Dividend investors can profit from precious metals after a recent price drop if they buy gold and silver at reduced valuations compared to just weeks ago.

The opening might be temporary as gold began ticking upward during the past week before slipping 3.2% on Friday, Dec. 4, to reach $1,838.10. Silver surged $1.12 per ounce, or 4.94%, to hit $23.78 on Dec. 1, and rose $0.19 per ounce to close on Friday, Dec. 4, at $24.35.

Reasons why the recent drop in gold and silver may be short-lived include news about promising final-stage testing to develop safe and effective COVID-19 vaccines, President-elect Joe Biden announcing former Fed Chair Janet Yellen would be nominated as Treasury Secretary and the likelihood Republicans will hold control of the Senate after a Jan. 5 special election in Georgia to fill two Senate seats. But the calm that usually reins in precious metals pricing could give way to a sluggish U.S. economy, Congress not passing a follow-up federal stimulus package and a U.S. unemployment rate of 6.9% that is more than double last February’s rate of 3.5%, prior to the COVID-19 crisis disrupting America.

Bank of America predicts that as the economy recovers from COVID-19 restrictions, relief will come to restaurants, bars and stores that have been required by politicians to curb customer capacity and, in many cases, cut their hours of operation. Plus, gold will face “more challenges,” the investment bank added.

As a result, it will be “tricky” for gold to reach $3,000 an ounce, or 65.65% above current levels, but ongoing fiscal and monetary stimulus should push the yellow metal past $2,000 per ounce, or a modest 10.34% above current levels, according to Bank of America.

Dividend Investors Can Profit from Precious Metals with Silver Seemingly Poised to Rebound

Due to silver’s industrial uses, the white metal is not as much of a hedge against economic chaos as gold. Of course, silver’s price can climb as demand grows for the precious metal from industry and investors alike.

“Silver is our preferred play on rising investment in solar panels,” Bank of America concluded in a recent research report about metals and mining.

Key factors to weight for 2021 include the expected rollout of COVID-19 vaccines, a recovery in the U.S. economy as soon as the second quarter and plans by President-elect Biden and his fellow Democrats who control the U.S. House of Representatives to “tackle climate change,” Bank of America predicted. Those developments would be bullish for copper and industrial metals, but heighten headwinds on gold, the research report forecast.

For many people, buying shares in gold or silver stocks and funds is near their risk-taking limit in the topsy-turvy precious metals market.

Maryland’s Asset Strategies International Does Not Fear for Dividend Investors Amid Precious Metals Price Drop

Contrary to Bank of America’s optimistic view of near-term progress toward an economic reopening, governors in California, Maryland, Virginia and many other states cite rising COVID-19 cases and deaths for their recent tightening of COVID-19 restrictions, said Rich Checkan, president and chief operating officer of Asset Strategies International, a full-service tangible asset dealer in Rockville, Maryland. That stark reality should boost precious metals pricing, he added.

President-elect Biden has “fully endorsed” scaling back activity, which no doubt will “kill another bunch of businesses” that barely survived previous shutdowns, Checkan said.

“Gold dipped below $1,800 per ounce on thin holiday trading and euphoria over vaccines, but things are locking down… not opening up,” Checkan said. “Ask yourself what has changed over the past week fundamentally for gold to drop $100 per ounce.”

Checkan suggested that investors should ask these questions:

- Are we 10 years into this bull market?

- Is gold two to three times the previous bull market high of $1,921?

- Is the Gold/Silver Ratio down between 35 to 50?

- Are interest rates rising to high single-digit levels?

- Are you getting gold and silver tips from your Uber driver?

- Are the U.S. and the world all of a sudden socially and politically calm?

- Is the U.S. Dollar Index above 95 and climbing?

“Since I have ‘No’s’ for all of the above, I see this as a bull market dip and a clear buying opportunity,” Checkan said.

Rich Checkan, president of Asset Strategies International

Dividend Investors Can Profit after Precious Metals Price Drop, Money Manager Kramer Says

“Gold tends to outperform when the global economy is under stress,” said Hilary Kramer, host of a national radio program, “Millionaire Maker,” and head of the GameChangers and Value Authority advisory services. “We were bullish on gold for much of 2020 but now, even in inflationary environments, the white precious metals have the edge for a very simple reason: industrial applications mean silver and platinum get consumed faster as the economy heats up. With vaccines on the horizon, that seems to be where we’re headed.”

Indeed, the United Kingdom approved a COVID-19 vaccine for emergency use on Dec. 2 from dividend-paying Pfizer Inc. (NYSE:PFE), a New York City-based multinational pharmaceutical company, and its partner BioNTech. Pfizer, which offers a current dividend yield of 3.77%, already has requested Emergency Use Authorization from the Food and Drug Administration to begin providing its vaccine to high-risk health care providers and caregivers in the United States and a regulatory approval may come quickly.

Market forecasters had expected 2020 to be a strong year for silver due to the metal’s rising industrial use in the automotive and telecommunications industries where demand is climbing faster than supply, Kramer continued. The pandemic delayed the expected surge in silver, but now industrial users are stockpiling the white metal, she added.

Industrial Use of Silver Should Help Dividend Investors Profit from Precious Metals

“I think that’s a good sign for silver,” Kramer said. “Environmental applications would only accelerate consumption and give miners a motive to expand production.”

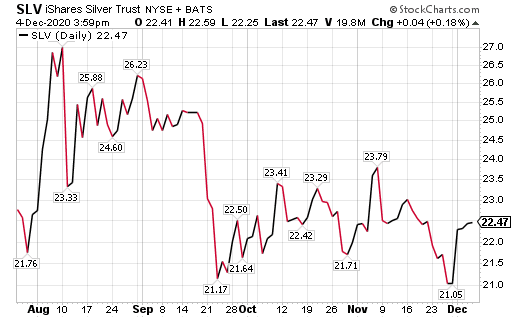

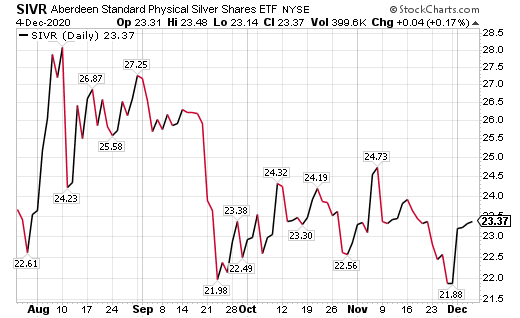

For investors, “pure plays” on silver are notoriously scarce because most of the metal coming to the market is a byproduct of larger-scale industrial mining, Kramer counseled. Investors can start gaining exposure to the precious white metal by purchasing shares in iShares Silver Trust (NYSE:SLV) as a trading opportunity or in Aberdeen Standard Physical Silver (NYE:SIVR) for exposure to the metal itself, she added. Unfortunately for income investors, neither currently offers any dividend yield.

Chart courtesy of www.stockcharts.com

Chart courtesy of www.stockcharts.com

“I wouldn’t hold the physical metal as part of a normal portfolio… gold is still a more cost-effective hedge against long-term inflation and political upheaval,” said Kramer, who also heads the IPO Edge trading service that seeks to identify companies before they pursue initial public offerings (IPOs) and recommends the ones she expects to excel.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

Dividend Investors Can Profit from Precious Metals, Including Gold After Its Price Drop

One of the “surprising changes” since the Nov, 3 presidential election has been the selloff in gold and silver, even in the face of a declining dollar, said Mark Skousen, who heads the Forecasts & Strategies investment newsletter, as well as the Home Run Trader, TNT Trader, Five Star Trader and Fast Money Alert trading services.

However, the recent precious metals price drop makes it difficult for investors and advisors to predict how soon they may rise again, Skousen said.

“Gold, silver and mining stocks could rally at any time, so I’m reluctant to sell,” Skousen wrote to his Forecasts & Strategies subscribers on Nov. 30.

The retreat may prove to be fleeting, similar to what occurred in the early 1980s when gold and silver entered a bear market, but mining stocks recovered and hit new highs, Skousen suggested.

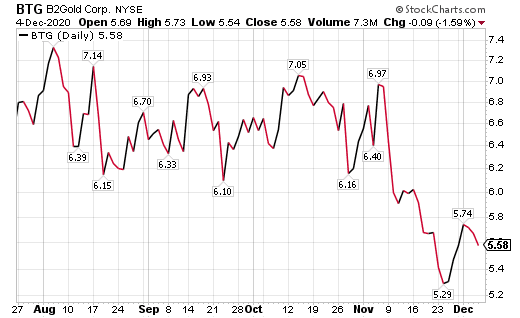

A dividend-paying gold stock that I personally own is B2Gold Corp. (NYSE:BTG). I rode it up and down during the time I have owned it this year but I expect it to climb again to continue its long-term ascent. Gold has a tendency to stay bullish for years and turn bearish for long periods, too. Despite the volatiliy, patient investors have been rewarded by the company’s 2.82% dividend yield.

Headquartered in Vancouver, British Columbia, B2Gold operates mines in Nicaragua, Namibia, Mali and the Philippines, as well as owns properties for exploration of precious metals. Despite a coup d’état in Mali during August in which President Ibrahim Boubacar Keita was forced to step down at gunpoint, B2Gold management reported to me that its mining operations in the country are continuing to operate normally. Zacks Equity Research wrote on Dec. 1 that investors should buy the stock now, so my decision to invest in it does have its supporters.

The company’s Fekola mine expansion project in Mali was completed ahead of its scheduled date on September 30, 2020. The mine expansion and the company’s enlarged fleet at the site are likely to significantly increase Fekola’s processing throughput in the years ahead.

Precious Metals Price Drop Triggers Sell Signal Used in Successful Investing to Protect Profits

The Gold Fund Composite (GFC) used by Jim Woods in his Successful Investing newsletter to determine when to buy and sell the precious yellow metal dipped below its key 125-day moving average on Oct. 30 to signal a “Sell” in gold. On that day, Woods recommended the sale of his then-recommended holidings in the iShares MSCI Global Gold Miners ETF (NASDAQ:RING), SPDR Gold Shares (NYSE:GLD) and Direxion Daily Gold Miners Index Bull 2X Shares (NYSE:NUGT).

“We captured nice gains in these funds and the Gold Plan worked quite well, getting us out of these gold and gold mining funds with substantial, double-digit-percentage wins, while also sidestepping the volatility we’ve witnessed in gold and particularly gold mining stocks since our Sell,” Woods wrote to his subscribers in the December 2020 issue of Successful Investing.

As of Dec. 4, Woods, who also leads the Intelligence Report investment newsletter and the Bullseye Stock Trader advisory service, still was monitoring the GFC to determine when it will be safe for his subscribers to resume taking positions in gold.

Paul Dykewicz interviews Jim Woods before the COVID-19 social distancing restrictions.

Pension Fund Chairman Still Likes Gold Fund, Despite Pullback in Price

“The Fed clearly wants inflation to rise considerably higher than recent levels,” wrote Bob Carlson in the December 2020 issue of his Retirement Watch investment newsletter.

“I’m not betting against the Fed,” said Carlson, who also serves as chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. “That’s why I’ve recommended inflation hedges in the portfolios.”

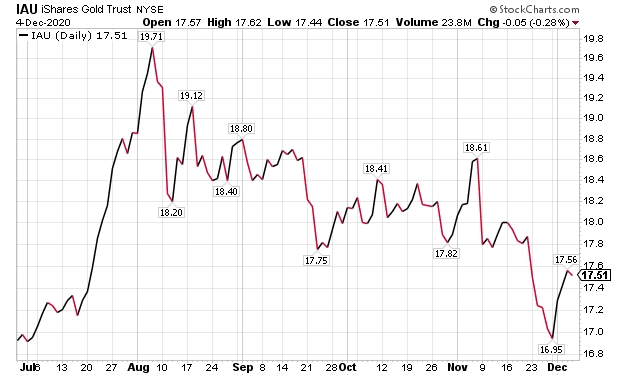

Carlson’s approach to profit from the Fed policy for the past couple of years has been to recommend that his subscribers buy and hold iShares Gold Trust (NYSE:IAU). He increased his recommended holding in IAU earlier in 2020 and is watching the price of gold to assess if any changes are needed. Income investors should be aware that IAU currently does not offer a dividend yield.

Chart courtesy of www.stockcharts.com

“This is the best way for an investor to own gold,” Carlson said. “The exchange-traded fund (ETF) is easy to trade and usually carries the lowest fees of similar ways to buy gold.”

Hedge funds and other short-term traders tend to prefer other gold ETFs, so IAU’s price is less likely to be disrupted when the faster traders make major portfolio changes, Carlson added.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz in an interview before social distancing became standard after the COVID-19 outbreak.

COVID-19 Remains a Huge Factor for Dividend Investors Seeking to Profit from Precious Metals, but a Vaccine Could Help Restore Normalcy

The COVID-19 pandemic not only inflicted economic fallout and huge job cuts but led to a new surge in cases recently that included the infection of President Trump and his related hospitalization Friday, Oct. 2, until Monday, Oct. 5. The overall weekly hospitalization rate is at its highest point in the pandemic, with steep increases in individuals aged 65 years and older, according to the Centers for Disease Control and Prevention (CDC).

COVID-19 cases have rocketed to 14,337,640 and led to 278,594 deaths in the United States, along with 65,760,928 cases and 1,515,990 deaths worldwide, as of Dec. 4, according to Johns Hopkins University. America has the dubious distinction of incurring the most cases and deaths of any nation in the world.

Dividend investors can profit from precious metals, despite the recent price weakness. The traditional political honeymoon for a newly elected president may boost the spirits of many people who hope for the best but dividend investors can profit from precious metals in the months ahead because gold and silver tend to rise when rosy outlooks fail to materialize.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.