Disney DIS demonstrated its entertainment powerhouse status in 2024, achieving an impressive feat with three films surpassing the billion-dollar mark globally. Inside Out 2 led the charge with $1.69 billion, followed by Deadpool & Wolverine at $1.3 billion, and Moana 2 reaching $1.1 billion. This success propelled Disney to become the only studio to surpass $5 billion in worldwide box office revenues in 2024, marking the first such achievement since 2019. With 32 Disney films now in the billion-dollar club compared to only 24 non-Disney films achieving this milestone, the studio's dominance in creating blockbuster entertainment remains unmatched.

2025 Content Pipeline and Parks Expansion

Disney's 2025 theatrical slate appears formidable with 12 major releases, including potential blockbusters like Captain America: Brave New World, Avatar: Fire and Ash, and The Fantastic Four: First Steps. The Parks division is expanding significantly with new attractions, including Disney Villains: Unfairly Ever After and the Disney Starlight nighttime parade. However, weather-related impacts and pre-launch costs may affect near-term performance. The parks' guidance projecting 6-8% operating income growth for fiscal 2025 reflects cautious optimism amid these investments.

Entertainment Evolution and Market Position

Disney's ability to monetize intellectual property across multiple platforms remains a key strength. The success of Moana 2 particularly demonstrates this capability, with the film setting records across various international markets and becoming the highest-grossing Walt Disney Animation Studios release in multiple territories. The company's strategic focus on franchise development, evidenced by its 2025 slate heavily featuring sequels and remakes, suggests a conservative but potentially reliable approach to content creation.

Streaming Progress and Challenges

While the company's streaming division showed promising signs by turning profitable with a $253 million operating profit in fourth-quarter fiscal 2024, Disney+ faces intensifying competition from incumbents like Netflix NFLX, Amazon AMZN-owned Amazon Prime Video and Apple AAPL-owned Apple TV+ and projects modest subscriber growth in early 2025. The decline in Linear Networks revenues, down 6.4% year over year to $2.46 billion, reflects ongoing structural changes in content consumption patterns. The streaming landscape's evolution presents both opportunities and challenges as Disney balances subscriber growth with profitability.

Financial Outlook and Investment Considerations

The Zacks Consensus Estimate projects fiscal 2025 revenues of $94.94 billion, indicating 3.91% year-over-year growth, with earnings expected to increase 8.85% to $5.41 per share. These projections suggest steady but modest growth ahead.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

However, investors should carefully consider the company's substantial debt of $45.81 billion against a cash position of $6 billion, along with its premium valuation at 2.13X (3-year trailing 12-month P/S) compared with the Zacks Media Conglomerates industry's 1.09X.

DIS’ 3-Year P/S TTM Ratio

Image Source: Zacks Investment Research

The company's guidance of high-single-digit adjusted EPS growth for fiscal 2025 and the $3 billion stock repurchase program demonstrate management's confidence in future performance. Yet, these initiatives must be weighed against the current market environment and competitive pressures in the entertainment industry.

Investment Perspective

While Disney's recent box office triumphs and strategic initiatives present long-term potential, current valuations and near-term challenges suggest investors might benefit from patience. The convergence of successful theatrical releases, streaming profitability progress, and parks expansion indicates positive momentum in the company's transformation efforts. However, the premium valuation multiples and substantial debt levels warrant careful consideration.

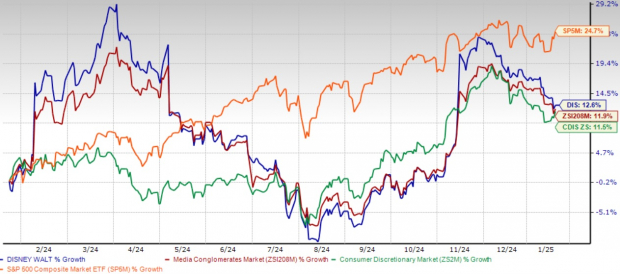

For potential investors, watching for more attractive entry points might be prudent, particularly given the company's ongoing transformation challenges and competitive pressures. The stock's 12.6% gain in the past year versus the Zacks Consumer Discretionary sector's 11.5% growth suggests much optimism may already be priced in.

1-Year Performance

Image Source: Zacks Investment Research

Conclusion

While Disney's long-term prospects remain promising, supported by its unmatched IP portfolio and multi-platform monetization capabilities, the current valuation levels and near-term headwinds suggest a wait-and-see approach might be most appropriate. Investors should closely monitor quarterly results, particularly focusing on streaming subscriber metrics, parks performance, and progress in debt management before considering new positions. Disney currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.1% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.