Coinbase Company Overview

Zacks Rank #2 (Buy) stock Coinbase Global (COIN) operates the largest crypto exchange in the United States by trading volume. Coinbase benefits from global crypto adoption with its widespread sweet of unique crypto offerings.

After COIN debuted during the “crypto winter” of 2021, shares suffered amid falling crypto prices and the demise of its largest competitor, FTX. However, the company’s shares and fundamentals are rebounding rapidly amid widespread global crypto adoption, innovations, and a robust balance sheet. Below are some reasons why the momentum in Coinbase will continue.

Coinbase Inks Apple Pay Partnership

A significant roadblock in the crypto industry has been converting fiat currency into crypto seamlessly. Monday, Coinbase announced an initiative to smoothen the process. The Coinbase website wrote, “Today, we’re excited to announce the launch of Apple (AAPL) Pay for all fiat-to-crypto purchases via Coinbase Onramp, the easiest tool to build onramps into your existing products.”

Earlier this year, Coinbase also announced a strategic partnership with payment giant Stripe to “expand global adoption.” The Stripe and Apple deals represent a landmark moment for Coinbase, which appears to be the de facto choice for legacy payment giants. These deals put COIN in the poll position to take advantage of further global crypto adoptions.

SEC Changes Benefit Coinbase

Coinbase arguably benefits from the Donald Trump presidential victory more than any other stock on Wall Street. President-elect Trump announced during his campaign that he plans to fire Securities and Exchange head Gary Gensler on day one. Gensler has been enemy number one of COIN because he has failed to provide regulatory clarity to Coinbase on whether certain assets should be treated as securities or commodities.

Alt Coins Soar Amid Regulatory Clarity

Though Trump has yet to step foot back in the White House, investors are bidding up “alt coins” with vengeance in an effort to discount the future. For instance, Ripple (XRP), a crypto locked in legal battles for years, is up more than 300% since the election.

Image Source: TradingView

The robust price action and flurry of volume are major catalysts for Coinbase which charges hefty commissions, ranging between 0.5% to 4.5% depending on the coin.

Mass Crypto ETF Adoption

Thus far, the performance and flows into Bitcoin ETFs such as the iShares Bitcoin Trust ETF (IBIT), Fidelity Wise Origin Bitcoin ETF (FBTC), and ARK 21 Shares Bitcoin ETF (ARKB) have been unprecedented. The company stands to benefit Because Coinbase acts as the custody servicer for most crypto ETFs. Meanwhile, COIN may benefit further as public companies like Semler Scientific (SMLR) and Rumble (RUM) look to mirror MicroStrategy’s (MSTR) wildly successful “Bitcoin Standard.”

Bull Flag Pattern & Bullish Call Flow

After breaking out on election day, COIN shares are coiling in a picture-perfect bull flag pattern. Meanwhile, heavy-handed, long-term-focused call option buyers continue to enter the market, providing conviction to the current chart pattern.

Image Source: TradingView

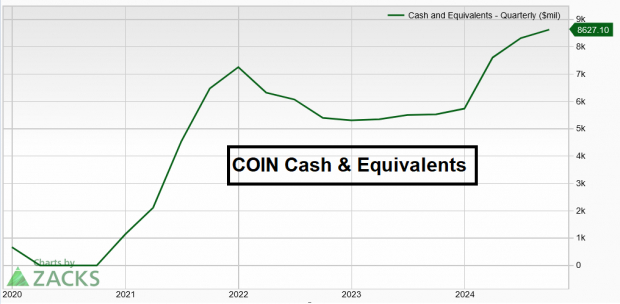

COIN Sports Strong Balance Sheet

Coinbase boasts a sparkling balance sheet and a growing cash hoard despite the crypto industry’s “Wild West” reputation.

Image Source: Zacks Investment Research

Bottom Line

Coinbase is the true market leader in the crypto industry. The stock should benefit from global crypto adoption, strategic partnerships, and a strong balance sheet.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Apple Inc. (AAPL) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Rumble Inc. (RUM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.