Costco Wholesale (NASDAQ: COST) is experiencing surging sales since the onset of the pandemic, and this quarter is not expected to be any different. Folks are increasingly relying on the large membership-only store for essentials and nonessentials alike. The retailer will report fiscal 2021 third-quarter results on Thursday, May 27.

Costco sells its products on thin margins and relies on membership fees to drive profits. That's why when this international warehouse club chain reports earnings on Thursday, membership totals are what investors (and would-be investors) will want to monitor.

Costco members are the key to its business

As of the end of the second quarter, Costco had 108.3 million paying cardholders. That was a 1.2 million increase from the 107.1 million reported at the end of the first quarter. Costco offers two membership tiers -- regular and executive. The regular membership costs $60 for an annual membership, and the executive is $120 and comes with additional perks like 2% cashback on spending.

Costco boasts a total of 108.3 million cardholders. Image source: Getty Images.

Executive members are 23.8 million of the overall total and increased by 506,000 quarter over quarter. So, while executive members are less than 25% of the overall total, they consisted of almost 50% of the member growth quarter over quarter. Executive members tend to spend more than their counterparts. The main reason they choose the executive membership is because of the cashback feature. And most will not choose the higher tier unless they plan on spending enough to make up for the additional fee in cashback returns.

Membership renewal rates are pretty high. Once Costco acquires a new customer, they tend to stick around. In fact, in the most recent quarter, the worldwide membership renewal rate was 88.5%, up from the prior quarter's 88.4%. Renewal rates are higher (91%) in the U.S. and Canada. That's why, when the company reports third-quarter earnings, the membership total will be what you need to know.

What this could mean for investors

Analysts on Wall Street expect Costco to report revenue of $43.63 billion and earnings per share of $2.32, which would be increases of 17.5% and 22.7%, respectively. If results turn out to be as expected, it would be yet another quarter of boosted performance since the pandemic.

Still, doing business while a deadly virus is lurking is challenging. Costco has spent over $1 billion on COVID-related expenses, mostly increased wages for employees, since the onset. Fortunately for shareholders, some of those expenses will be reduced starting in the third quarter. That could mean that going forward, Costco will get the benefit of nearly 90% of the new customers it has gained during the pandemic and expenses that will be much lower than they were during the height of the pandemic.

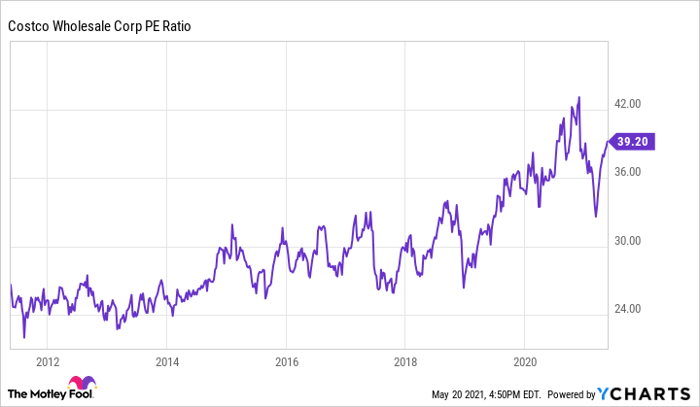

Data source: YCharts.

Costco is trading at a price-to-earnings ratio of 39.2, near the highest it has traded for in the last decade (see chart). So the excellent long-term outlook may already be priced into the stock. Still, investors should keep Costco on their lists and wait for an opportunity to start accumulating shares.

10 stocks we like better than Costco Wholesale

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Costco Wholesale wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of May 11, 2021

Parkev Tatevosian has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.