SiriusXM SIRI is navigating a critical transition phase as it emerges as a fully independent public company following its separation from Liberty Media. While the company aims to reach ambitious targets of 50 million subscribers and $1.8 billion in free cash flow, current market conditions and valuation metrics suggest investors might want to exercise caution. The company's trailing 12-month P/E ratio of 16.52X, significantly above the Zacks Broadcast Radio and Television industry average of -181.32X, raises questions about the stock's near-term potential.

SIRI’s P/E TTM Ratio Depicts Premium Valuation

Image Source: Zacks Investment Research

Financial Performance

Sirius XM reported a third-quarter 2024 loss of 84 cents per share. The Zacks Consensus Estimate for earnings was pegged at 75 cents per share. The company reported earnings of 90 cents per share in the year-ago quarter. Total revenues, on a reported basis, declined 4.4% year over year to $2.17 billion and missed the consensus mark by 0.91%. Advertising revenues dropping 2% to $450 million. While the company added 14,000 self-pay subscribers, representing an improvement from the previous year, the adjusted EBITDA decreased 7% to $693 million. The company maintains a relatively stable EBITDA margin of 32%, supported by ongoing cost optimization efforts targeting $200 million in savings for 2024.

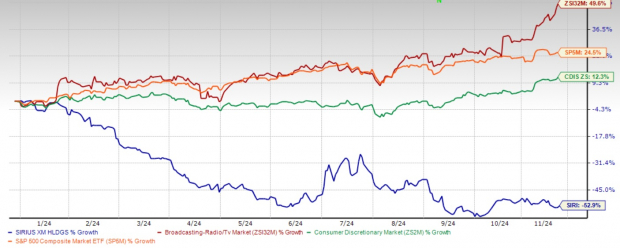

SiriusXM finds itself at a critical juncture in 2024. The satellite radio giant has experienced a dramatic 52.9% decline in its stock price year to date, underperforming the broader Zacks Consumer Discretionary sector’s return of 12.3% and raising questions about its future prospects.

Year-to-Date Performance

Image Source: Zacks Investment Research

Growth Initiatives and Challenges

SiriusXM is actively pursuing several growth initiatives, including a new pricing structure starting at $9.99 for both streaming and in-car services, strategic partnerships with major brands like Walmart and ESPN+, and exclusive content deals, such as the Unwell podcast network. However, the advertising segment faces headwinds from increased CTV supply, shifting advertiser preferences and a truncated election cycle, leading to a $75 million reduction in revenue guidance.

Capital Structure and Investment

The company's current net debt to adjusted EBITDA ratio is pinned at 3.8x, with management targeting a reduction to the low to mid-3x range. Capital expenditure plans indicate significant investment in technology infrastructure, with non-satellite CapEx expected to remain at $450-$500 million through 2025 before declining below $400 million in 2026. Satellite CapEx is projected to decrease steadily from $300 million in 2024 to near zero by 2028.

Tesla to Spotify: SIRI's Rivals Spell Trouble

Sirius XM faces intense competition in an increasingly competitive and rapidly evolving audio entertainment landscape, raising concerns about its future viability.

SiriusXM's traditional stronghold — the automotive sector — is facing unprecedented disruption. The rise of electric vehicles (EVs) and autonomous driving technology has opened the door for tech giants and innovative startups to challenge SiriusXM's once-unassailable position in in-car entertainment. Tesla TSLA, for instance, has been equipping its vehicles with its own entertainment system, bypassing traditional satellite radio altogether.

The streaming audio market, once viewed as a complementary service to SiriusXM's core business, has now become an existential threat. Spotify SPOT, Apple AAPL Music and Amazon Music have continued to expand their user bases, offering personalized playlists, exclusive content and seamless integration across multiple devices.

While SiriusXM has invested heavily in podcast content and technology, it faces fierce competition from dedicated podcast platforms like Spotify and Apple Podcasts, as well as newcomers like Substack and Patreon, which offer creators more control and monetization options.

Investment Perspective and Recommendation

Given the current valuation metrics and market challenges, investors might want to hold off on new positions or await a more attractive entry point.

The Zacks Consensus Estimate for 2024 revenues is pegged at $8.68 billion, indicating 2.99% year-over-year decline. The Zacks Consensus Estimate for 2024 earnings is pegged at a loss of $6.03 per share.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

While SiriusXM's strategic initiatives and cost optimization efforts are promising, the elevated P/E ratio suggests the stock may be overvalued relative to industry peers. The company's transition period, coupled with advertising headwinds and significant capital expenditure requirements, could create near-term pressure on the stock price.

The company maintains its dividend program, having paid $103 million to shareholders in the third quarter, but the focus on deleveraging might limit aggressive capital returns in the near term. Investors should monitor the success of new pricing strategies, subscriber growth trends and advertising revenue recovery before considering new positions. For existing shareholders, maintaining current positions while watching for execution of strategic initiatives may be the prudent approach in the current market environment.

Conclusion

The stock's premium valuation would be more justifiable if the company demonstrated sustained subscriber growth and successful implementation of its strategic initiatives, particularly in reversing advertising revenue declines. Until then, a wait-and-see approach appears warranted for potential investors. SiriusXM currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpApple Inc. (AAPL) : Free Stock Analysis Report

Sirius XM Holdings Inc. (SIRI) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Spotify Technology (SPOT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.