DocuSign (NASDAQ: DOCU) shares exploded higher after the electronic signature-solutions provider saw its revenue and billings growth accelerate in its most recent quarter. The stock has been on a strong run in recent months after treading water for much of the year and is now up more than 55% on the year.

Let's dig into the company's most recent quarterly results to see what all the excitement is about and whether the momentum can continue.

Accelerating growth

DocuSign was a pandemic winner, seeing revenue surge during this period. But like many pandemic winners, it also saw a lot of pull-forward in demand that later led to much more modest revenue growth.

For it fiscal third quarter, DocuSign reported revenue up 8% from a year ago to $754.8 million. Subscription revenue also rose by 8% to $734.7 million, while professional service revenue jumped 11% to $20.1 million. This was substantially ahead of the $743 million to $747 million in total revenue and $722 million to $726 million in subscription revenue that the company forecast in September. In the past two quarters, the company grew revenue by 7%.

International markets yet again grew more quickly than domestic revenue, increasing 14% and accounting for 28% of total revenue.

Billings growth accelerated from just 2% last quarter to 9% growth and was $752.3 million for the quarter. That was substantially higher than the company's guidance for billings to be between $710 million to $720 million.

Image source: Getty Images.

It ended the quarter with 1.63 million customers, an increase of 11% compared to a year ago. Its dollar-net retention in the quarter rose to 100%, up from 99% last quarter. The company said this demonstrated its efforts in stabilizing its core business.

Gross margin fell slightly to 79.3% versus 79.6% a year ago, as the company migrated to the cloud. Meanwhile, it kept its operating expenses largely in check. Adjusted earnings per share (EPS) climbed 14% to $0.90.

DocuSign generated $234.3 million of operating cash flow in the quarter, with free cash flow of $210.7 million. It ended the quarter with cash and investments of $1.1 billion and zero debt after repurchasing $172.7 million worth of shares in the quarter.

The company once again increased its full-year revenue and billings guidance. It now expects revenue to be in the range of $2.959 billion to $2.963 billion, with subscription revenue of $2.885 billion to $2.889 billion. It guided for billings to be between $3.056 billion and $3.066 billion.

Below is a chart of DocuSign's full-year guidance updates throughout the year.

| Metric | March | June | September | December |

|---|---|---|---|---|

| Revenue |

$2.915 billion to $2.927 billion |

$2.92 billion to $2.932 billion |

$2.94 billion to $2.952 billion |

$2.959 billion to $2.963 billion |

| Subscription Revenue |

$2.843 billion to $2.855 billion |

$2.844 billion to $2.856 billion |

$2.864 billion to $2.876 billion |

$2.885 billion to $2.889 billion |

| Billings |

$2.97 billion and $3.024 billion |

$2.98 billion and $3.03 billion |

$2.99 billion and $3.03 billion |

$3.056 billion and $3.066 billion |

Data source: DocuSign earnings releases.

For the fourth quarter, the company projected revenue of between $758 million and $762 million, representing growth of nearly 7%. Billings are forecast to be between $870 million and $880 million, which would be about 5% growth at the midpoint of guidance.

Is it too late to buy the stock?

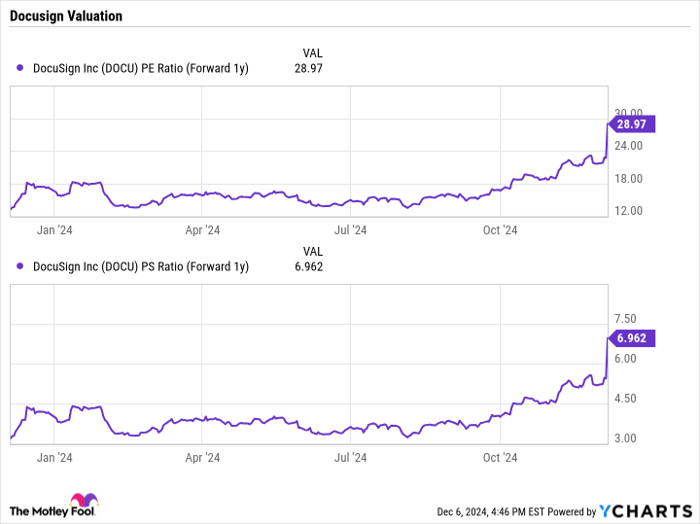

DocuSign stock has been in the bargain bin the past couple of years, but with the recent surge in its stock price, it now trades at a forward price-to-earnings (P/E) ratio of just over 29 times next year's analyst estimates and about 7 times price-to-sales (P/S). That's a big increase in valuation compared to where it was trading earlier this year.

DOCU PE Ratio (Forward 1y) data by YCharts.

The company is clearly starting to make some strides in its turnaround, with an improvement in billings growth, dollar net retention, and revenue growth. Meanwhile, it continues to be a cash flow machine. It's also expanding the capabilities of its Intelligent Agreement Management (IAM) platform and bringing it to new geographies.

That said, its stock price and valuation have moved up very quickly in a short period of time, and revenue growth only ticked up slightly this quarter. As such, I'd look to take profits, which is something I did after earnings, and not chase the stock.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $361,233!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,681!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $505,079!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 9, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Docusign. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.