Fintel reports that on May 19, 2023, Citigroup initiated coverage of TPG Inc - (NASDAQ:TPG) with a Buy recommendation.

Analyst Price Forecast Suggests 31.28% Upside

As of May 11, 2023, the average one-year price target for TPG Inc - is 35.11. The forecasts range from a low of 30.30 to a high of $42.00. The average price target represents an increase of 31.28% from its latest reported closing price of 26.74.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for TPG Inc - is 1,525MM, a decrease of 0.67%. The projected annual non-GAAP EPS is 1.95.

What is the Fund Sentiment?

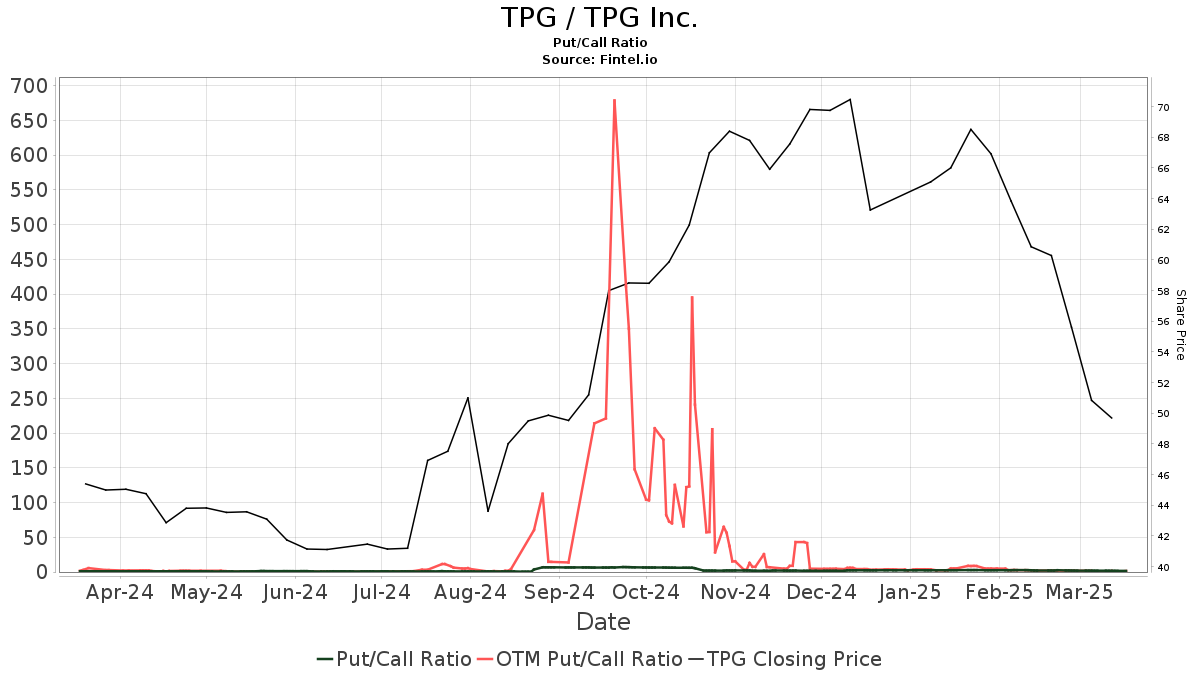

There are 221 funds or institutions reporting positions in TPG Inc -. This is an increase of 14 owner(s) or 6.76% in the last quarter. Average portfolio weight of all funds dedicated to TPG is 0.17%, an increase of 6.72%. Total shares owned by institutions increased in the last three months by 6.87% to 53,686K shares.  The put/call ratio of TPG is 2.12, indicating a bearish outlook.

The put/call ratio of TPG is 2.12, indicating a bearish outlook.

What are Other Shareholders Doing?

Temasek Holdings holds 5,220K shares representing 6.48% ownership of the company. No change in the last quarter.

Capital International Investors holds 4,129K shares representing 5.13% ownership of the company. In it's prior filing, the firm reported owning 3,795K shares, representing an increase of 8.08%. The firm increased its portfolio allocation in TPG by 9.88% over the last quarter.

Perpetual holds 2,859K shares representing 3.55% ownership of the company.

Pendal Group holds 2,776K shares representing 3.45% ownership of the company. In it's prior filing, the firm reported owning 2,826K shares, representing a decrease of 1.80%. The firm decreased its portfolio allocation in TPG by 99.91% over the last quarter.

Massachusetts Financial Services holds 2,451K shares representing 3.04% ownership of the company. In it's prior filing, the firm reported owning 2,432K shares, representing an increase of 0.79%. The firm decreased its portfolio allocation in TPG by 84.03% over the last quarter.

TPG Background Information

(This description is provided by the company.)

TPG Inc., previously known as Texas Pacific Group, is an American investment company. The private equity firm is focused on leveraged buyouts and growth capital. TPG manages investment funds in growth capital, venture capital, public equity, and debt investments.

Key filings for this company:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20with%20Buy%20Recommendation%20%7C%20Nasdaq&_biz_n=0&rnd=589774&cdn_o=a&_biz_z=1743108337300)

%20with%20Buy%20Recommendation%20%7C%20Nasdaq&rnd=329290&cdn_o=a&_biz_z=1743108337304)