Comparing Apples to Apples

We’ve been talking about how hard it is to compare market quality when how stocks trade depends much more on things like their size, liquidity, sector and earnings growth, rather than market microstructure.

However, there is one place where we can compare apples to apples – and that’s when a stock switches from one listing exchange to another.

Then, we don’t need to “control” for all the other variables, as it’s the exact same stock in two different marketplaces – with just a switch happening overnight – making most pre-and post-periods also comparable.

The results are revealing.

Looking at listing switches intraday

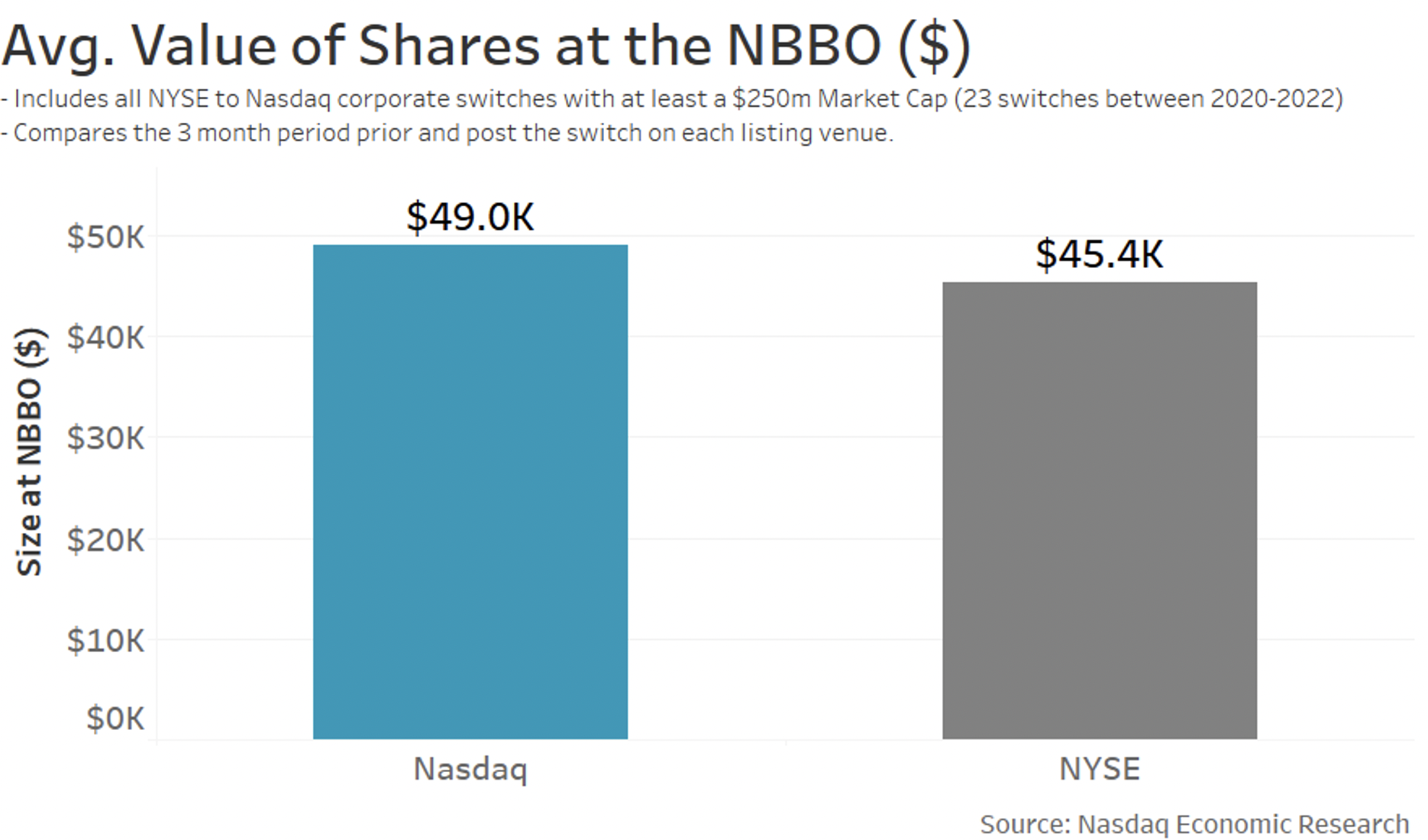

Depth, representing the value of shares at the best prices, is important. It helps large investors execute trades faster and with less impact, allowing them to own more of a company’s stock.

When we look at the depth on the NBBO, [PM1] before and after a switch, we see that Nasdaq primary listings have around 8% more depth.

Chart 1: Switching to Nasdaq increases depth by 8%

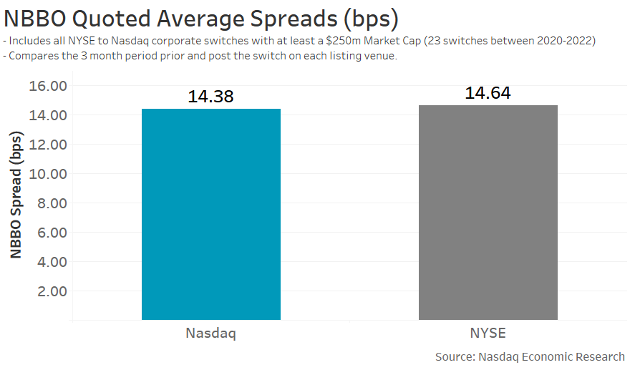

Spreads are also important to investors, as they represent the cost of executing a trade immediately.

Spreads are even important for algos that work orders, trying to capture spread, because large investors need to accumulate positions and can’t always afford to wait. Research suggests even patient algos end up crossing spreads more than they capture them.

The data shows that spreads improve around a quarter of a basis point after switching to Nasdaq. With total trading costs of institutions estimated at $70 billion per year, those small spread savings can still add to millions of dollars in additional investor returns.

Chart 2: Switches to Nasdaq see spreads get cheaper

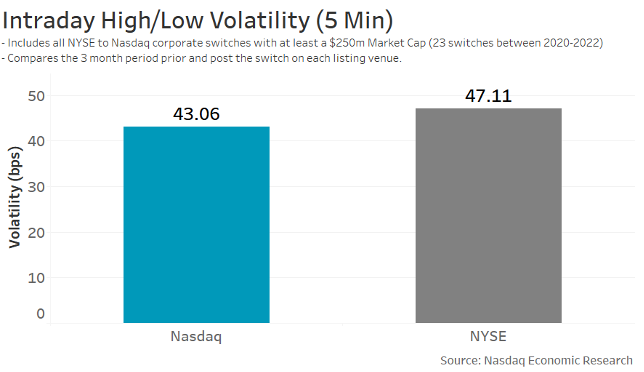

With more liquidity and tighter spreads, you would expect a stock’s volatility to decline, as the same flow of orders should cause prices to move less often and less dramatically when they do.

The data suggests that’s true. Looking at the high/low ranges over the day, in 5-minute buckets, we see a stock’s volatility almost 9% lower.

Chart 3: Nasdaq is also less volatile intraday (looking at 5-minute trading windows)

Why would this happen?

We have talked before about how Nasdaq’s markets treat all market makers more equally, which we think attracts more liquidity providers and grants fairer competition for their quotes.

This data seems to confirm that’s working – with more depth, tighter spreads and lower volatility on the same stocks after they switch to a Nasdaq primary listing.

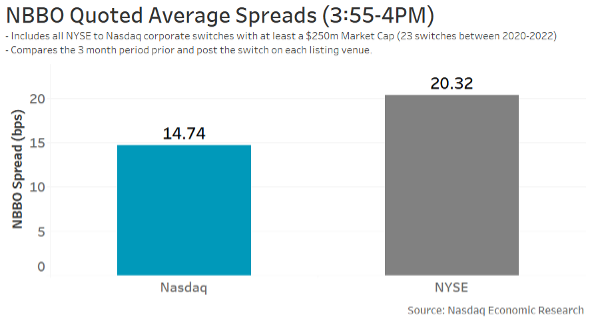

Looking at listing switches into the close

The closing auction is a very important facility for issuers and investors.

- Investors find a large source of liquidity, often between 5%-10% of the whole day’s volume, in the closing auction.

- Investors also use the closing auction to price mutual fund cashflows, measure risk and tracking error, as well as help decide when stocks look historically cheap to buy.

- Issuers are also concerned about the closing auction efficiency, and the close is used for most volatility calculations of their stocks.

It follows that establishing a robust closing auction is important for maximizing investor returns and minimizing costs of capital.

Looking at the data on our switches, we see that spreads on stocks that switch to a Nasdaq listing are much tighter (almost 30% lower) leading into the close. We think our more predictable and transparent closing auction likely helps market makers to confidently provide liquidity into the close, which is something academic studies support.

Chart 4: Switches to Nasdaq have spreads that are much tighter leading into the close

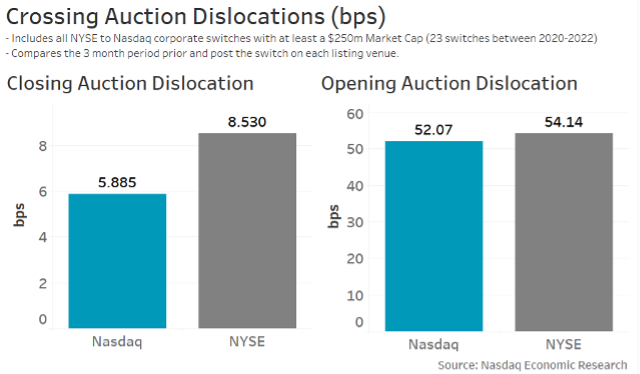

Given how much price discovery happens during the day, it makes sense that the close price fairly similarly reflects the valuation of each stock right before the close. However, closing dislocations are difficult to completely eliminate. As the data shows, large orders are sometimes added to the close, which give the market very little time to adjust to the additional supply or demand required. That supply and demand surprise can impact prices, although arguably the actual market impact (for such large trades) is relatively small.

Because of Nasdaq’s more predictable close and different order types that focus on lowering volatility in the close and firming up matched liquidity, we see that the difference between the last “continuous” trading prices and the close price is smaller for stocks that have switched to Nasdaq.

Chart 5: Switches to Nasdaq have less closing price dislocation

Our earlier research shows how quickly the market accounts for new imbalance information and order submission cutoffs. However, the times and rules for Nasdaq and NYSE to send imbalance news, and cut-off order submissions, are different. Importantly, by 3:55 p.m., all imbalance messages are being disseminated at a greater frequency and contain more relevant information, including imbalances of closing D-Orders on NYSE. So, when we compare the difference in closing auction price dislocation between Nasdaq and NYSE, we compared the closing auction price to the average volume-weighted price (VWAP) in the last 5 minutes of trading (3:55-4 p.m.).

A smaller difference between the two prices (continuous trading VWAP and the close) would reflect greater price stability and predictability heading into the close, which is what is seen in Chart 6 following the switch to Nasdaq.

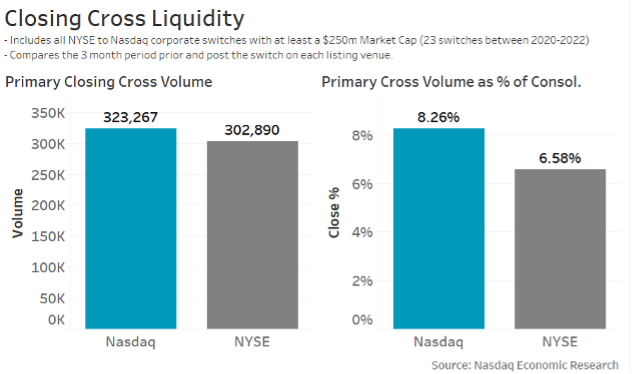

Comparing close liquidity

Closing cross volumes are also important, as they are an important source of liquidity, which allows investors to build larger positions in the companies they like.

Our data shows that companies that switch to Nasdaq see almost 7% more liquidity in the close. Investors and traders seem to trust the Nasdaq close more, too, as the close volume — as a proportion of all trading — also increases by more than 25%.

Chart 6: A switch to Nasdaq sees more liquidity on close too

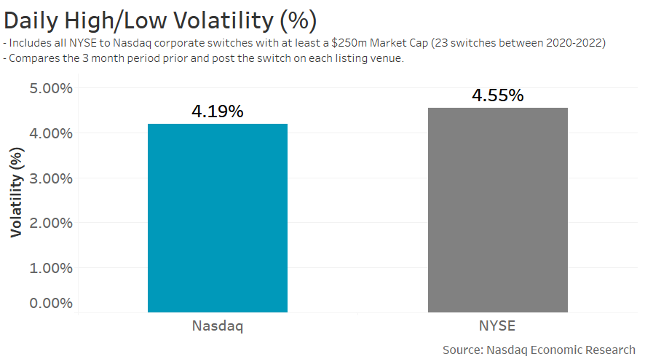

Looking at listing switches volatility

The range that a stock trades in over the whole day is another measure of volatility and trading impact. We see that this measure of volatility also falls by around 8%. That indicates that trading large orders signal less, making those trades less expensive for institutional investors.

Chart 7: Helping to make Nasdaq listings less volatile

Switching to Nasdaq is good for stocks and investors

This comparison of the same tickers around a switch from one primary listing to the other offers the best “apples to apples” comparisons yet. The distortions from the sector, market cap and single stock effects are all eliminated.

The results are compelling. Stocks listed on Nasdaq trade better – during the day and in the close. That reduces costs and volatility, which makes a switch good for investors and for issuers.