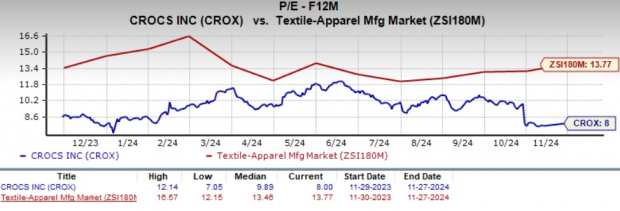

Crocs, Inc. CROX is currently trading at a notable low price-to-earnings (P/E) multiple, well below the averages of the Zacks Textile – Apparel industry and the broader Retail-Wholesale sector. With a forward 12-month P/E of 8x, the CROX stock reflects a discount to the industry average of 13.77x and the Consumer Discretionary sector’s average of 19.65x.

CROX Stock Looks Undervalued

Image Source: Zacks Investment Research

This shows the CROX stock is undervalued relative to its industry peers, presenting an attractive opportunity for investors seeking exposure to the Consumer Discretionary sector. Furthermore, CROX's Value Score of A underscores its appeal as a potential investment.

Crocs has surged 13.5% year to date, significantly outpacing the industry’s decline of 12.8%. This impressive performance can be attributed to the company’s strategic initiatives, including robust market expansion and product diversification efforts.

CROX Stock Year to Date Performance

Image Source: Zacks Investment Research

Factors Driving the CROX Brand

Crocs is advancing its long-term strategy with key initiatives focused on sustainable growth. The company’s approach centers on three main pillars. These include elevating iconic products across brands to boost awareness and relevance, strategically investing in Tier 1 markets to increase market share through enhanced talent, marketing, digital and retail expansion, and diversifying its product range to appeal to a broader consumer base.

Crocs has strategically expanded its product range, leveraging diversification to attract a broader consumer base. The Crocs brand’s remarkable growth in global awareness and desirability has been fueled by innovative collaborations and unique product offerings. Recent partnerships include a Bath & Body Works collection featuring the Classic Clog and cozy sandal with mystery scent Jibbitz charms, as well as creative collaborations with popular names like Batman, Squishmallow and McDonald’s Happy Meal.

Crocs is also driving momentum with innovations like the Echo and in-motion franchises, and upcoming launches such as the Echo Wave, Molded Mule and Echo Search — all priced under $100 — to attract budget-conscious yet style-savvy consumers. The debut of Pet Crocs, designed with BARK, was a third-quarter 2024 highlight. These EVA foam booties allowed dogs and their owners to match in iconic Classic Clogs, available globally online and in select stores. Additionally, the brand also added a playful touch with a Crocs costume — a life-sized version of the Classic Clog with Jibbitz charms, available in left and right versions for pairing with friends.

Current Pressures on CROX

Despite all the positives, Crocs' HEYDUDE brand underperformed, with revenues dropping 17.4% year over year in the third quarter. This decline was led by a 22.9% fall in wholesale revenues and a 9.3% drop in direct-to-consumer (DTC) revenues. Comparable DTC sales for the HEYDUDE brand also decreased by 22.2%.

Looking ahead, Crocs anticipates a relatively subdued consumer environment in the United States until the Black Friday/Cyber Monday holiday period. Per the company, the industry saw heightened promotional activities in China during the mid-season festival, reflecting a more conservative approach by China consumers. As a result, the company expects to see a greater pullback in major Tier 1 cities like Shanghai and Beijing.

Given the challenging macroeconomic conditions, Crocs has issued a cautious outlook for the fourth quarter and 2024, anticipating flat-to-slight revenue growth year over year, in constant currency. The Crocs brand is expected to grow 2% in the fourth quarter, while HEYDUDE revenues may decline 4-6%. International growth is projected to slow due to regulatory challenges in India, and North America faces consumer selectivity and wholesale timing pressures, though DTC revenues remain positive.

For 2024, enterprise revenues are projected to increase 3% year over year in constant currency, which is at the lower end of the previously guided 3-5% growth. Revenues for the Crocs brand are expected to grow 8%, while HEYDUDE brand revenues are anticipated to decline 14.5% due to weaker-than-expected sellouts in both wholesale and digital channels. Previously, management had estimated the Crocs brand’s revenues to grow 7-9% and HEYDUDE’s revenues to decrease 8-10%.

Investment Opinion on CROX

Investors may find Crocs stock attractive for its undervaluation compared to industry peers, with a lower price-to-earnings ratio. Given strategic initiatives, margin improvements, successful partnerships and a focus on sustainability, the stock presents a compelling investment opportunity for those looking to capitalize on the company’s growth trajectory.

However, CROX faces challenges, including soft revenue expectations, struggles with the HEYDUDE brand and headwinds in China, which could impact its near-term performance. These factors introduce some uncertainty, suggesting a more cautious approach to investing in Crocs at this stage. CROX’s current Zacks Rank #3 (Hold) reinforces its appeal as a solid investment opportunity.

Three Stocks Showing Potential

Some better-ranked stocks are Wolverine World Wide WWW, Gildan Activewear Inc. GIL and Steven Madden, Ltd. SHOO.

Wolverine World Wide designs, manufactures and distributes a wide variety of casual and active apparel and footwear. The company sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for WWW’s current financial-year sales indicates a decline of almost 23% from the year-ago reported figures. The consensus mark for EPS reflects significant growth to 89 cents from 5 cents reported in the prior year. WWW has a trailing four-quarter earnings surprise of 17.03%, on average.

Gildan Activewear manufactures and sells various apparel products in the United States, North America, Europe, the Asia Pacific and Latin America. It carries a Zacks Rank of 2 (Buy) at present. GIL has a trailing four-quarter earnings surprise of 5.4%, on average.

The consensus estimate for Gildan Activewear’s current-financial year sales and earnings indicates advancements of 1.5% and 15.6%, respectively, from the prior-year figures.

Steven Madden designs, sources, markets and sells fashion-forward, name-brand and private-label footwear. It currently has a Zacks Rank #2.

The Zacks Consensus Estimate for Steven Madden’s 2024 earnings and sales indicates growth of 8.2% and 13.4%, respectively, from the year-ago actuals. SHOO has a trailing four-quarter average earnings surprise of 9.6%.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.Wolverine World Wide, Inc. (WWW) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.