti Computing stock?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Why are quantum computing stocks taking a breather?

Jensen Huang is the CEO of the largest semiconductor company in the world, Nvidia. Earlier this month, Huang spoke in detail about quantum computing and the role Nvidia is playing in the development of this potentially groundbreaking AI technology.

In the video below, Huang explains specific use cases surrounding quantum computing, how the technology works, and why Nvidia is playing an important role in its development.

Listen to Jensen explaining why Nvidia is a significant part of quantum computing. pic.twitter.com/xrjUsy1BlH

-- The AI Investor (@The_AI_Investor) January 8, 2025

As you can see in the chart below, shares of Rigetti Computing were on a tear prior to Huang's discussion in early January. However, shortly after his comments, Rigetti stock fell in epic fashion -- bottoming out around $6 per share. So, what happened?

While Huang's comments could be viewed as largely bullish, he did say that quantum computing won't be entirely useful for another two decades at the earliest. As such, investors who thought quantum computing would be an overnight success story left the party early and sold their shares.

Image source: Getty Images.

How is Rigetti Computing's business performing?

Heavy selling activity in stocks is not always a bad thing. In fact, many times sell-offs are predicated on panic and emotion rather than sound financial judgement. Let's explore if now is a lucrative time to scoop up shares in one of AI's next big waves.

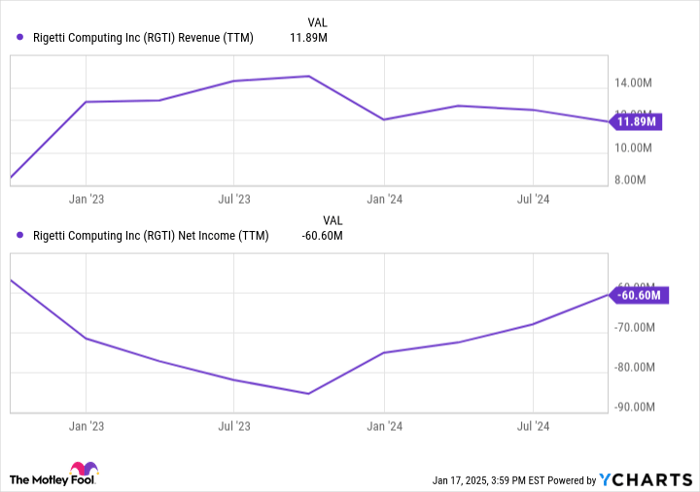

In the charts below, I've illustrated trends in Rigetti's revenue and profitability. Clearly, the company is not generating much in terms of revenue -- with less than $12 million in sales over the last year. Moreover, the graph shows some notable ebbs and flows across Rigetti's top line -- suggesting that its services are not consistently in demand. In a way, these dynamics align with Huang's view that quantum computing is not top of mind for many of AI's major forces right now.

RGTI Revenue (TTM) data by YCharts

Perhaps the more important aspect to point out in Rigetti's financial profile is its hefty cash burn. While the company's losses have improved, burning $60 million while only generating $12 million in revenue doesn't exactly inspire confidence.

Is now a generational opportunity to buy the dip?

Given the financial profile above, I wouldn't be surprised if you are ready to run for the hills. However, if you're still open to the idea of investing in Rigetti, allow me to explore some valuation trends before I close my argument.

Even with a near-50% drop in the stock, Rigetti Computing still holds a market capitalization of $2.8 billion. Given the company is only generating about $12 million in revenue, this implies that Rigetti Computing is trading at a price-to-sales (P/S) multiple of 234.

As I explained in this piece about Quantum Computing stock, the ongoing sell-offs in stocks such as Rigetti, IonQ, and D-Wave Quantum are very much not opportunities to buy the dip. All of these stocks are still overbought, despite the appearance of a low share price and "cheap" valuation.

While an investment in Rigetti Computing could carry game-changing upside potential, there is no guarantee that the company will even be around in 20 years. After all, at its current burn rate Rigetti is going to be hard pressed for liquidity sooner rather than later seeing as how the company only boasts $20 million of cash on the balance sheet.

Although the prospects of quantum computing are intriguing, I think it's a tough area to invest in at the moment. To me, a stock such as Rigetti is best left avoided.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $357,084!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,554!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $462,766!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 13, 2025

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.