The better part of 2024 has been particularly challenging for dollar store chains like Dollar General (NYSE: DG) and Dollar Tree (NASDAQ: DLTR), the latter of which also owns Family Dollar. Whereas higher-earning households have comfortably curbed costs by shopping at Walmart (NYSE: WMT) more often than they have in the past, Dollar Tree's and Dollar General's core customers don't have a comparable downgrade option. They're simply spending less.

And it's shown. Dollar General's same-store-sales growth has been practically nil since last year, while at least Family Dollar's has been outright negative (and Dollar Tree's has been unreliable, at best).

If you're waiting for proof that inflation and lethargic wage growth is finally easing for these companies' core customers though, you've arguably now got it. Last quarter's numbers are the proverbial light at the end of the tunnel. It's not too soon to step into either of these struggling tickers in anticipation of a turnaround in 2025.

Green shoots

Inflation hurts everyone. However, it disproportionately hurts lower-income households with tighter budgets. As Dollar General CEO Todd Vasos explained of the company's lackluster second-quarter results, underscored by a 20% dip in income, "the softer sales trends are partially attributable to a core customer who feels financially constrained." His comments echo those Dollar Tree CFO Jeff Davis made around the same time of his company's same-quarter numbers, which were equally disappointing due to the "increasing effect of macro pressures on the purchasing behavior of Dollar Tree's middle- and higher-income customers."

Both stocks have performed as these frustrations would have suggested.

The tone and timbre of the environment has changed since then, though. Dollar General's same-store sales improved 1.3% during the quarter ending in early November, snapping back from a multi-quarter lull. Dollar Tree's grew even more, up 1.8% year over year. Even its struggling Family Dollar chain's same-store sales improved, growing 1.9% after several quarters of nil to outright negative same-store-sales comparisons.

It's not just Dollar Tree and Dollar General showing fresh strength within the value-minded section of the retail arena either, by the way. Five Below (NASDAQ: FIVE) reported a small same-store increase for its recently ended third quarter, reversing the sizable same-store-sales setbacks suffered during the prior two quarters.

Were it one of these store chains logging this new growth, it might mean little. To see several different companies suddenly doing so much better, however, is a hint worth taking.

Economic tailwinds are picking up speed

One good quarter doesn't necessarily mark the beginning of a new trend. All major long-lived trends, however, start with that first small step. And the argument that even lower-earning households are coming up with more discretionary dollars these days does hold water.

Take Bain & Company's Dynata Consumer Health Indexes as an example. While November's data shows improving optimism among households earning in excess of $100,000 per year, the comparable index for households with annual earnings of less than $50,000 -- Dollar General's and Dollar Tree's target customer -- was higher for the month as well, and up for the three-month span ending in November. Numbers from the U.S. Conference Board confirm Bain's data.

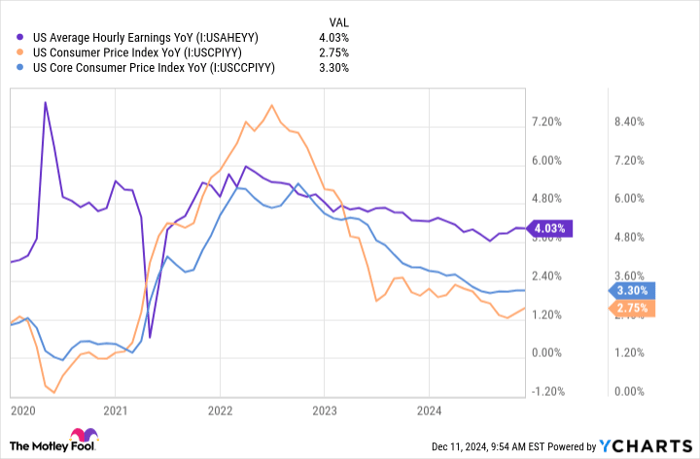

These shoppers may be feeling the impact of the reasonably resilient jobs market as well as the upside of inflation that's at least relatively contained -- plus the benefit of continued wage growth. November's average hourly pay in the U.S. was up 4% year over year, remaining slightly ahead of annualized consumer inflation at a time when many consumers feared that wouldn't be the case.

US Average Hourly Earnings YoY data by YCharts

The underlying tailwind is likely to keep blowing, too, if not accelerate.

Although the United States' economy certainly still faces challenges, even hopes for a so-called economic soft landing seem unnecessary anymore. Goldman Sachs now expects this country's GDP to grow a respectable 2.5% in 2025, topping expectations while also keeping pace with the global economy's projected economic growth in the coming year.

This growth won't benefit all socioeconomic grouping equally; the rich will likely get disproportionally richer.

It's still going to be fiscally beneficial to the dollar store industry's lesser-earning shoppers though, restoring at least some of the purchasing power they feel like they've lost over the course of the past year.

Now's the time to take a calculated risk -- even if few others are

A guaranteed winner right out of the gate? No, neither of these two stocks are guaranteed to be at their exact long-term lows right now, just as there's no guarantee last quarter's rekindled same-store sales will continue growing without fail going forward. It would also be naïve to ignore the fact that Dollar General missed last quarter's earnings estimates, while rival Ollie's Bargain Outlet reported a slight same-store-sales dip for the same three-month stretch. There's risk here to be sure.

Successful investing, however, requires you to take calculated, predictive risks based on your bigger-picture assessments. If you're waiting for it to become blatantly obvious a prospective investment is a winner, much of any upside is in the rearview mirror.

To this end, there's enough of a glimmer of hope for Dollar General as well as Dollar Tree at this time take a small shot on either one before the end of 2024.

You just might want to limit your exposure by only owning one or the other, but not both.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $356,125!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,959!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $499,141!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 9, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group and Walmart. The Motley Fool recommends Five Below and Ollie's Bargain Outlet. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.