If billionaire investor Warren Buffett is bullish on a stock, that's normally a sign for other retail investors to pile into it as well. Last month, investors learned that Domino's Pizza (NYSE: DPZ) became one of his latest holdings and unsurprisingly, the stock has rallied since then.

But what about for retirees? While the pizza company is a well-known brand and it pays a dividend, is it a suitable option to put into your retirement portfolio today? Let's take a closer look at the business.

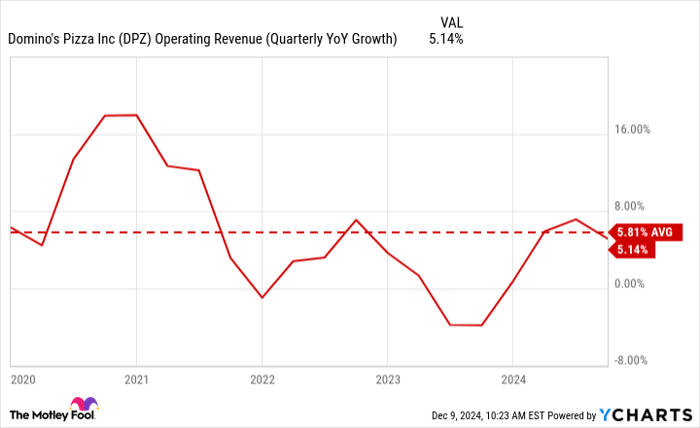

Domino's has been growing but at a slower rate than in previous years

The past five years have been volatile for Domino's as stay-at-home orders during the pandemic led to a surge in revenue and that made the stock a hot buy with investors. But business has been slowing down since then. And in some recent quarters, sales have even declined on a year-over-year basis.

DPZ Operating Revenue (Quarterly YoY Growth) data by YCharts

For growth investors, this may appear to be a troubling trend. But for retirees, what's arguably more important is stability. And in each of the past four quarters, Domino's has posted a profit of at least $125 million with sales topping at least $1 billion. Over the trailing 12 months, its net profit margin has been north of 12%, which could provide a valuable buffer if economic conditions worsen and the company needs to be more aggressive on price.

Another buffer investors can get from the business is from its dividend, which could look deceptively low.

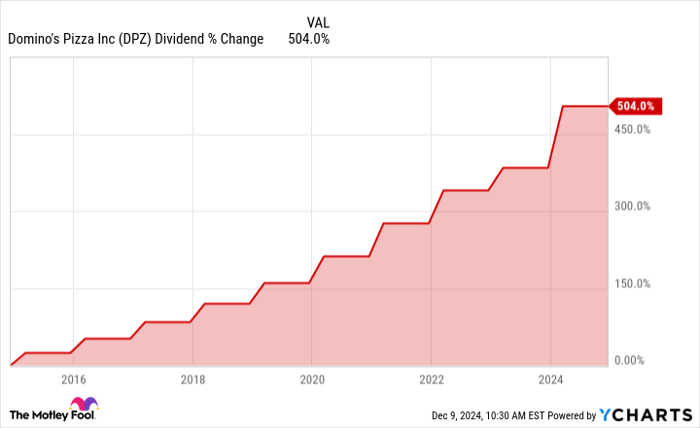

The company has significantly raised its dividend over the past decade

For retirees, a dividend can be an important feature of a stock as it allows investors to generate recurring cash flow without having to sell their shares of a business. Domino's offers a modest dividend yield of 1.3%, which is in line with the S&P 500's average.

That yield may be a bit underwhelming but Domino's can still potentially be a great dividend stock to own. That's because what may be appealing to retirees is Domino's rate of dividend growth. Over the past decade, the company has increased its payouts by more than 500%.

DPZ Dividend data by YCharts

Large dividend increases may not continue if the economy struggles but the good news is that with a payout ratio of less than 40%, there's plenty of room for the company to continue growing its dividend for the foreseeable future, even if business doesn't take off.

For retirees, whether or not a company grows its dividend can be crucial when picking an income stock to buy as that can offset the effects of inflation, which would otherwise chip away at the dividend income over time.

Is Domino's Pizza stock a good option for retirees?

Pizza delivery hasn't gone out of style in more than 135 years, with the first recorded delivery taking place back in Italy in 1889. It has evolved over the years but there's still growing demand for pizza, which is evident in Domino's strong numbers.

The consistency the business offers investors, coupled with its growing dividend, makes Domino's Pizza a potentially ideal stock for retirees to hang on to. It isn't likely to go on wild swings in value and can provide investors with a solid stream of recurring income through its dividend payments.

Should you invest $1,000 in Domino's Pizza right now?

Before you buy stock in Domino's Pizza, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Domino's Pizza wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $853,765!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 9, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Domino's Pizza. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.