A stock's share price and fundamentals don't always move in the same direction. Take Airbnb (NASDAQ: ABNB), for example. The company's digital platform for booking short-term rentals and experiences is more popular than ever, but the stock is near its lowest price since going public nearly two years ago.

Don't waste your time trying to figure out why this happens; the stock market's daily moves can be irrational, and looking at the big picture is often how the long-term investor succeeds. So instead, I'll dive into the numbers to show you the long-term opportunity in Airbnb stock and whether now is the time to buy.

Airbnb isn't slowing down

I don't think Airbnb needs a ton of introduction; the company's name has become synonymous with short-term rentals. You don't book a place to stay when you go away for the weekend; you book an Airbnb. It's a basic but powerful signal of just how strong the company's brand is today.

The market has had a real stinker of a year in 2022, but Airbnb's first six months have been strong. The company saw more than 100 million nights and experiences booked in this year's first and second quarters, something that had never occurred before.

It shows how strongly Airbnb has roared back after the pandemic lockdowns cratered the travel industry. Over the past four quarters, revenue has exceeded $7 billion, which is plenty of volume to make the business profitable. Airbnb's free cash flow was $1.5 billion over that time, converting roughly $0.20 of every dollar into cash profits. Airbnb doesn't own properties; instead, it operates the digital platform and takes a cut of each booking. It makes Airbnb more like a technology company than a traditional hotel stock.

Corporations across Wall Street are warning of a potential recession threatening growth, a reasonable worry considering how inflation is squeezing consumers. Investors should pay attention to the company's comments on guidance when third-quarter earnings come out in the coming weeks. Vacations are traditionally a discretionary spending category for people. Still, the business could prove surprisingly resistant to a recession if consumers believe Airbnb can be a cheap getaway. Thriving through a down economy would only strengthen the case for Airbnb as a long-term investment.

Plentiful long-term opportunity

Even if the ride is occasionally bumpy for investors, Airbnb's long-term growth seems to be going places. Airbnb is already a global company, which gives it a tremendous opportunity to expand its presence in various markets worldwide. Over the first half of 2022, Airbnb's revenue split roughly 50-50 between the U.S. and international markets. However, global markets account for about 75% of the world's gross domestic product (GDP).

In other words, international markets are potentially a tremendous growth opportunity for Airbnb on top of any future U.S. growth. This idea plays out further in the actual numbers; international revenue is up 91% year over year through the first two quarters of 2022 versus a gain of 37% for U.S. revenue. Airbnb's revenue will become increasingly global if this trend continues given the current 50-50 split between markets.

That's great news for investors because Airbnb has much to gain from establishing its brand in emerging markets. For example, Airbnb operates in India, a country with 1.4 billion people and could be one of the best international growth areas over the coming years. Investors should follow the company's long-term progress as global revenue becomes more significant; emerging markets could provide sustained growth opportunities.

Consider your time horizon

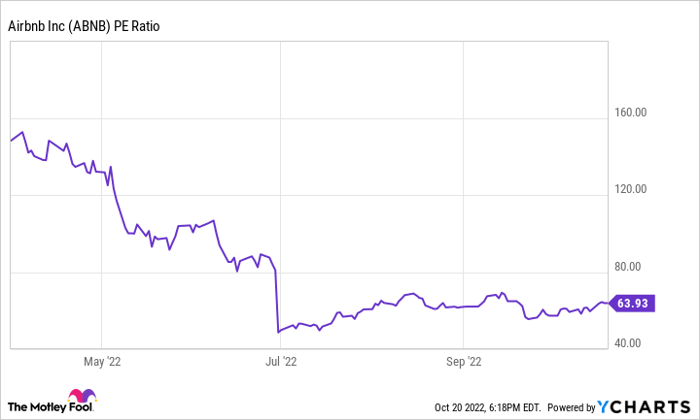

A rapidly growing company with strong free cash flow isn't often cheap, and Airbnb's stock has managed to fetch a premium even if the stock has fallen off its highs. Valuing the company on its profits translates to a price-to-earnings (P/E) ratio of 64. Analysts estimate the company could earn $4.10 per share in its fiscal 2025 year, which is still a P/E ratio of 28 from today's price!

ABNB PE Ratio data by YCharts

Investors might be better off looking elsewhere if they're looking for short-term returns; the stock isn't cheap even considering the company's strong free cash flow and path to long-term growth. Premium valuations are sometimes vulnerable in fearful markets like what we see today.

But if you're willing to invest with a time horizon of at least five years, Airbnb looks like an excellent potential investment. It checks many boxes with a strong brand and the growth and financials discussed earlier. One might consider a dollar-cost averaging strategy to accumulate shares slowly. This could help you dip your toes into the stock without falling too deeply if volatility creates further declines.

10 stocks we like better than Airbnb, Inc.

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Airbnb, Inc. wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of September 30, 2022

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Airbnb, Inc. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.