In this week’s digest, we examine how the market has fared in Q1 2024, as well as major news on-chain events that could impact the sector growth in the April and beyond.

Investor interest grows despite market pull-back

While Bitcoin (BTC) price has retraced 10% from the global peak of $73,990 recorded on March 11, on-chain data shows that the investor interest in the crypto market continues to grow.

Despite Bitcoin’s rise to a peak of $71,325.61 on April 1st, as recorded by CoinMarketCap reference Pricing, the crypto market has shed over $300 billion from its peak value of $2.8 trillion recorded on March 13.

Crypto Market Valuation, March 13 – April 5 2024 |Source: CoinMarketCap

Crypto Market Valuation, March 13 – April 5 2024 |Source: CoinMarketCap

The losses were particularly dominant among mega cap altcoins like Solana (SOL), Avalanche (AVAX) and Ripple (XRP) which have all experienced double-digit drawback. Such corrections are not uncommon in the digital asset markets, particularly in the periods leading up to halving events.

Meanwhile, Memecoins have encountered the most significant headwinds, recording the steepest decline with month-to-date returns sliding to -24.02%, following their outstanding performance in the Q1.

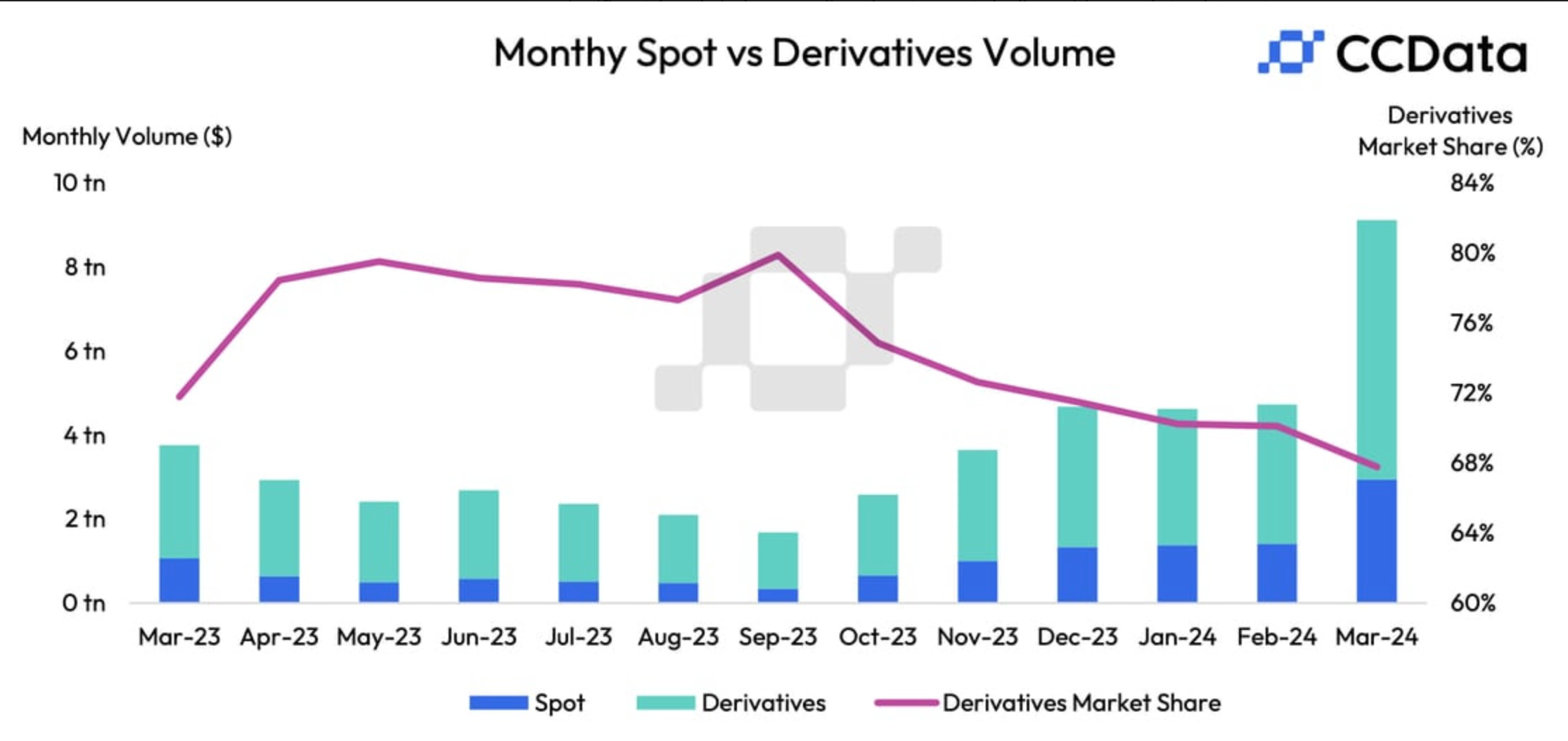

In contrast to the current month’s setbacks, March showcased a notable uptick in trading volumes across centralised exchanges, surging by 92.9% to reach a record high of $9.12tn.

This period of heightened activity correlated with Bitcoin’s record-setting performance in March, as well as the ongoing buildup to the halving event.

Crypto Trading Volume Hit New $9.1 Trillion All-Time High in March

The combined trading volume on centralized cryptocurrency exchanges nearly doubled to a record-breaking $9.1 trillion in March, with spot trading outpacing the growth of derivatives trading.

According to CCData’s latest Exchange Review report, spot trading volumes rose 108% to $2.93 trillion, the highest monthly figure since May 2021, with leading cryptocurrency exchange Binance being able to capitalize on the market frenzy and see trading volume reach its highest level since May 2021.

Crypto Monthly Spot trading vs Derivatives Volume | Source: CCData

Crypto Monthly Spot trading vs Derivatives Volume | Source: CCData

The platform’s spot trading volume jumped 121% to $1.12 trillion while derivatives volumes rose by 89.7% to $2.91 trillion. Overall, spot and derivatives trading on centralized exchanges rose 92.9% last month.

Trading volumes for spot Bitcoin exchange-traded funds also spiked in March, reaching a total of $111 billion. This increase represented almost triple growth compared to the $42.2 bilion observed in February, with the ETFs from Grayscale and BlackRock leading the charge, and signaling the continued interest in spot Bitcoin investments.

When Spot Volumes exceed Derivatives trading volume, is suggests that the ongoing market rally is being driven by organic market demand, rather than speculative activity.

This underlines the maturity of the global crypto market, also sets the crypto prices up to maintain relatively high support levels in the Q2 2024, and avoid flash clash crashes observed in previous rally cycles.

This article was originally posted on FX Empire

More From FXEMPIRE:

- Dogwifhat (WIF) Price Forecast: What Next for Solana’s top dog after 500% gains in March?

- Gold Prices Forecast: Was a Bull Trap Set on Friday?

- D.R. Horton Shares Building Value on Heavy Institutional Demand

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.