By Goran Damchevski

This article was originally published on Simply Wall St News

Besides financial performance, there are some other factors that drive the quality of stocks, such as shareholder ownership structure, top shareholders and governance structure. Upon examining Clover Health Investments, Corp. (NASDAQ:CLOV) we will turn to these factors and see what they can tell us about the foundation that drives this company.

Shareholder Ownership Breakdown

Clover Health Investments has a market capitalization of US$3.6b, so it's too big to fly under the radar and there is a good chance that big and small investors have already noticed the company and have made decisions on joining as shareholders.

Let's take a closer look to see what the different types of shareholders can tell us about Clover Health Investments.

Check out our latest analysis for Clover Health Investments

The general public is by far the largest shareholder group in Clover, with a 38% stake in the business. This means that retail investors ascribe the most value to the company. This could imply a lack of interest from other groups, or that the larger stake was driven by catalysts such as Subreddits and news.

Individual insiders own some 28% of the company. This suggests that insiders maintain a significant holding in Clover Health Investments, Corp. It has a market capitalization of US$3.6b, and insiders have US$1.0b worth of shares in their own names.

The company's CEO Vivek Garipalli is the largest shareholder with 20% of shares outstanding. For context, the second-largest shareholder (Greenoaks Capital Partners LLC) holds about 18% of the shares outstanding, followed by an ownership of 5.0% by SCH Sponsor III LLC.

It is good to see insiders holding a sizeable portion of the company. This implies both skin in the game from management and trust that the company still has a lot of future potential.

With a stake of 18%, private equity firms could influence the Clover Health Investments board. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time, they may look to sell and redeploy capital elsewhere.

We can see that Private Companies own 5.0%, of the shares on issue. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies.

Institutions do not have sizeable portions of the company. Their stake hoovers around 10.5%. This means that they may still find the company to be risky and would wait a bit more before jumping on-board. Or that the current price is more than their estimate of the value of Clover.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

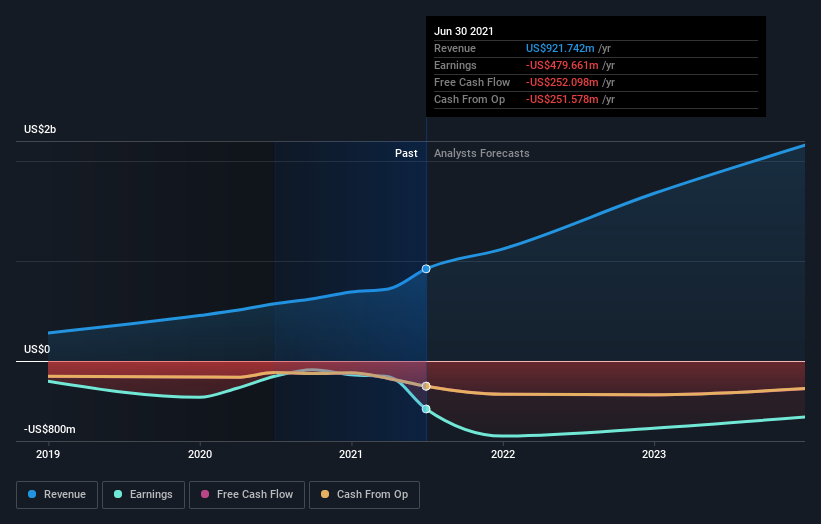

By looking at the financial performance, we can see that Clover is in the beginning of its growth phase and may need to gain a bit more traction before the institutions join in. It is hard to see when the company will turn profitable, and we are just testing out the first iterations of Clover's business.

With a revenue of almost $1 billion and a Market Valuation of $3.6b, it is possible to see that the company has upside potential as long as it delivers organic growth and client satisfaction.

It would also be wise to analyze the balance sheet, because it seems that Clover will need a substantial cash supply in order to fund growth, while operating at a loss. Even though the risk of liquidation is fairly low, the appearance of distress and funding issues can set the development back a fair bit.

Governance

The job of the board of directors is to oversee management. This means holding the CEO and other members accountable, and making sure that their activities are aligned with the interests of shareholders.

As investors, we want to see Clover have an independent and effective board of directors.

We can find the current structure of the board here.

Since it is hard to quantify performance of people, we will only do some basic checks and analyze the board on a higher level. These are the items we will look at:

- Small board - Yes, Clover has a board of less than 9 people. This increases effectiveness, and it is easier for them to coordinate.

- Independence - No, Clover's CEO is also chairman of the board, and the CTO is also on. This can be a red flag for board effectiveness, because the main role of the board is to oversee management, not be a part of it. Investors are putting their faith in the capabilities and discretion of management, which has the potential to diverge from their interests.

- Focused board - No, some directors of the board have multiple positions and serve on other boards as well. This means that Clover is not "the" company they are developing, but rather "a company" they are holding.

With this rough overview, we can see that Clover health does not have an effective and independent board of directors. Investors are left relying on the competence of management and the hope that they will not diverge from the interests of shareholders.

Key Takeaways

The ownership structure of Clover suggests that institutions, a.k.a. "Smart Money" are not yet on-board. The company is large enough to have been noticed, so the absence can be attributed to estimated overvaluation or lack of trust in the business.

The company has healthy growth, but is also some ways off from profitability. This may deter investors because of fears of being too early.

The governance structure is not the best for Clover. Even though two management members are also serving on the board, investors can cut the company some slack on this point. The main problem however, is that the directors are not focused on Clover because some of them have other occupations and are serving on other boards as well.

Investors may also want to be aware of fundamental risks. We've spotted 2 warning signs for Clover Health Investments that you should be aware of before investing here.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.