A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

#marketseverywhere | "For-profit companies have scale and a much bigger impact on society. They end hunger, provide shelter, educate workers, and invent the future. Their profits measure success in delighting customers. Profits are purpose..."

-Andy Kessler, Profits Can Be Your Purpose

* source: Nasdaq

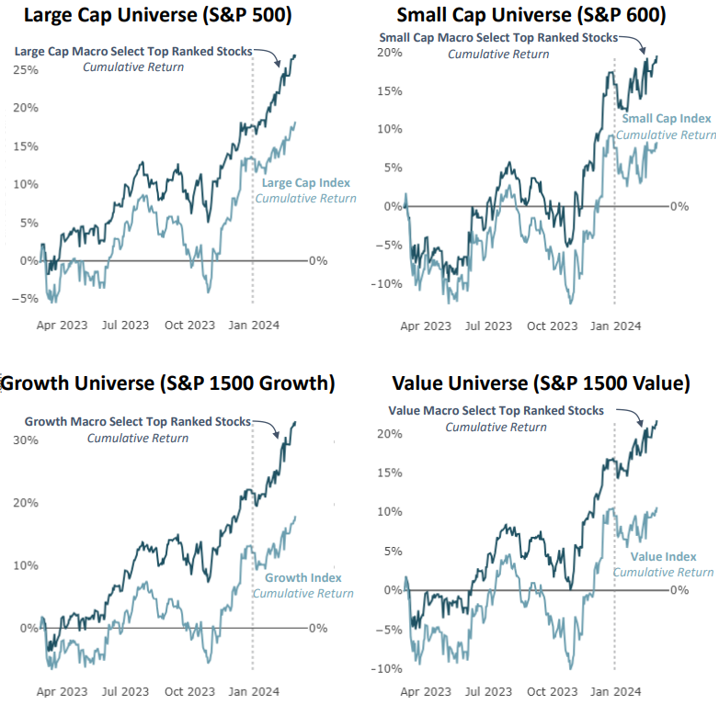

| "we have seen investors reach for high quality stocks with strong fundamentals. More recently, as the quality leadership trip has persisted, investors are increasingly being selective within the trade and looking for Quality At a Reasonable Price (QUARP)."

-Piper Sandler, Michael Kantrowitz

| "The preference for quality has not just been a bid toward the Magnificent 7, quality has been outperforming in every corner of the equity market."

* source: Piper Sandler

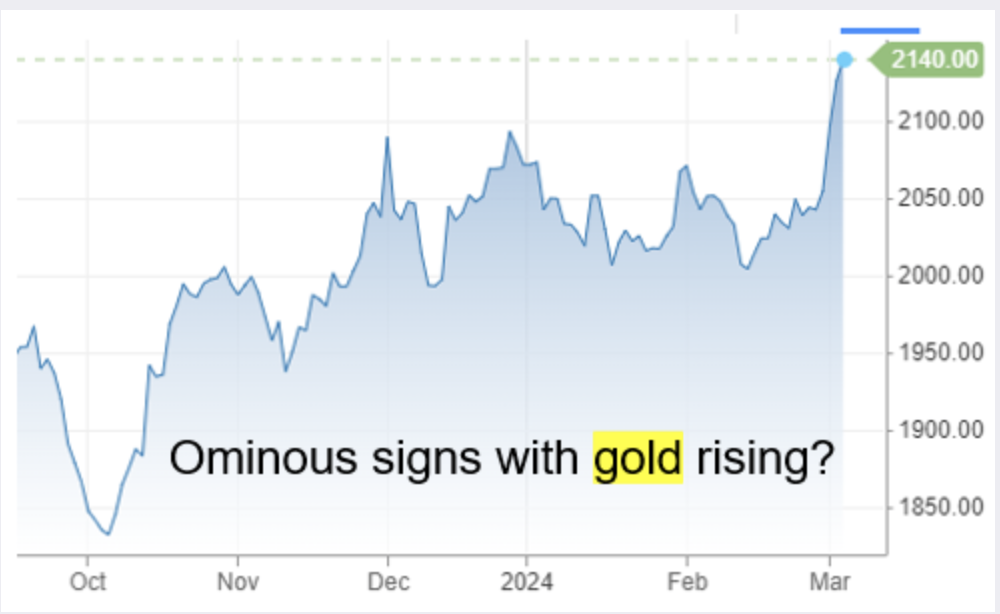

| Hmmm...inflationary / economic uncertainty / debt level concerns? | hitting all time high!

* source: CNBC

| "In February, the market was captivated by leading AI chip designer, Nvidia’s, meteoric rise (which has accounted for almost 28% of the S&P 500’s gains in 2024)...S&P 500 gains since Jan 2023, the equity rally has broadened in 2024, with more than 2/3 of S&P 500 stocks currently trading above their 50 day moving average."

-Tom Joyce, MUFG

| Strong returns for global equities in February | "resilient economic data, notable policy pivots, and tech sector strength" | Chinese equities rebounding, Nikkei + US markets hit record highs

* source: MUFG, Tom Joyce

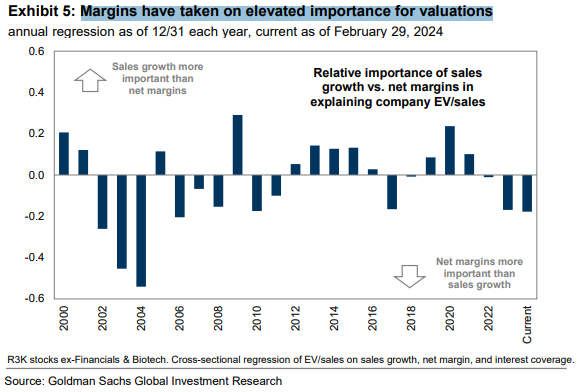

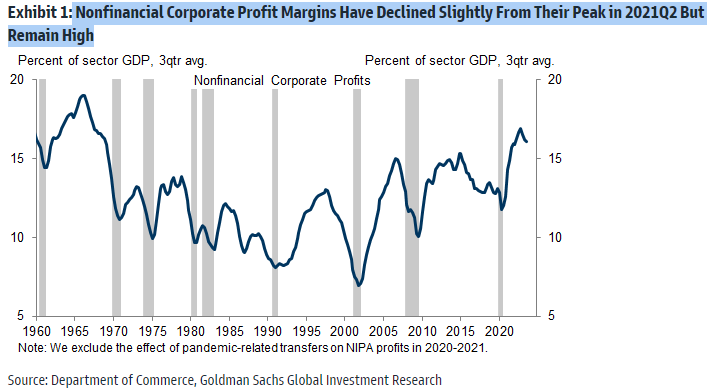

| "the cost of capital (WACC) is much higher today and investors are focused on margins rather than “growth at any cost...a higher WACC means valuations of small and unprofitable growth stocks are unlikely to return to their 2021 highs."

-David Kostin, Goldman Sachs Global Investment Research

* source: Goldman Sachs Global Investment Research

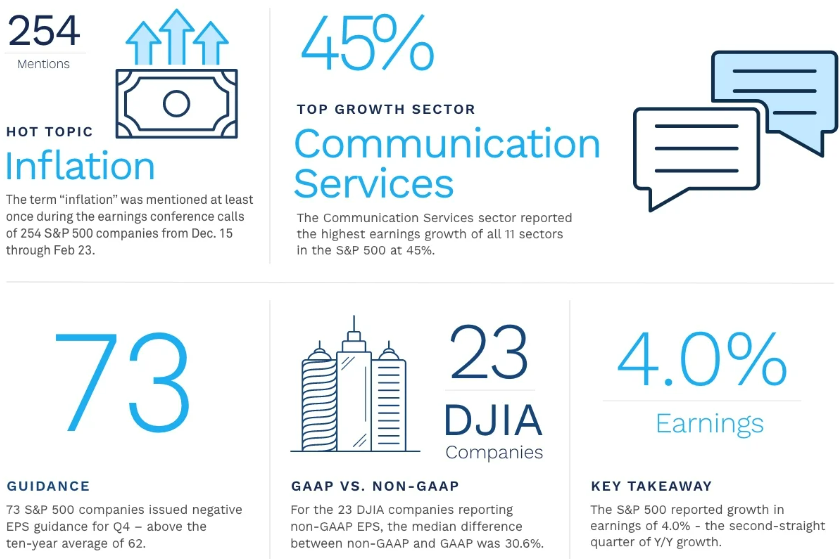

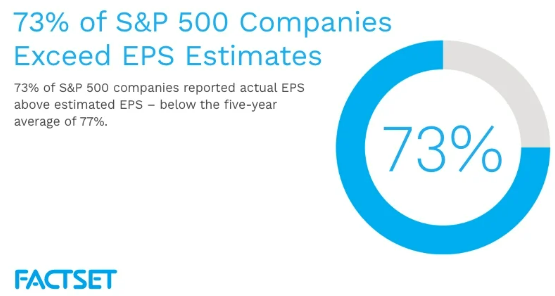

| Factset: Q4 2023 Earnings by the Numbers

* source: Facset Insight

| "Today we have the latest ISM Services PMI. Today's CoTD shows the correlation with US YoY CPI with a 2-month lag, which has been quite strong since the series started in 1997. So if these higher prints are sustained, that’ll be an important warning sign for inflation this year."

-DB's Jim Reid

* source: Deutsche Bank, Jim Reid

| "What would be the signal for investors to take on more risk? A broad based earnings recovery is the most consistent signal for a sustained risk-on recovery but we are not yet seeing it happen."

-Piper Sandler

* source: Piper Sandler

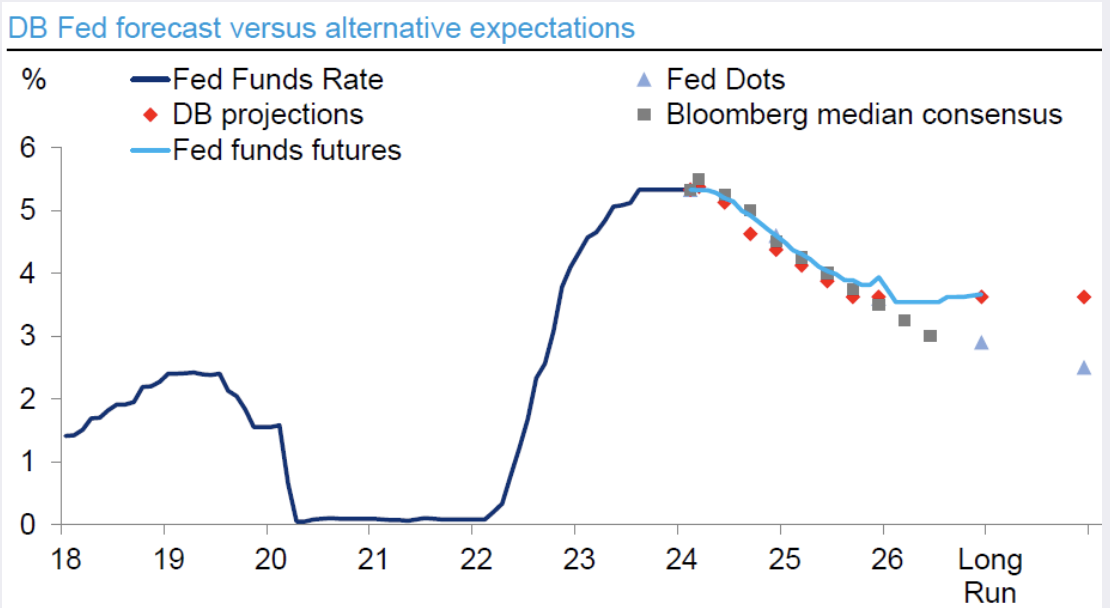

| DB Fed expectations: First cut in June, 100bps of cuts in 2024, nominal neutral rate ~3.5%

* source: Deutsche Bank

| market breadth is rising slightly but still below 30YR average of 35

* source: Goldman Sachs Global Investment Research

1) KEY TAKEAWAYS

1) Dollar + Gold HIGHER | Oil + Equities + TYields LOWER

-busy macro week ahead | ISM services = Tue, ADP private payrolls + JOLTS job openings report = Wed, initial claims = Thurs, employment report = Fri | Fedspeak | Super Tuesday

DJ -0.6% S&P500 -0.6% Nasdaq -1.1% R2K -0.4% Cdn TSX +0.1%

Stoxx Europe 600 -0.1% APAC stocks MIXED, 10YR TYield = 4.162%

Dollar HIGHER, Gold $2,129, WTI -0%, $79; Brent -0%, $83, Bitcoin $68,797

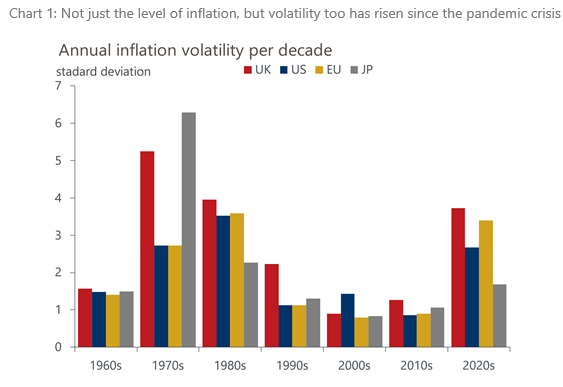

2) Data trends suggest more inflation volatility ahead | services inflation is now dominant in US + Eurozone

* source: Oxford Economics

3) "With Trump’s aggressive tariff proposals pushing up trade uncertainty, onshoring/reshoring – already near record highs – is poised to accelerate, as is it did last cycle" -Nancy Lazar, Piper Sandler

* source: Piper Sandler, Nancy Lazar

4) THIS WEEK:

"The US jobs report and Fed Chair Powell's testimonies will be among the highlights next week.

In Europe, there will be the ECB decision and economic activity indicators for key countries.

And on the political side, next week will see 'Super Tuesday' in the US, as well as the UK Budget.

Over in Asia, the focus will be on the National Party Congress in China and the

Tokyo CPI in Japan.

Corporate earnings include Broadcom and Target."

-Deutsche Bank

* source: Barclays' Emmanuel Cau

2) MARKETS, MACRO, CORPORATE NEWS

- Bostic sees Fed pausing after just one rate cut in third quarter-BBG

- For Fed tightening, there's more to think about than just tapering-BBG

- Sticky services inflation emboldens ECB to resist calls for rate cuts-FT

- JPMorgan sees ‘froth’ in US stocks, while Goldman says rally justified-BBG

- Investors in China stick to bargains as fiscal bazooka proves elusive-RTRS

- China says it will defuse financial risks at its top legislative meeting-BBG

- Don’t invest in China, Goldman Sachs wealth management CIO warns-BBG

- Global funds are returning to China stocks, Morgan Stanley says-BBG

- Tokyo prices heat up again, supporting case for BOJ rate hike-BBG

- China's services activity growth momentum softens in Feb-Caixin PMI-RTRS

- Euro zone business activity moves closer to recovery, PMI survey shows-RTRS

- UK firms report growth at 9-month high but price pressures mount-RTRS

- Japan's service activity grows in Feb on firm tourism-RTRS

- S. Korean economy grows 1.4 pct in 2023, unchanged earlier estimate-YNA

- Gaza ceasefire talks end no breakthrough as Ramadan deadline looms-RTRS

- Macron said France will not send troops to Ukraine in the near future 18:36-APA

- China drops 'peaceful reunification' reference to Taiwan-RTRS

- China defense spending to climb 7.2% as Xi pursues buildup-BBG

- OpenAI expands its communications operation-AXIOS

- Global M&A volumes to rise by 50% this year, says Morgan Stanley-RTRS

- Eli Lilly races boost capacity it rolls out rival Novo Nordisk weight-loss drug-FT

- Nippon Steel exec to meet USW head to seek support for U.S. Steel deal-RTRS

- Walgreens CEO says no plans to sell specialty pharmacy unit-RTRS

- American orders 260 jets in haul for Boeing, Airbus, Embraer-BBG

- Bank runs spooked regulators. Now a clampdown is coming-NYT

- Azul working with Citi, Guggenheim as it mulls bid for rival Gol-BBG

- EU antitrust regulators halt for now probe into IAG's Air Europa deal-RTRS

- AMD hits US roadblock in selling AI chip tailored for China-BBG

- Apple’s iPhone struggles in China deepen with a 24% sales plunge-BBG

- Engie seeks to sell $1 billion of US renewable assets-BBG

- US PE giant Thoma Brava keeps tabs on Iress, Jarden on scene-AFR

- Sanofi’s CEO on the consumer divestiture, a future in weight loss, antitrustand AI’s secrecy wave: Q&A-END

Oil/Energy Headlines: 1) Oil prices rise as funds scale back bearish positions-RTRS 2) Opec+ defers tricky decision on production increases-FT 3) Guyana beats Venezuela in oil exports during border dispute-BBG 4) War insurers shrug off Rubymar sinking in Red Sea, rates stable-RTRS

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.