Clean Energy and Smart Grid Infrastructure: Industry Report and Investment Case

A Convergence of Renewables, Energy Storage, Electric Vehicles, and Digitization is Reshaping the Energy Landscape

Defining Clean Energy

Over the past decade, clean energy has gone from niche to mainstream. Clean energy covers a range of products and services enabling the transition from fossil fuels to low- and zero-carbon sources, including:

- Renewable Energy including solar, wind, geothermal, and hydroelectric power

- Energy Intelligence products and services such as smart meters, energy management systems, and light emitting diodes (LEDs) for lighting

- Energy Storage & Conversion including advanced lithium ion batteries, inverters, and fuel cells

- Advanced Transportation such as electric vehicles (EVs) and fleet management

Defining Smart Grid Infrastructure

Smart grid infrastructure is the enabler of a 21st century electric grid. Among other things, this modern grid is more resilient to natural and human- made disasters and provides for the two-way flow of electrons (enabling customers to not only consume energy, but also produce and share it). Products and services include:

- Grid Infrastructure (Transmission Lines, Superconductors, etc.)

- Electric Meters and Smart Devices

- Energy Storage and Electric Vehicle Network Management

- Enabling Software

The past two decades have seen a significant change in how the U.S. and the world powers its homes, businesses, factories, and vehicles. At the forefront of this dramatic shift has been the growth of renewable energy (primarily solar and wind), the recent rise of energy storage and EVs, and the advent of smart and connected electric grids.

Technology, capital, and policy-related developments driving this significant change, include:

- Declining Costs: Utility-scale wind and solar power are now the most cost-effective forms of new electricity generation, beating out new nuclear, coal, and even natural gas plants. Technological innovation has enabled entirely new economies of scale for renewable sources, unthinkable by most market players just a decade earlier.

- Investment Shift from Fossil Fuels to Clean Energy and Smart Grid: Global investments in clean energy (renewables to energy smart technologies) expanded from $64 billion in 2004 to $334 billion in 2017, according to Bloomberg New Energy Finance. By comparison, just $103 billion was invested in new fossil fuel (coal and natural gas) generators globally last year.

- Electrification of Everything: With energy storage and electric vehicles now experiencing cost declines similar to renewables, the concept of the “electrification of everything” is emerging. This means that electricity is poised to replace fossil fuels not only for power generation, but also transportation. Underlying this trend is the digitization of energy, from smart meters to connected devices, and the smart grid backbone that supports it.

- Low Carbon Policies: Both national and subnational governments have signed commitments to reduce their carbon footprints. While President Trump has noted his intention to withdraw the U.S. from the Paris Climate Agreement, the U.S. will not officially pull out until after the next presidential election. Regardless, policies that support renewables and clean transportation are playing out from China and Denmark to states like Hawaii and California, including renewable portfolio standards (up to 100% targets in some cases), energy storage mandates, and incentives.

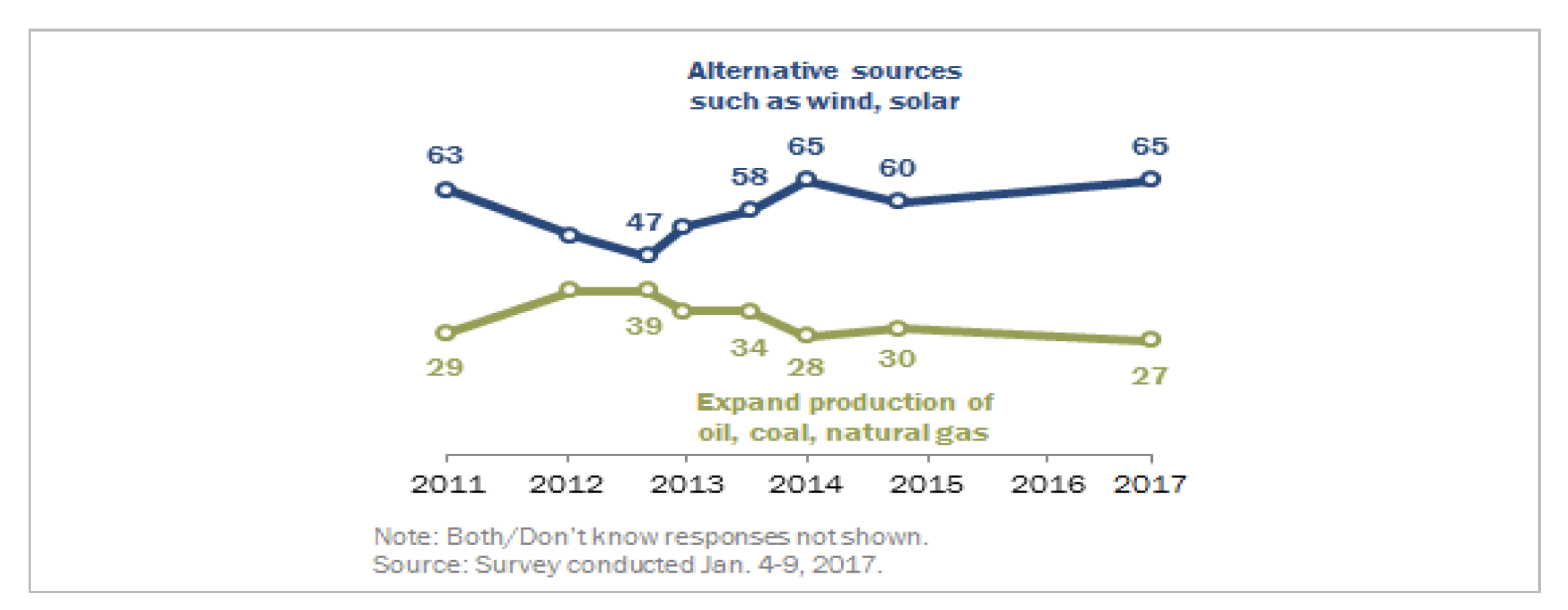

- Public Demand: The demand for low-carbon sources of energy is not only coming from governments, but also from corporations and individuals. A 2017 Pew Research Center survey finds that 65% of Americans give priority to developing clean energy sources, compared with 27% who would emphasize expanded production of fossil fuel sources (with both Democrats and Republicans favoring clean energy). In addition, more than 150 multinational corporations have now committed to getting 100% of their electricity from renewables as part of the RE100 campaign (a collaborative, global initiative uniting businesses committed to 100% renewable electricity) – driving significant growth of clean-energy generation and the connected grid.

Most In U.S. Give Priority To Developing Alternative Energy Over Fossil Fuels

% of U.S. Adults Who Say_____ Should Be The More Important Priority For Addressing America's Energy Supply

Economics and The Rise of Clean Energy

As noted earlier, solar and wind power are now the most cost-effective forms of new electricity generation in many regions – beating out coal, nuclear, and even natural gas. Lazard, a financial advisory and asset management firm which has been tracking the levelized cost of energy (LCOE) for more than a decade, has research that shows that the LCOE for wind declined from $135 in 2009 to just to $42 per megawatt hour (MWh) in 2018. Similarly, utility scale solar declined from $359 to $43 per MWh over the same time frame. As a result, 2017 marked the third year in a row where wind and solar both cost less than natural gas combined cycle power generation. And both coal and nuclear were above the $100 per MWh range, making them approximately two to three times the cost of new solar and wind on a levelized cost basis.

This reversal of fortune, with once low-cost fossil fuel generated electricity now more expensive than renewables, has seen the rapid adoption of both new solar and wind. In the U.S., for example, solar and wind experienced compound annual growth rates of 31.8% and 26.3% respectively between 2000 and 2016, while coal declined 2.9% annually over the same time period, according to data from the U.S. Energy Information Administration. From a percent of total generation, Coal declined from 51.4% share in 2000 to 29.6% in 2016, compared to wind’s increase from a 0.1% share in 2000 to 5.4% in 2016.

At the state level, the rise in renewable energy sources is even more dramatic. Back in 2010, just three states received 10% or more of their in-state electricity generation from non-hydro utility-scale renewables (solar, wind, and geothermal). By 2016, 17 states joined the 10% club with three states (Iowa, South Dakota, and Kansas) getting 30% or more of their electrons from utility-scale wind. Another three states exceeded 20% non-hydro utility-

scale renewables generation (Oklahoma, California, and North Dakota). Perhaps demonstrating the non-partisan nature of clean energy, these state leaders were politically diverse with the top 10 states for renewable electricity generation including five red states and five blue states.

Adoption of low-cost, low-carbon energy solutions have seen a similar uptick globally. Between 2010 and

2016, global average annual net capacity additions were led by renewables, according to data compiled by the International Energy Agency (IEA) in their World Energy Outlook 2017. Between 2017 and 2040, the organization projects that annual net capacity additions from renewables will equal more than those from coal, gas, and nuclear combined.

Smart Grid Infrastructure: The Great Enabler

Unlike computer technology, which saw the number of transistors crammed onto computer chips double every 18-24 months for more than 50 years (Moore’s Law) and the dramatic move from large mainframe computers to today’s smart phones, the electric grid’s underlying technology has remained relatively constant. In fact, more than a century after its invention, early grid innovators such as Thomas Edison and Nikola Tesla would still be familiar with much of today’s grid technology. This has offered great reliability and consistency, and until recently, grid operators were wary of messing with a system that has been ranked as one of civilization’s greatest engineering achievements. But with the dawn of the always-on digital internet-driven era, along with the recent upsurge in demand for low-carbon energy sources and greater resiliency to counter natural and human-made disasters, the grid is now experiencing its own technological renaissance.

This new emerging grid is being built through advances in big data, artificial intelligence, distributed networks, and other technologies, enabling the digitization of the electric grid. A host of relatively recent innovations, from demand-side management and smart meters to blockchain-enabled energy trading networks and microgrids, are changing the grid from a centralized network to a nodal one, with a myriad of connected devices. It is creating a distributed ecosystem of “prosumers” who can sell their surplus energy (whether produced onsite or stored in a battery pack), as well as buy from sources across the network.

In Texas, for instance, retail electricity provider Direct Energy, along with LO3 Energy, has launched a blockchain- enabled platform that once implemented promises to allow customers of all sizes to engage in real-time energy transactions with a range of energy providers (from large wind farms and distributed solar panels, to microgrids and aggregated demand-side management from multiple users). Smart meters, which support these type of functions, can also help provide greater customer insights, pinpoint outages, and better manage electrons overall. In recent years, smart meter deployment has climbed to 30 percent penetration globally, and is projected to reach 53 percent by the end of 2025, according to Navigant Research.

As a result, distributed energy, electric vehicles, and energy storage are poised to dramatically rewire the electric grid, much like cell phones did for the telecommunications system. We are moving beyond siloed technologies and into a new age where it’s the interplay of technologies that matter. Technology mash-ups such as rooftop solar

+ energy storage, wind turbines + offshore platforms, and microgrids + blockchain-enabled trading networks are becoming the norm. Helping investors understand these meta trends and track the growing connections between diverse companies and industries is the goal of the Nasdaq-Clean Edge clean energy and smart grid infrastructure indexes.

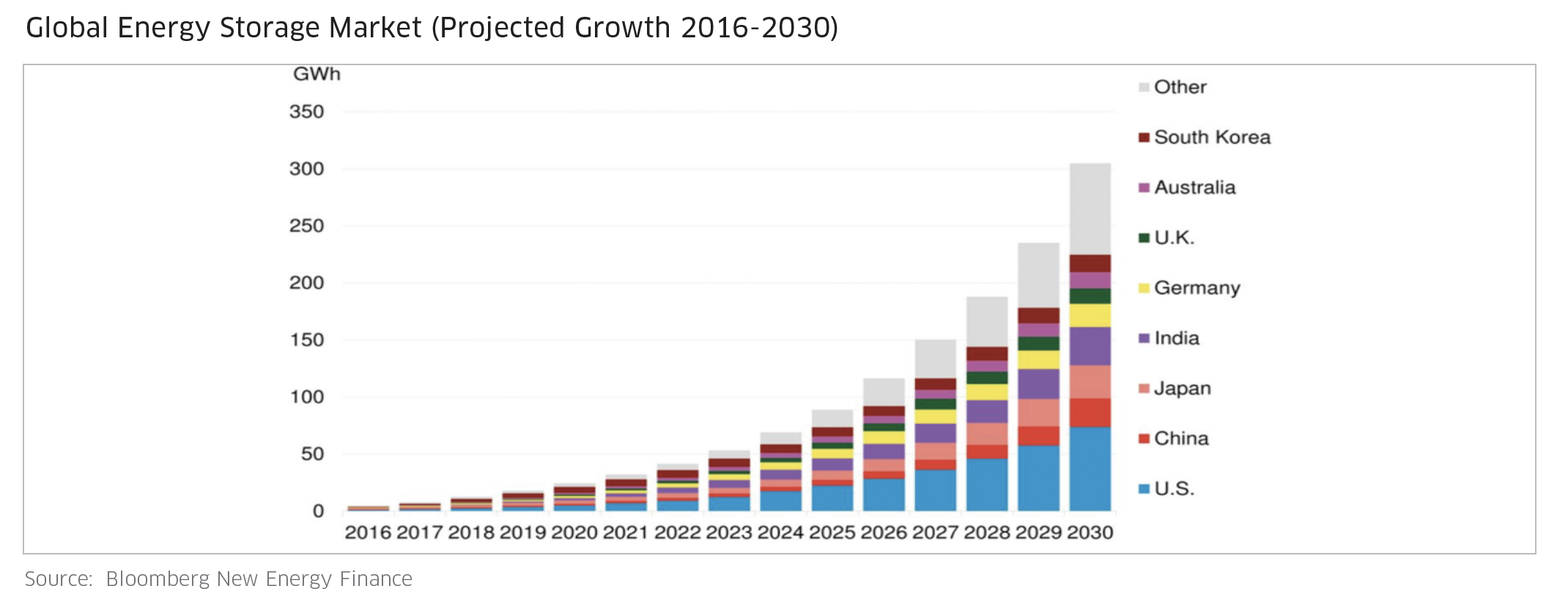

Energy storage, for example, is about to experience growth rates similar to the expansion of the solar photovoltaic market over the past 15 years (where solar PV installations doubled seven times). Bloomberg New Energy Finance projects that the size of the global energy storage market will double six times by 2030, expanding from just under 5 gigawatt-hours in 2016, to more than 300 gigawatt-hours (equaling 125 gigawatts of capacity) by 2030. An estimated $103 billion will be invested in energy storage over this time period.

Electric vehicles are on a similar growth curve. Between 2011 and 2017, global sales of electric vehicles increased from just 52,000 to more than 1 million annually. Bloomberg New Energy Finance projects that EV sales will expand from a record 1.1 million sold worldwide in 2017 to 11 million in 2025 and 30 million in 2030. China is projected to lead the way. Bloomberg estimates that Chinese EV sales will account for almost 50% of the global EV market in 2025 and 39% in 2030. The city of Shenzhen, for example, recently converted its entire fleet of 16,359 buses to battery-operated vehicles. This makes it the largest electrified bus fleet in the world and outnumbers the size of the non-electric bus fleets of such major cities as New York City and Toronto. Shenzhen has now set its eyes on electrifying its entire taxi fleet.

Major auto manufacturers – as well as technology companies – are positioning themselves to compete in this new electrified world. Electric car innovators like Tesla and BYD have a head start, but now BMW, Ford, GM, Volvo, along with tech companies such as Google and Apple, are joining the race. This will have a significant impact on

EV charging infrastructure, autonomous drive, and charging network and grid infrastructure as vehicles move from liquid fossil fuels to electricity.

These totals include both battery electric vehicles, or BEVs, and plug-in hybrid electric vehicles, or PHEVs. They do not include conventional hybrids. RoW stands for rest of the world

Source: UN Environment, Bloomberg New Energy Finance

Investments Fuel Clean Energy and Grid Modernization

As highlighted in the introduction, Bloomberg New Energy Finance tracked global investments in clean energy equaling $334 billion in 2017, up nearly six-fold from $62 billion in 2004. In recent years, the top three areas of clean energy investment have been solar, wind, and energy smart technologies such as efficiency, demand response, energy storage, and electric vehicles (covering many of the smart grid infrastructure companies tracked and discussed here). Moving forward, investments in renewables are projected to outpace those for traditional fossil fuel-generated electricity by a significant margin. Bloomberg projects that renewable energy is set to attract nearly three quarters of the $10.2 trillion the world will invest in new power generating technology through 2040.

This represents a once-in-a-lifetime investment opportunity as corporations, governments, and other institutions shift their support from fossil fuels to clean energy, electrified transportation, and a smart, resilient 21st century grid. Nasdaq and Clean Edge’s clean energy and smart grid infrastructure indexes offer investors efficient vehicles for tracking these key sectors, both within the U.S. and globally.

How does someone track the Clean Energy and Smart Grid Infrastructure sectors?

Now that we have covered clean energy and smart grid infrastructure sectors in great detail, the following sections of this piece will review the two Nasdaq Clean Edge indexes (and the respective First Trust ETFs tracking them).

NASDAQ CLEAN EDGE GREEN ENERGY TOTAL RETURN INDEX (CEXX)

The Nasdaq Clean Edge Green Energy Index is a modified market capitalization weighted index designed to track the performance of companies that are primarily manufacturers, developers, distributors and/or installers of clean energy technologies, as defined by Clean Edge. The Index began on November 17, 2006, at a base value of 250.00. As of January 25, 2019, the index had 39 components. Investors can gain exposure to the index through the corresponding ETF which is the First Trust Nasdaq Clean Edge Green Energy Index Fund (QCLN).

Eligibility Criteria

To be eligible for inclusion issuers of the security must be classified, according to Clean Edge, as technology manufacturers, developers, distributors, and/or installers in one of the following sub-sectors:

- Advanced Materials (nanotech, membranes, silicon, lithium, carbon capture and utilization, and other materials and processes that enable clean-energy technologies);

- Energy Intelligence (conservation, automated meter reading, energy management systems, smart grid, superconductors, power controls, etc.);

- Energy Storage & Conversion (advanced batteries, hybrid drivetrains, hydrogen, fuel cells for stationary, portable, and transportation applications, etc.); and

- Renewable Electricity Generation (solar, wind, geothermal, and water power).

NASDAQ CLEAN EDGE GREEN ENERGY TOTAL RETURN INDEX (CEXX)

The table below captures performance between September 22, 2003 and January 25, 2019. We’ve started this chart a base value of 100. The Nasdaq Clean Edge Green Energy Total Return Index hit its peak price on December 26, 2007, at 189.45. From Q4 2016 to Q1 2018, the index experienced a nice run-up in performance and subsequently declined in October and December along with the market. The Index then recovered to a significant level as of January 25, 2019 compared to the market low in December 24, 2018. Across the entire 15+ year period, the cumulative return was 22.39%.

CEXX vs ECOTR Index: November 30, 2007 – January 25, 2019

The following includes a comparison of the Nasdaq Clean Edge Green Energy Total Return Index (CEXX) and the Wilderhill Clean Energy Total Return Index (ECOTR). Shown here are performances of each index since just before the financial crisis (November 30, 2007) to current (January 25, 2019). As can be seen in the chart and table shown, the Nasdaq Index has greatly outperformed cumulatively.

CEXX vs ECOTR Index: Annual Performance (2008 – 2019 YTD)

Below is a breakdown of annual performance. On an annual basis, the Nasdaq Index outperforms in most periods. The largest outperformance of CEXX vs ECTOR was in 2013 at 30.82%, followed by 2016 (19.35%). The top performing years for CEXX were 89.33% (2013), followed by 44.72% (2009). The worst performing year for CEXX was in the heart of the financial crisis, in 2008, same for ECOTR. Returns for CEXX in 2008 were -63.44% and they were -69.89% for ECOTR.

ICB Industry Allocations Comparison: January 25, 2019

As of January 25, 2019, the Nasdaq Clean Edge Green Energy Total Return Index (CEXX) has a much larger allocation in Technology (18%) when compared to the Wilderhill Clean Energy Index (6%). It also has a much smaller allocation towards Oil & Gas (15%) vs. the ECOTR Index (37%).

NASDAQ OMX CLEAN EDGE SMART GRID INFRASTRUCTURE TOTAL RETURN INDEX (QGDX)

The Nasdaq OMX Clean Edge Smart Grid Infrastructure Index is designed to act as a transparent and liquid benchmark for the smart grid and electric infrastructure sector. The Index includes companies that are primarily engaged and involved in electric grid; electric meters, devices, and networks; energy storage and management; and enabling software used by the smart grid and electric infrastructure sector. The Index began on September 22, 2009, at a base value of 250.00. As of January 25, 2019, the index had 50 components. Investors can gain exposure to the index through the corresponding ETF which is the First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (GRID).

Eligibility Criteria

To be included in the Index, a security must meet the following criteria:

- Be classified as a smart grid, electric infrastructure EV network, smart building, software, and/or other grid related activities company according to Clean Edge;

- Be listed on an index-eligible global stock exchange;

- One security per issuer is permitted;

- Have a minimum worldwide market capitalization of $100 million;

- Have a minimum three-month average daily dollar trading volume of $500 thousand;

- A minimum free float of 20%; and

- The security’s foreign ownership restriction limitations have not been met.

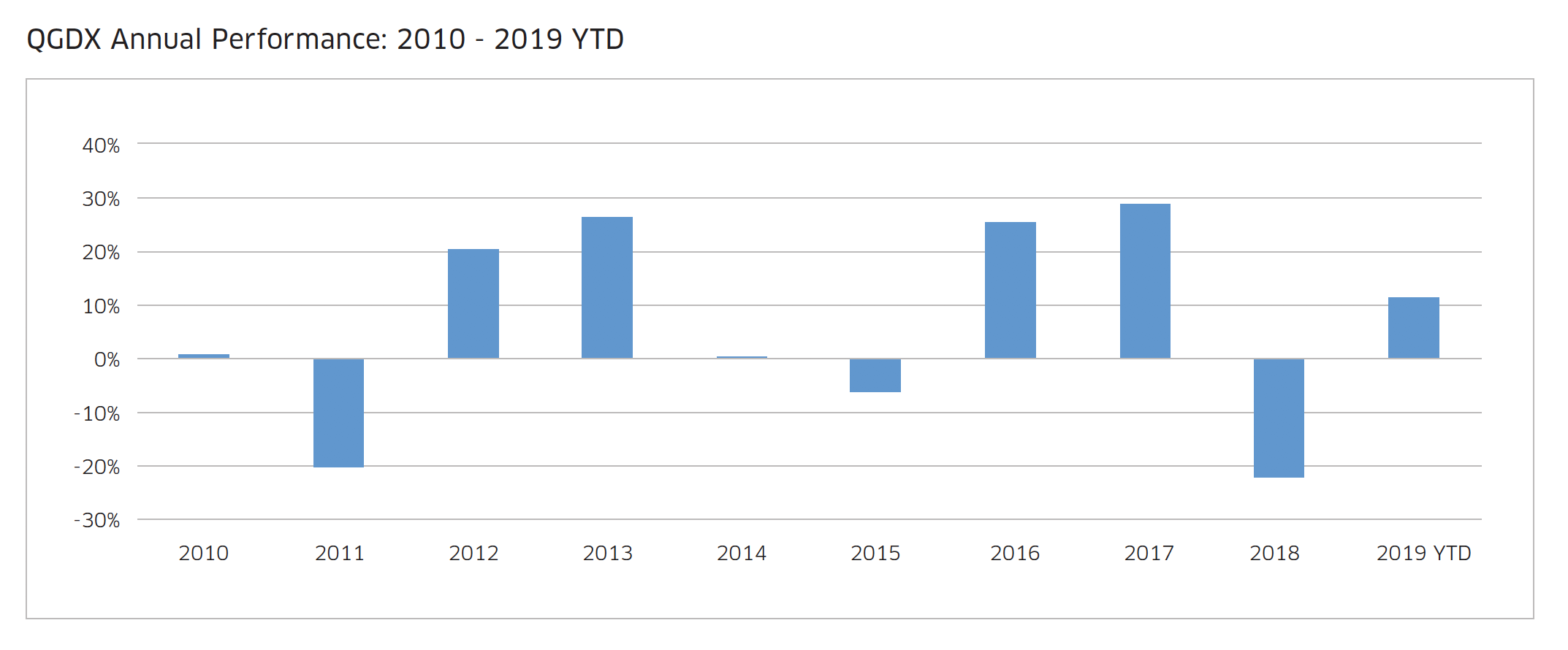

Historical Performance: September 22, 2009, to January 25, 2019

Below is a brief look at the performance of the index since inception. The index has cumulative return of 69.31%, with an annualized volatility of 18.36%. The chart shown here is based at 100 on the September 22, 2009. The Index hit its peak value of 204.97 on January 26, 2018, experienced relatively flat performance until Q4 2018, when the market declined in October and December. The Index has since recovered about 50% of the Q4 2018 losses from year-end 2018 to January 25, 2019.

On an annual basis, the top performing years were 2017 (+28.83%), 2013 (+26.15%) and 2016 (25.30%).

ICB Industry Allocations: January 25, 2019

The Nasdaq OMX Clean Edge Smart Grid Infrastructure Index has its largest allocation towards Industrials (54.81%), Technology (13.23%), and Consumer Goods (13.0%).

Conclusion

In this research piece we initially discussed how over the past decade, clean energy has gone from niche to mainstream and covers a wide range of products and services. We also noted how smart grid infrastructure is the enabler of a 21st century electric grid and supports the convergence of renewable energy, EVs, and energy storage. A number of other important points covered include:

- Clean energy, in many regions, is now the lowest cost option (less expensive than coal and nuclear, and attracting an increasing share of new capacity additions).

- Energy storage and EVs are not far behind in terms of cost reduction, following growth trajectories similar to solar over the past 15 years.A growing number of investors are shifting their focus to clean energy and smart grid technologies – driven by economics and public and private actions that support this new infrastructure. Examples of major actions include the recent decision in CA to require all new homes to have solar power along with the state’s passage of an aggressive 100% renewable electricity target by 2045, as well as decisions in China regarding massive electric vehicle adoption.

- According to Bloomberg and others, growth prospects for renewable energy remain positive moving forward.

These and other developments create unique opportunities of which investors should be aware. The NASDAQ

Clean Edge Green Energy Total Return Index (CEXX) and the NASDAQ OMX Clean Edge Smart Grid Total Return Infrastructure Index (QGDX) both provide access to companies involved in these businesses. Investors can gain exposure to the indexes through the corresponding ETFs which are the First Trust Nasdaq Clean Edge Green Energy Index Fund (QCLN) and the First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (GRID), respectively.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2019. Nasdaq, Inc. All Rights Reserved.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.