CRISPR Therapeutics CRSP reported a net loss per share of 98 cents in the second quarter of 2023, narrower than the Zacks Consensus Estimate of a loss of $2.18. The company had posted a loss of $2.40 per share in the year-ago period.

CRISPR Therapeutics' total revenues, comprising collaboration revenues, were $70 million in the second quarter, primarily attributed to a research milestone achieved during the quarter in connection with a non-exclusive license agreement with Vertex Pharmaceuticals VRTX. Revenues substantially beat the Zacks Consensus Estimate of $3.2 million. In the year-ago quarter, revenues were less than $0.2 million.

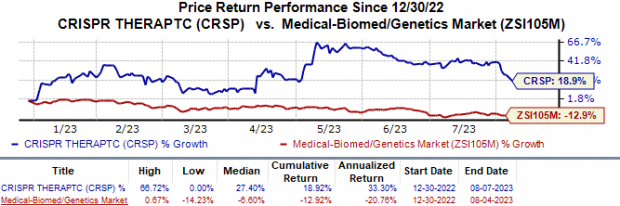

Post the announcement, CRISPR Therapeutics’ shares inched up 1.6% in after-market trading on Aug 7. The stock has gained 18.9% year to date against the industry’s fall of 12.9%.

Image Source: Zacks Investment Research

Quarter in Detail

For the reported quarter, research and development expenses fell 18% year over year to $101.6 million, driven by reduced variable external research and manufacturing costs.

Also, general and administrative expenses declined 18% to $19.0 million due to a fall in external professional costs.

Collaboration expenses in the quarter reached $44.6 million, up 32% year over year. The upside can be attributed to a rise in the company’s manufacturing and pre-commercial costs on the exa-cel program (being developed in collaboration with Vertex Pharmaceuticals).

As of Jun 30, 2023, CRISPR Therapeutics had cash, cash equivalents, marketable securities and accounts receivables of $1.84 billion compared with $1.88 billion as of Mar 31, 2023.

Pipeline Updates

CRISPR Therapeutics has developed exa-cel — an investigational ex-vivo CRISPR gene-edited therapy for treating sickle cell disease (SCD) and transfusion-dependent beta-thalassemia (TDT) — in partnership with Vertex Pharmaceuticals.

In June, CRISPR Therapeutics and Vertex announced that the FDA accepted their biologics license application (BLA) submissions seeking approval for exa-cel in SCD and TDT indications and a final decision is expected by Dec 8, 2023, and Mar 30, 2024, respectively. The companies have filed similar regulatory submissions for exa-cel in Europe, which were validated this January.

Apart from exa-cel, CRISPR Therapeutics is developing two chimeric antigen receptor T cell (CAR-T) therapy candidates — CTX110 and CTX130 — for hematological and solid-tumor cancers.

The company has been enrolling patients in the phase II study evaluating CTX110 in relapsed/refractory B-cell malignancies. CRISPR Therapeutics is also enrolling patients in the ongoing phase I COBALT-LYM study evaluating CTX130 targeting CD70 for treating relapsed or refractory T cell malignancies.

CRSP is also advancing two next-generation CAR-T product candidates, CTX112 (targeting CD19-positive B-cell malignancies) and CTX131 (targeting relapsed or refractory solid tumors) in separate phase I/II studies. These candidates have been designed to enhance CAR-T potency.

The company also remains on track to advance its lead in-vivo program, CTX310, into clinical development later this year. CTX310 has been designed to target angiopoietin-related protein 3 (ANGPTL3), which is responsible for the development of atherosclerotic cardiovascular disease.

CRISPR Therapeutics AG Price

CRISPR Therapeutics AG price | CRISPR Therapeutics AG Quote

Zacks Rank & Stocks to Consider

CRISPR Therapeutics currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include Caribou Biosciences CRBU and Johnson & Johnson JNJ,each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Caribou Biosciences’ loss estimates for 2023 have narrowed from $1.91 to $1.63 per share in the past 30 days. During the same period, the loss estimates per share for 2024 have narrowed from $2.60 to $1.72. Year to date, Caribou Biosciences’ stock has risen 4.8%.

Caribou Biosciences beat earnings estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed a negative earnings surprise of 1.36%. In the last reported quarter, CRBU delivered an earnings surprise of 4.17%.

In the past 30 days, estimates for J&J’s 2023 earnings per share have increased from $10.66 to $10.74. During the same period, the earnings estimates per share for 2024 have risen from $11.01 to $11.29. Shares of J&J are down 2.0% in the year-to-date period.

Earnings of J&J beat estimates in each of the last four quarters, witnessing an average earnings surprise of 5.58%. In the last reported quarter, J&J’s earnings beat estimates by 7.28%.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Caribou Biosciences, Inc. (CRBU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.