Fintel reports that on May 2, 2023, Citigroup maintained coverage of Pinduoduo Inc - ADR (NASDAQ:PDD) with a Buy recommendation.

Analyst Price Forecast Suggests 59.62% Upside

As of April 24, 2023, the average one-year price target for Pinduoduo Inc - ADR is 109.48. The forecasts range from a low of 75.75 to a high of $141.75. The average price target represents an increase of 59.62% from its latest reported closing price of 68.59.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Pinduoduo Inc - ADR is 164,407MM, an increase of 25.93%. The projected annual non-GAAP EPS is 29.94.

What is the Fund Sentiment?

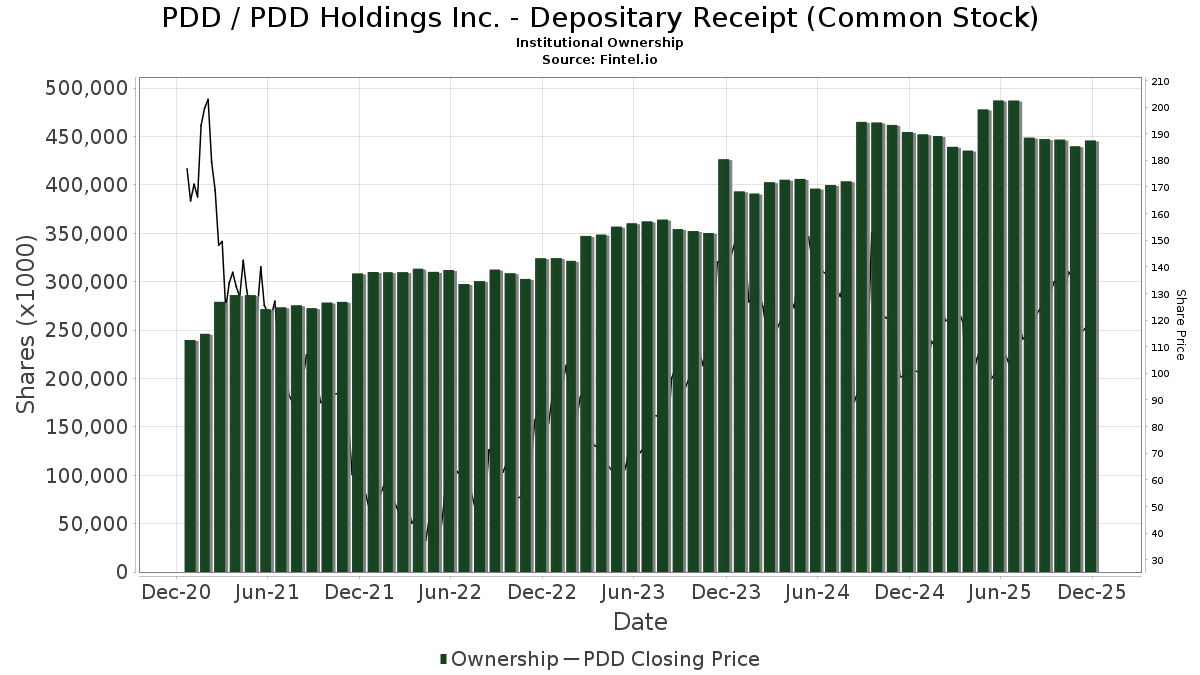

There are 837 funds or institutions reporting positions in Pinduoduo Inc - ADR. This is an increase of 93 owner(s) or 12.50% in the last quarter. Average portfolio weight of all funds dedicated to PDD is 1.29%, a decrease of 8.06%. Total shares owned by institutions increased in the last three months by 10.98% to 356,802K shares.  The put/call ratio of PDD is 0.94, indicating a bullish outlook.

The put/call ratio of PDD is 0.94, indicating a bullish outlook.

What are Other Shareholders Doing?

Baillie Gifford holds 28,626K shares representing 2.15% ownership of the company. In it's prior filing, the firm reported owning 28,211K shares, representing an increase of 1.45%. The firm increased its portfolio allocation in PDD by 33.65% over the last quarter.

IDG China Venture Capital Fund IV Associates holds 8,324K shares representing 0.63% ownership of the company. No change in the last quarter.

Goldman Sachs Group holds 8,202K shares representing 0.62% ownership of the company. In it's prior filing, the firm reported owning 5,875K shares, representing an increase of 28.37%. The firm increased its portfolio allocation in PDD by 76.14% over the last quarter.

Ubs Asset Management Americas holds 6,596K shares representing 0.50% ownership of the company. In it's prior filing, the firm reported owning 5,518K shares, representing an increase of 16.35%. The firm increased its portfolio allocation in PDD by 45.60% over the last quarter.

Invesco Qqq Trust, Series 1 holds 6,244K shares representing 0.47% ownership of the company. In it's prior filing, the firm reported owning 6,873K shares, representing a decrease of 10.07%. The firm increased its portfolio allocation in PDD by 20.34% over the last quarter.

Pinduoduo Background Information

(This description is provided by the company.)

Pinduoduo provides an online marketplace that connects millions of agricultural producers with consumers across China. Pinduoduo aims to bring more businesses and people into the digital economy so that local communities can benefit from the increased productivity and convenience through new market opportunities.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.