By Steve Schoffstall, Director, ETF Product Management, Sprott Asset Management

Copper has been mined for thousands of years. Its uses are many, and this critical mineral has helped shape human history. Copper’s durability, malleability and superior conductivity (second only to that of silver) have diversified its uses, which range from construction to power generation to electronics. About 22% of copper demand comes from electricity networks, solar and wind power, and electric vehicles (EVs).[1] These applications are expected to account for a large portion of the increase in demand for the metal. We believe copper’s demand outlook is bright, but participating in the investment opportunity isn’t always straightforward.

Growing Demand for Copper

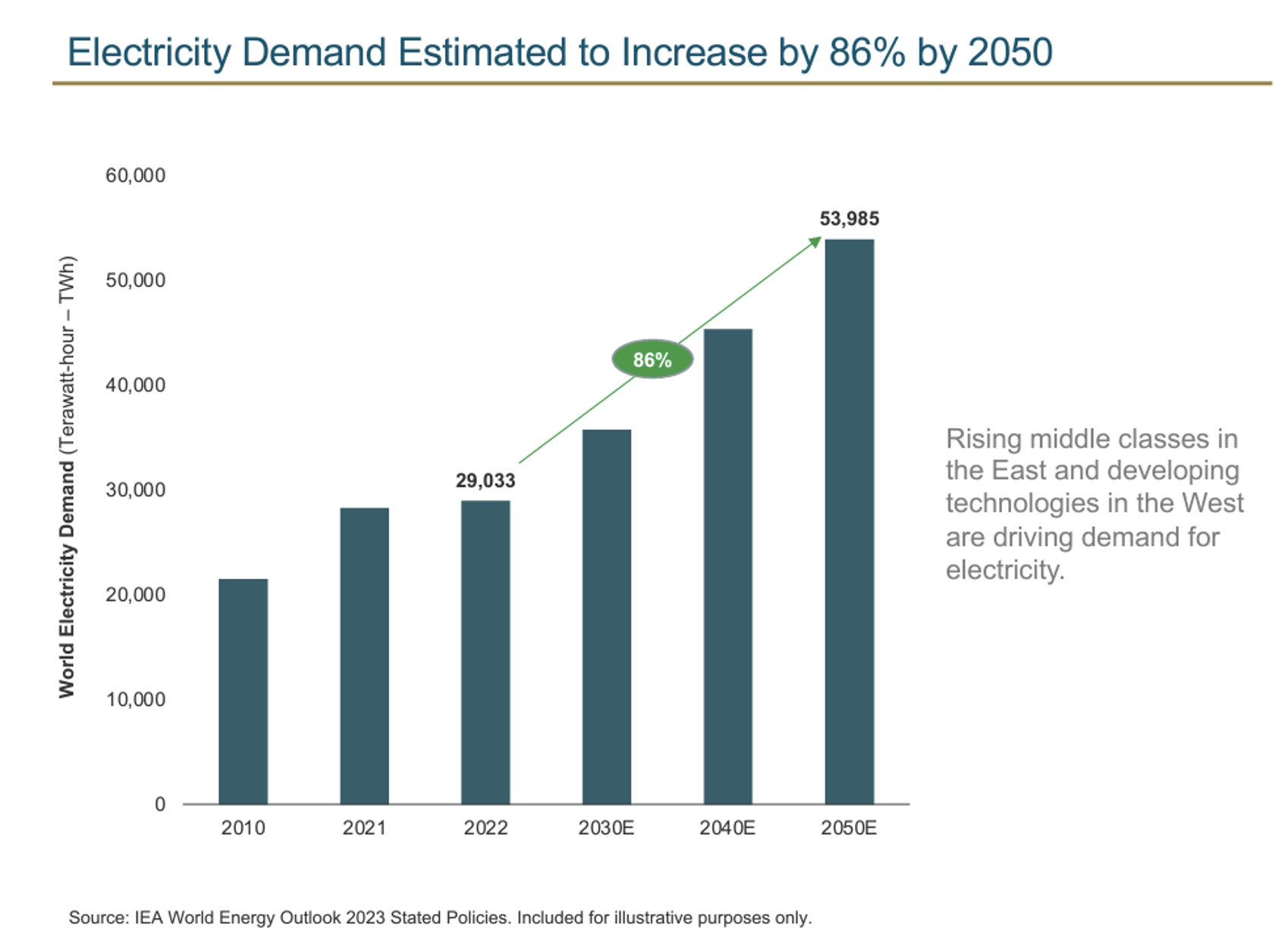

Rising middle classes in the East and developing technologies in the West are driving the demand for electricity. According to the International Energy Agency (IEA), demand for electricity is expected to increase by 86% by 2050.[2] As the world economy increases its reliance on renewable energy sources, copper may be positioned to play a starring role. Many clean energy technologies require a significant amount of copper relative to their fossil fuel counterparts. For example, EVs, solar and onshore wind power installations all require about two and a half times the copper required by their fossil fuel counterparts, while offshore wind projects require seven times the copper needed to generate power from natural gas or coal.[3] Additionally, the development of AI and data centers will further increase demand for copper, with estimates of up to 1 million tons by 2030.[4] The expected demand for copper is so great that estimates indicate the world will require more than twice the copper that has ever been produced between 2023 and 2050.[5]

Who Are the Leading Copper-Producing Companies?

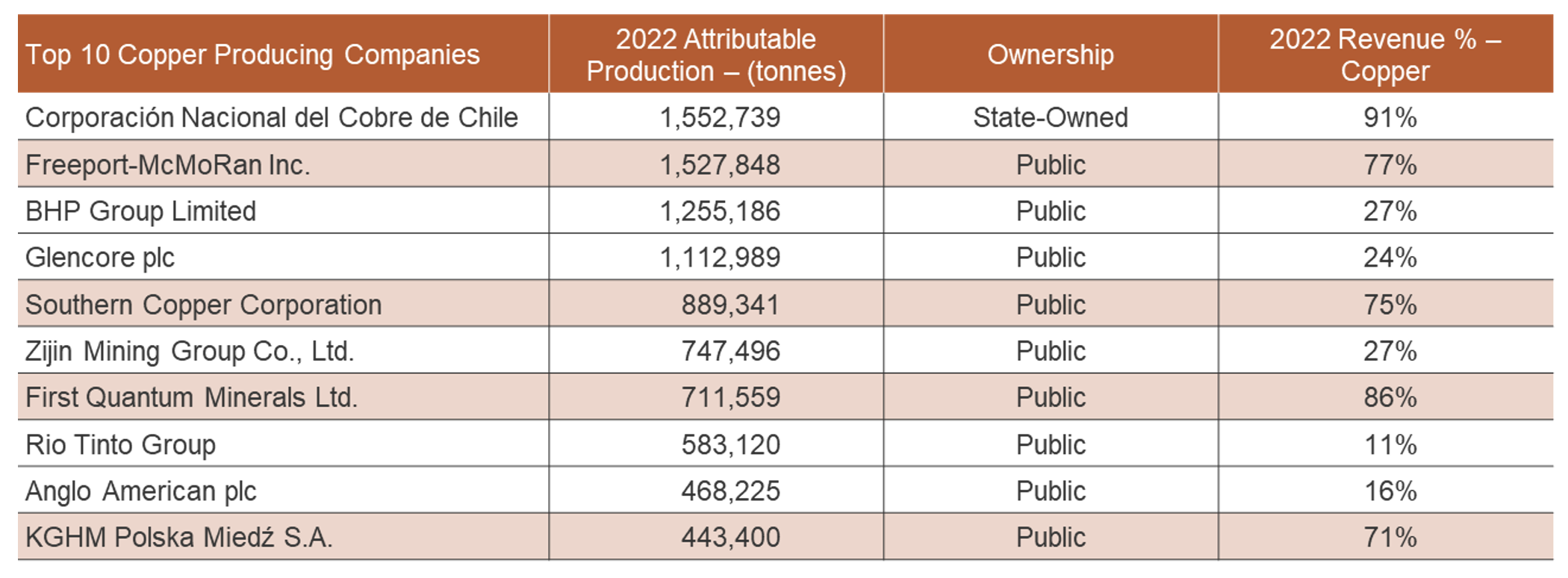

Copper miners may be either pure-play or diversified miners. We define pure-play copper miners as companies that have at least 50% of their revenue or assets dedicated to mining copper. Conversely, diversified miners do not meet the 50% threshold, and though they may be a leading copper producer, copper mining may be a relatively small part of their overall business. For example, Rio Tinto Group is a top-10 copper-producing company. Yet, revenue from copper makes up about 11% of the company's revenue and is dwarfed by its revenue from the production of iron ore and aluminum. When it comes to producing copper, only four of the top ten copper-producing companies are majority copper miners and publicly listed.[6]

Source: S&P Capital IQ, Bloomberg and company financial statements. Data for 2022. Included for illustrative purposes only.

Highlighted companies have over 50% revenue exposure to copper and are publicly listed.

Investing in Copper Miners

Investing in individual copper miners may not be as straightforward as investing in other areas of the market. Copper miners span the market capitalization spectrum from micro-cap to large-cap. Companies that are lower in market cap and generally focused on exploration are referred to as “junior miners,” while “senior miners” have established mining operations and larger market capitalizations.

Copper miners are domiciled around the globe, potentially making it more difficult for some investors to access many individual companies directly. Adding to the investment complexity is the fact that each mining jurisdiction comes with its own unique challenges related to supply chains, regulations and social considerations, which may vary greatly among countries. Investors may also have a low tolerance for the potential lack of liquidity in some junior miners and may benefit from a more diversified approach. These challenges are just a few of the reasons why we believe most investors seeking copper exposure may benefit from a diversified approach that focuses on selecting pure-play copper miners.

Important Information

This article is intended solely for the use of Sprott Asset Management USA, Inc. for use with prospects, investors and interested parties. Investments, commentary and statements are unique and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc., Sprott Asset Management LP, Sprott Inc., or any other Sprott entity or affiliate. Opinions expressed in this presentation are those of the presenter and may vary widely from the opinions of other Sprott-affiliated Portfolio Managers or investment professionals.

The intended use of this material is for information purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice, since such advice always requires consideration of individual circumstances.

Generally, natural resources investments are more volatile on a daily basis and have higher headline risk than other sectors, as they tend to be more sensitive to economic data, political and regulatory events, as well as underlying commodity prices. Natural resource investments are influenced by the price of underlying commodities such as oil, gas, metals, coal, etc.

The investments discussed herein are not insured by the FDIC or any other governmental agency and are subject to risks, including a possible loss of the principal amount invested.

Past performance is not indicative of future results.

© Sprott 2024

[1] Source: “Critical Minerals Market Review”, International Energy Agency (IEA), July 2023.

[2] Source: IEA World Energy Outlook 2023 Stated Policies.

[3] Source: The role of critical minerals in clean energy transitions, IEA, May 2021.

[4] Source: “AI could add one million tons copper demand by 2030 says Trafigura,” Reuters, April 8, 2024.

[5] Sources: ENERGYminute, March 17, 2023; “Estimating Global Copper Demand Until 200 with Regression and Stock Dynamics,” Science Direct, May 2018; “How Much Copper Has Been Found in the World?,” USGS, 2024; “The Role of Critical Minerals in Clean Energy Transitions,” International Energy Agency (IEA), March 2022.

[6] Source: S&P Capital IQ, Bloomberg and company financial statements. Data for 2022. Included for illustrative purposes only.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.