A lot of good things have happened at ConocoPhillips (NYSE: COP), but none of them matter much because of one overriding issue. If you are trying to build a million-dollar portfolio, this energy giant could help you get there. But you won't want to go all-in on this stock.

Good things are happening at ConocoPhillips

At the end of May 2024, ConocoPhillips announced that it was planning to buy Marathon Oil. The deal was fully consummated last week. From a big-picture perspective, that was pretty solid execution with regard to closing a big acquisition.

Image source: Getty Images.

But the benefits of the Marathon Oil purchase are many. For starters, it lifted ConocoPhillips into the top tier of U.S. oil and natural gas producers -- it's now in third place, production-wise. The combined business also has the second-largest inventory of land to develop in the future. And all of the resources that ConocoPhillips added have a fairly low average cost of around $30 per barrel of oil. Taken as a whole, it seems like a pretty solid deal. At this point, ConocoPhillips will get 60% of its production from the 48 contiguous U.S. states, with the rest coming from Alaska and foreign countries.

Those are not the only positives for investors here, however. When ConocoPhillips announced its Marathon Oil purchase, it also stated that it would increase its dividend dramatically and boost its share buybacks after the deal closed. When the energy company announced third-quarter earnings, it also hiked the dividend by 34% and upped its share buyback authorization to $20 billion (going from roughly $5 billion a year to roughly $7 billion), effectively living up to its promises.

It would be understandable if investors saw all of these positives and thought about adding ConocoPhillips to their portfolios, perhaps hoping that stock gains would follow. Yet ConocoPhillips stock is now more than 15% below its 52-week high, and the reason why is pretty simple.

ConocoPhillips is still an energy company

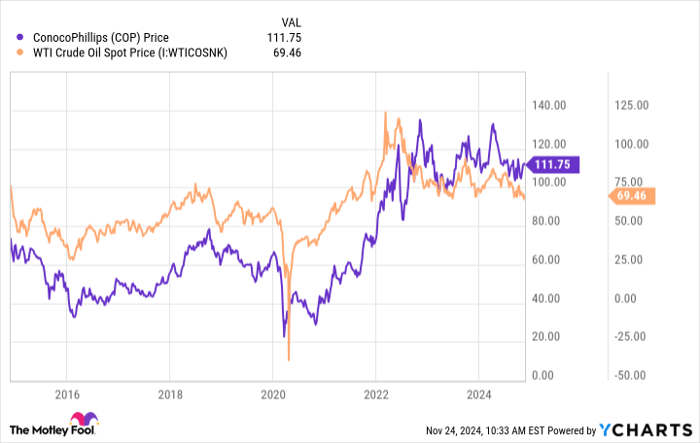

No matter how much good news there is on the operating front at ConocoPhillips, it can't escape the basic nature of the energy business it operates in. As an upstream company, it produces oil and natural gas -- commodities that are subject to swift and often dramatic price swings. The price of West Texas Intermediate (WTI) crude, a key U.S. oil benchmark, has been heading lower since April. And, thus, ConocoPhillips' stock price has been heading lower, too. It's almost as if the Marathon Oil acquisition didn't matter to investors.

As the chart above reflects, ConocoPhillips' stock price moves generally track the price of oil over time. There's really nothing that the company can do about that because the prices of oil and natural gas basically determine its revenues and earnings. Though it increased production by 3% year over year in the third quarter, a 10% drop in the company's realized price resulted in earnings falling roughly 18% year over year. That's just par for the course in the energy patch.

This is where investors trying to build million-dollar portfolios need to step back and think about what ConocoPhillips actually offers as an investment. It has been executing fairly well, and that could make it an interesting addition to a diversified portfolio. Effectively, it provides exposure to a key industry (energy) to which most investors should probably have exposure. But that industry is volatile, and most investors should tread carefully around it, limiting the money they allocate to the energy sector so that an industry downturn doesn't wipe out their portfolios.

Buy ConocoPhillips, but buy with a hint of caution

There's nothing inherently wrong with ConocoPhillips. In fact, there are a lot of good things happening at the company right now. But it's still an energy company and the energy sector is inherently volatile. Good company-specific news isn't enough to overcome that. Yes, ConocoPhillips could help you grow your wealth, but the best way to invest in the stock would probably be to make it one modest part of a diversified portfolio. Simply put, if you bet the house on ConocoPhillips you could end up losing that house. That's a risk that most investors won't want to take.

Should you invest $1,000 in ConocoPhillips right now?

Before you buy stock in ConocoPhillips, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ConocoPhillips wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $869,885!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 25, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.