By Goran Damchevski

This article was originally published on Simply Wall St News

Cloudflare, Inc. (NYSE:NET) ended the second quarter on a strong growth note. They acquired new customers and increased the services sold to their existing base.

We will take a look at the long-term predictions for the company and put their earnings into perspective.

In a bid to highlight the important developments of Q2, the Cloudflare CEO stated:

“...We also added a record number of large customers, signing the equivalent of more than two six-figure customers every single business day in Q2.”

The company reported a record second quarter result with improved revenues and control over costs. Although losses increased, this is necessary for growing companies that reinvest in their business model or further customer acquisition.

Check out our latest analysis for Cloudflare

Notes from Q2 2021 results:

- Revenue: US$152.4m, up 53% from 2Q 2020 - beating forecasts by 4.3%

- Net loss: US$35.5m, an increase of 36% from 2Q 2020 - 4.3% smaller than the analysts expected

- Strong large customer growth, with a record addition of roughly 140 large customers in the quarter, bringing the total number of large customers to 1,088

- Record dollar-based net retention of 124% (revenue growth from existing customers)

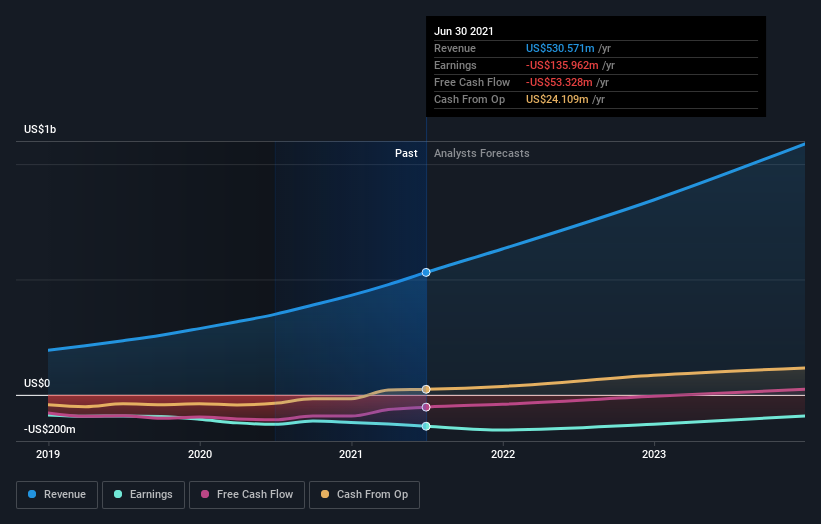

In order to put earnings into perspective, we can take a look at the larger picture, both with the financial history, and the future forecasts as estimated by analysts that follow Cloudflare.

The chart above shows that Cloudflare is in a high growth phase and still expanding their customer base. They are mostly targeting large clients from which they can derive the highest dollar amount. The operating and free cash flows are expected to break positive sooner than statutory profits, but neither of these are important as of now, since the company's main priority is to peak their large client base - a goal that requires growth and capital investments.

We thought it informative to get a better feel of the client base that Cloudflare is dealing with, and present a sample in the image below:

Future Estimates

Taking into account the latest results, the current consensus from Cloudflare's 17 analysts is for revenues of US$632.0m in 2021, which would reflect a solid 19% increase on its sales over the past 12 months. Per-share losses are supposed to see a sharp uptick, reaching US$0.51. Before this latest report, the consensus had been expecting revenues of US$614.8m and US$0.50 per share in losses.

The analysts increased their price target 20% to US$125.

Concerning the range of price targets, we observe that the most optimistic Cloudflare analyst has a price target of US$140 per share, while the most pessimistic values it at US$91.00.

The period to the end of 2021 brings more of the same, according to the analysts, with revenue forecast to display 42% growth on an annualized basis. That is in line with its 52% annual growth over the past year.

Conclusion

Cloudflare is a high-growth network security company, that is gaining even more traction and trust among large clients.

The growth rate is high, and their net retention rate is positive, indicating that they are attracting more clients and managing to sell more services to existing clients.

It will take a few more years before Cloudflare turns profitable, but that is to be expected from a company that is currently concentrated on growing their revenues and client base.

It seems that the company is providing a necessary service to clients that is hard to shake off, and even harder to mimic by competitors. This might put Cloudflare in a high barrier to entry situation in the future, giving them stable earnings in the long term.

Analysts upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. There was also a nice increase in the price target.

One major risk factor of the company is their intrinsic value, which is hard to get right for a high growth technology company, but essential not to get too wrong, else investors will be stick waiting a long time for the company to deliver on price. Get our daily estimate of Cloudflare's intrinsic value HERE.

It is also worth noting that we have found 3 warning signs for Cloudflare that you need to take into consideration.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.