Dominion Energy’s D shares have rallied 31.9% year to date compared with the Zacks Utility – Electric Power industry’s growth of 24.1%. In the same period, the company has outperformed the broader Zacks Utilities sector and the Zacks S&P 500 Composite.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Dominion Energy plans to invest $43 billion through 2029 to strengthen its infrastructure and prevent outages. The company is also working to lower emissions from electricity production. Dominion Energy aims to attain net-zero carbon and methane emissions from its electric generation and natural gas infrastructure by 2050.

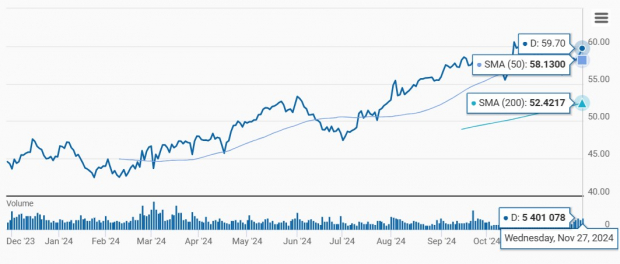

Dominion Energy’s Price Performance YTD

Image Source: Zacks Investment Research

The chart below indicates that D’s shares are trading above the 50-day and 200-day simple moving average, indicating a bullish trend.

Image Source: Zacks Investment Research

Factors in Favor of Dominion Energy

Dominion Energy’s portfolio realignment and focus on regulated assets are evident from its investments in regulated infrastructure, which will boost its operation term. To focus on its core operation, Dominion Energy divested some of its merchant generation facilities and electric retail energy marketing business.

Recently, Dominion Energy signed a Memorandum of Understanding with Amazon AMZN to explore innovative new development structures for enhancing potential Small Modular Reactor (“SMR”) nuclear development in Virginia. The SMAs will be providing clean energy to customers and meet their need over the long term.

Dominion Energy has a well-chalked-out long-term capital expenditure plan to strengthen and expand its infrastructure. The company plans to invest $43 billion over the long-term to further strengthen its operation. Its long-term objective is to add more battery storage, solar, hydro and wind (offshore as well as onshore) projects by 2036 and increase the renewable energy capacity by more than 15% per year, on average, over the next 15 years.

Dominion Energy is experiencing commercial load growth driven by Data Centers demand. Attractive customer growth across its Virginia and South Carolina service areas is also boosting demand for its services. The initiatives taken by the company to strengthen its electric infrastructure will enable it to meet rising customer demand on a more efficient manner. The company connected 14 new data centers year to date through September and expects to connect an additional 16 data centers in 2024.

Dominion Energy has plans to upgrade electric infrastructure by installing smart meters and grid devices, as well as enhance services to customers through the customer information platform. The company is also working on a project of strategic undergrounding of 4,000 miles of distribution lines. These initiatives will increase the resilience of its operation and enable it to serve the expanding customer base more efficiently. It also started the deployment of electricity storage devices, which will support its renewable power projects.

D’s Earnings Estimates Moving North

Dominion Energy expects its 2024 EPS in the range of $2.68-$2.83 compared with $1.99 per share registered in 2023. The Zacks Consensus Estimate for D’s 2024 and 2025 earnings per share indicates year-over-year growth of 38.7% and 22.1%, respectively. The year-over-year increase in earnings estimates indicates analysts’ increasing confidence in the stock.

Image Source: Zacks Investment Research

Dominion Energy Increases Shareholders’ Value

Dominion Energy has been distributing dividends to its shareholders for a long time. The current annual dividend of the company is $2.67. The current dividend yield is 4.52% better than its industry’s yield of 3.18%. Check D’s dividend history here.

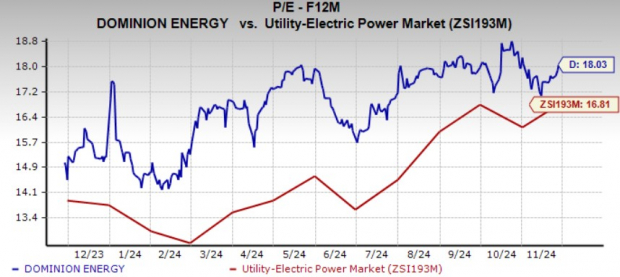

Dominion Energy Stock Currently Trading at a Premium

Dominion Energy is currently valued at a premium compared to its industry on a forward 12-month P/E basis. Given its high valuation at present, it is better to hold positions in the stock and wait for a better entry point.

Image Source: Zacks Investment Research

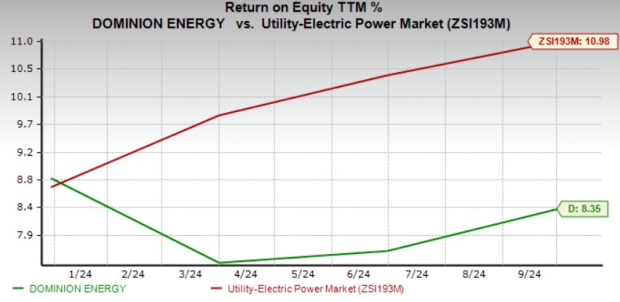

D Stock Returns Lower Than the Industry

Dominion Energy’s trailing 12-month return on equity of 8.35% is lower than the industry average of 10.98%. Return on equity, a profitability measure, reflects how effectively a company utilizes its shareholders’ funds to generate income. D’s current ROE indicates that the company is utilizing its funds less efficiently than its peers.

Image Source: Zacks Investment Research

Summing Up

D's systematic investment in increasing clean energy production volumes and strengthening its grid will assist in providing reliable service to its customers. Rising demand for clean energy is a tailwind for the company.

Yet, its high valuation and lower ROE compared to its industry keep us cautious. Those who already own this Zacks Rank #3 (Hold) stock would do well to retain it in their portfolio and enjoy the benefits of dividends, while new investors can wait further for a better entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.