Coty Inc. COTY has been benefiting from its focus on six core priorities, which include stabilizing Consumer Beauty make-up brands and mass fragrances, accelerating luxury fragrances and setting up Coty as a core player in prestige make-up, establishing a skincare portfolio in prestige and mass channels, strengthening e-commerce and Direct-to-Consumer capabilities, growing presence in China via Prestige and certain Consumer Beauty brands and setting Coty as an industry leader in sustainability. Moreover, the company’s strategic alliances have been yielding favorably.

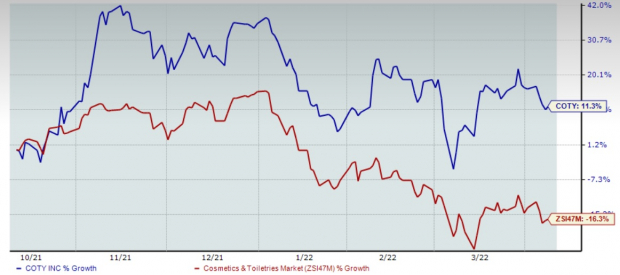

These upsides were visible in COTY’s second-quarter fiscal 2022 results, wherein management raised its guidance for fiscal 2022. Shares of this renowned cosmetics company have ascended 11.3% in the past three months against the industry’s decline of 16.3%. Let’s see if this Zacks Rank #3 (Hold) company can keep the momentum going amid cost inflation and supply-chain challenges.

Image Source: Zacks Investment Research

What’s Working for Coty?

On its second-quarter conference call, Coty said that it is making solid progress concerning every priority (discussed above) and has several initiatives planned for the future. This instills confidence in the company’s second-half prospects. Management is particularly impressed with the turnaround in the Consumer Beauty space due to key mass cosmetic brands. For stabilizing consumer beauty brands, the company is on track with repositioning campaigns and disruptive advertising. Coty’s efforts to reposition its key Consumer Beauty brands — COVERGIRL, Rimmel and Max Factor — are on track. The company has also been on track with product launches under the prestige unit. Management is on track to boost its leading brands through the innovations and renovations of key icons for the fragrance business. Moving on, the company’s e-commerce sales rallied 16% in the first half of the fiscal, with robust growth in Consumer Beauty.

Coty is also making strong progress with the expansion of the skincare portfolio. The company made several strategic partnerships to enhance its brand portfolio. On Nov 18, 2021, COTY signed a licensing agreement with Orveda – an ultra-premium skincare brand made in France. Before this, Coty entered into a multi-channel agreement with Perfect Corp. – a well-known beauty tech solutions provider. The partnership will help Coty customers shop in the most convenient and personalized manner, both online and offline. On Mar 3, 2021, the company signed a letter of intent to partner with LanzaTech – a pioneer in producing next-generation green and sustainable ingredients. Further, the company acquired a 20% stake in Kim Kardashian West's business in January 2021. Coty and Kylie Jenner unveiled their long-term alliance in January 2020 aimed at further building upon Kylie’s beauty business, which includes Kylie Skin and Kylie Cosmetics.

Main Headwinds

Coty has been encountering a volatile operating landscape, including inflation and supply-chain bottlenecks. Management anticipates the impact of inflation to be higher in the second half of fiscal 2022, though it remains on track with saving and inflation mitigation endeavors. Management stated that though it witnessed a gross margin expansion in the first half of the year, it does not expect to see a similar level of expansion in the second half. This can be attributed to increased inflation levels, seasonality factors and tough comparisons with the year-ago period’s one-time benefit. That said, the overall fiscal 2022 gross margin is likely to be higher than fiscal 2021 due to the strong growth witnessed in the first half.

Coty Price, Consensus and EPS Surprise

Coty price-consensus-eps-surprise-chart | Coty Quote

A Look at Q2 & Ahead

Coty posted robust second-quarter fiscal 2022 results, with the top and the bottom line increasing year over year and the latter surpassing the Zacks Consensus Estimate. COTY posted adjusted earnings of 17 cents per share, which surpassed the Zacks Consensus Estimate of 12 cents. The bottom line improved from 13 cents reported in the year-ago quarter. Net revenues came in at $1,578.2 million, up 12% year over year. Like for like or LFL revenues increased 12%, backed by the growth in the Prestige and the Consumer Beauty business segment.

Coty expects fiscal 2022 LFL sales to be at the upper end of its guidance range of low-to-mid teens percentage growth. Due to the solid fiscal second-quarter earnings performance, management pushed the fiscal 2022 earnings per share or EPS view upward. Fiscal 2022 adjusted EPS is expected in the range of 22-26 cents, up from the earlier guidance of 20-24 cents. In the third quarter of fiscal 2022 and the second half, LFL sales growth is envisioned in the mid-teens range. Coty expects fiscal 2022 sales at the higher end of its previous guidance range.

A Renowned Consumer Staple Stock

A popular pick from the broader Zacks Consumer Staples sector is Altria Group, Inc. MO, which has also been benefiting from its strong pricing power and a focus on oral tobacco products, such as on!. For 2022, Altria envisions 4% to 7% growth in the bottom line, which is likely to be more weighted toward the second half. This tobacco giant currently carries a Zacks Rank #3. Shares of MO have increased 20.1% in the past six months. The Zacks Consensus Estimate for the company’s current financial-year EPS suggests growth of around 5% from the year-ago reported figure.

Let’s Check These Solid Bets

Some better-ranked stocks are Nu Skin Enterprises NUS and Flowers Foods FLO.

Nu Skin, a beauty and wellness products company, sports a Zacks Rank #1 (Strong Buy) at present. Shares of Nu Skin have jumped 26% in the past six months. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nu Skin’s current financial-year sales and EPS suggests growth of 0.9% and 4.1%, respectively, from the year-ago reported number. NUS has a trailing four-quarter earnings surprise of 16.1%, on average.

Flowers Foods, the producer and marketer of packaged bakery products, currently carries a Zacks Rank #2 (Buy). Shares of Flowers Foods have risen 8.1% in the past six months.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales and EPS suggests growth of 7.2% and roughly 4%, respectively, from the year-ago reported figure. FLO has a trailing four-quarter earnings surprise of around 9%, on average.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altria Group, Inc. (MO): Free Stock Analysis Report

Flowers Foods, Inc. (FLO): Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS): Free Stock Analysis Report

Coty (COTY): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.